Breitbart Business Digest: China Will Pay for the 60% U.S. Tariff

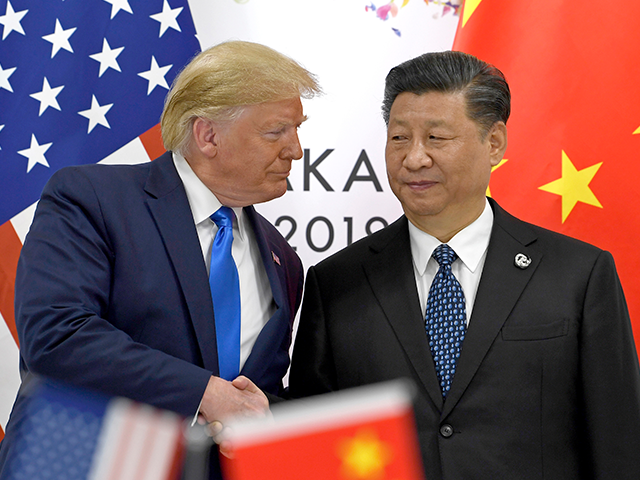

AP Photo/Susan Walsh

AP Photo/Susan Walsh

Trump’s China Tariffs Won’t Hurt U.S. Consumers

Donald Trump’s proposal for a 60 percent tariff on all Chinese imports has elicited cries of anguish from all the usual suspects. Fortunately, their gloom and doom have little basis in economics.

First of all, this is not 2016. The global economy and U.S firms have already adjusted to the idea that tariffs also rise and that China’s dominance of global manufacturing is unlikely to continue unabated. Between Trump’s first few rounds of tariffs, China’s increasingly paranoid totalitarianism, and the experience of China-dependence during the supply-chain crises of the pandemic, it has been clear for years that we’re “not going back” to the pre-Trump era. Even Joe Biden kept most of the once widely-criticized Trump tariffs on China in place.

The biggest complaint, of course, is the allegation that higher tariffs would raise consumer prices. But history suggests this is wrong. The current average tariff on an import from China is 19 percent, according to a recent note from Bank of America. Yet prior to the recent inflationary episode—which even critics of tariffs agree had nothing to do with import duties—the price of imports from China had not climbed.

Why? A combination of factors: Chinese manufacturers absorbed some of the tariffs through currency devaluation and price cuts, while U.S. importers narrowed their margins to stay competitive. Simply put, most of these tariffs weren’t passed through to American consumers.

We should also keep in mind the big picture. Trump’s tariffs are not merely about economic policy. They are a foreign policy and national security tool aimed at reducing America’s reliance on Chinese goods. The tariffs are also likely to have the beneficial effect of moving production to friendlier—and poorer—nations, strengthening the U.S. as a global leader and perhaps even decreasing pressure on our borders from those fleeing poverty at home.

Inflation Impact: More Fizzle Than Fire

Let’s start with the basic numbers. According to Bank of America, the U.S. imported around $430 billion worth of goods from China last year. A 60 percent tariff on these goods would, in theory, amount to about $170 billion in tariffs. Their research suggests that if all these costs were passed on to consumers—a big “if”—inflation could rise by up to 0.9 percentage points. But this is a worst-case scenario, a “partial equilibrium” analysis that ignores how the broader economy will adjust.

For one, the Chinese renminbi is unlikely to stay stable in the face of such tariffs. Bank of America reminds us of what happened during Trump’s first term. In 2018 and 2019, when Trump raised tariffs, the renminbi weakened by almost 13 percent against the dollar. This currency movement absorbed much of the tariff shock, making Chinese goods cheaper for U.S. buyers and reducing any inflationary effect. We can reasonably expect a similar dynamic this time around.

President Donald Trump, surrounded by American steel workers, signs the Section 232 Proclamations on Steel and Aluminum Imports that imposed tariffs to protect the American steel industry on March 9, 2018, in the White House. (Official White House Photo by Joyce N. Boghosian via Flickr)

Then there’s the question of how much of these costs will actually be passed on to consumers. Retailers, faced with fierce competition and wary of losing market share, are likely to absorb part of the tariffs in their margins. This is precisely what happened during the first rounds of Trump’s tariffs. The lesson here is clear: companies can’t always pass every dollar of tariff costs to consumers, especially when competition is fierce.

It’s also important to keep in mind that the revenues generated by the tariffs do not simply vanish. They can be used to reduce the deficit, increase government spending, or cut other taxes. In other words, the tariff money collected does not come out of the economy. It is shifted from the bank accounts of foreign producers and importers to taxpayers.

Supply Chains and Substitutes: Cushioning the Impact

Another point highlighted by Bank of America is the nature of U.S.-China trade. Many of the goods the U.S. imports from China are not direct consumer goods but intermediate or capital goods—products used in manufacturing other goods. This limits the immediate impact on consumer prices. The tariffs would be spread out over various stages of production, meaning that the sticker shock at retail stores won’t be as pronounced as some expect.

A big part of the effect of tariffs on prices will depend on the availability of substitutes. If U.S. retailers can switch to products from other countries or increase domestic production, the inflationary impact will be further blunted. In fact, this substitution effect is already happening, as U.S. companies have been gradually shifting supply chains away from China in response to the trade war. Trump’s tariffs would likely accelerate this trend, creating more resilient and diversified supply chains for American companies.

The Fallacy of China’s Economic “Advantage”

Economists often mistakenly assume that China must be the cheapest producer of goods simply because it currently produces them. In this naive view of trade balances, the fact that something is produced somewhere is proof that the current producer must have an economic advantage when it comes to producing it. In reality, however, China’s predatory practices have meant that things are produced in China and exported all over the world not necessarily because that is more efficient but because that is the price for access to China’s consumers.

Think of it this way. If you are going to have one factory producing your widget, allowing you to take advantage of economies of scale and benefits of geographic concentration and specialization, you would likely build it wherever quality-adjusted production was cheapest. But when China imposes trade barriers and the U.S. does not, it loads the dice in favor of Chinese production. Lots of production today occurs in China not because of market forces but because of trade and economic policies skewed toward Chinese manufacturing.

The other technique China uses to on-shore production is the threat of subsidized dumping. By credibly threatening to wipe out investment in production outside of China by dumping below costs products into markets, China is able to maintain oligopolistic control over the industries it targets. This allows it to charge higher prices than it would be able to in a competitive market because the higher prices do not bring forth competitors.

And once China has come to dominate an industry, it can continue to do so because the rewards of dominance create barriers to entry. Tim Cook, the chief of Apple, recently demonstrated this when he explained why Apple manufactures its phones in China.

“The reason is because of the skill, the quantity of skill in one location, and the type of skill it is,” he said.

This isn’t a story of comparative advantage. China’s land and people are not somehow naturally better at phone manufacturing. It’s a mercantilist advantage: it makes sense to manufacture in China because its predatory policies built it into an oligopoly.

Trump’s new China tariffs would simply be an offset to mercantilism practiced by China. Perhaps the strongest criticism of them is that 60 percent might not be high enough. We may need to go even higher to pry production away from China—although Trump’s promise of a big cut in corporate taxes for domestic U.S. production will also help.

China Pays for Tariffs

At the end of the day, China will bear the brunt of these tariffs. Thanks to factors like currency adjustments, retailer margins, and the shift toward alternative supply chains, the true inflationary effect of a 60 percent tariff on Chinese goods would likely be negligible. The Trump tax cuts would ameliorate the effect on the profits of U.S. importers. That means the real cost of the tariffs would be born by Chinese producers.

Look at what the International Monetary Fund just said about the U.S. economy. It’s expected to be the strongest in the world in the coming years, providing most of the thrust for global growth. China’s growth is expected to be even more sluggish than already forecast. The U.S. economy, in other words, has not suffered from the so-called trade war, but China’s economy is limping.

Source link