Breitbart Business Digest: Rates Will Stay Higher for Longer

Pexels

Pexels

Wall Street Retreats from Rate Cut Hopes

While Wall Street has finally come around to the view that interest rates are likely to stay higher for longer, it may still be underestimating just how high and how long.

Back in February, every single major bank and forecasting firm on Wall Street was predicting a cut in the first half of the year. Of the 18 firms surveyed by the Wall Street Journal's Fed watcher Nick Timiraos, six were projecting a Fed cut in May, and the remainder saw the first cut in June.

None had fewer than 75 basis points of cuts in their forecast for this year. Seven firms were forecasting 75 basis points of cuts, three had 100 basis points of cuts, six forecast 125 basis points, one saw 175 basis points of cuts coming, and UBS was the outlier with 250 basis points of cuts.

In the months since then, the forecasts have shifted dramatically. Timiraos's latest rundown counts 21 firms with projections for a Fed cut. After Goldman Sachs moved its forecast on Friday to September, there are now just three firms—JPMorgan, MUFG, and Citigroup—forecasting a cut in July (no one thinks we'll see a cut in June). Ten firms are projecting a cut at the September meeting. Five firms see the first cut in December, and three say the Fed will wait until next year.

Obviously, pushing out the date of the first cut means pushing out the total size of cuts likely this year. Seven firms are projecting just 25 basis points of cuts and seven more see 50 basis points of cuts. JPMorgan and Morgan Stanley agree that the Fed will cut 75 basis points. Citigroup is still projecting 100 basis points of cuts, which would be a quarter point cut every meeting starting in July. MUFG has 125 basis points of cuts. And, of course, the three firms who see the Fed waiting until next year see zero basis points of cuts.

With Goldman Sachs changing its Fed cut call to September, most sell-side bank forecasters and other Fed tipsheets now see the first cut in September, with December the next-most-likely date for a rate reduction pic.twitter.com/OQr8zVTMqQ

— Nick Timiraos (@NickTimiraos) May 24, 2024

Prudence Rules Out November and September Cuts

It's notable that none of the Wall Street forecasters think the Fed will cut at its November meeting. This meeting will take place in the two days following election day. It strikes us as likely that the Wall Street economists are right that the Fed will not want to add a change in interest rate policy to what is likely going to be a very volatile moment in markets and politics. Given all the chaos that has surrounded presidential elections for several cycles now, it is possible we may not even know for certain who won the election when the Fed convenes in November.

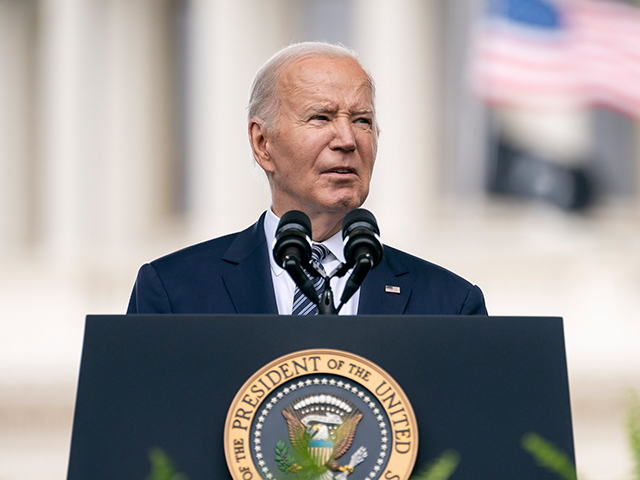

President Joe Biden delivers remarks in Washington, DC, on May 15, 2024. (Tia Dufour/Department of Homeland Security via Flickr)

We think that similar concerns for prudential central banking also rule out a September cut. Absent an unforeseen economic emergency, there's little good that could be accomplished by cutting in September that could not also be accomplished by a cut in December. And with Biden so vocally pushing for a Fed cut, a cut just prior to the election would inevitably have the appearance of inappropriate political favoritism. Why risk accusations of trying to interfere in the election when the Fed will have the opportunity to cut again three months later? Holding off for 12 weeks is unlikely to change the direction of the economy, especially given the Fed's view that changes in rates act on the economy with a long and variable lag.

It will probably not take very much to move forecasters off the idea of cuts this year at all, particularly those forecasters who are now projecting a December cut. Bank of America's Michael Gapen, for example, seems almost ready to throw in the towel on the December cut, writing in a note on Friday: “Recent Fedspeak and the May FOMC minutes make it clear that the upside inflation surprises this year, coupled with solid activity, are likely to take rate cuts off the table for now.”

The Still Unseen Specter of Hikes Haunts the Fed

Most of Wall Street is still convinced that a hike is close to a zero-probability event. But doubts about that have begun to creep in. Analysts are now saying that they think the bar is very high for a rate hike but no longer see it as impossible. Gapen's note, for example, states that “hikes would likely only come into play if inflation (or inflation expectations) increased considerably.” Given that the S&P Global U.S. PMI indicated that May saw the fastest economic expansion in two years and a resurgence in manufacturing, we may very well be headed toward exactly that.

We have said in the past that the Fed should start preparing the public for the possibility of rate hikes, both to allow the market to internalize the risk of higher rates and to minimize the political backlash that would follow from a sudden pivot from the current plan to start cutting rates soon.

Federal Reserve Chairman Jerome Powell answers questions at a press conference on May 1, 2024. (U.S. Federal Reserve via Flickr)

Imagine the political explosion that would be set off by the Fed surprisingly announcing a rate hike in a re-elected President Trump's first term back in the White House. Even if economic conditions justified the move, it would certainly be interpreted by many of Trump's supporters as a move against the president—especially after the Fed more or less promised a cut through the final year of Biden's first term.

Fortunately, the Fed has begun to send signals that a rate hike is a real possibility. The minutes from the last Fed meeting revealed that “various participants” said they were willing to hike rates if inflation goes in the wrong direction. More warnings of this sort would lesson the shock—and the political backlash—if the Fed finds itself in a position of needing to hike next year.

Source link