All Global Research articles can be read in 51 languages by activating the Translate Website button below the author’s name (only available in desktop version).

To receive Global Research’s Daily Newsletter (selected articles), click here.

Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Global Research Wants to Hear From You!

***

Americans are screwed over people and are too insouciant to notice.

And not just on big things, such as being forced to be injected with an untested new kind of “vaccine” with unknown safety and effectiveness.

Millions of Americans were faced with the choice of being injected or losing their job and ability to pay rent or mortgage, car payments, utilities, and buy food.

The “vaccine” has caused many deaths and millions of injuries from new diseases and profusions of what previously were rare diseases among age groups not previously affected.

American babies now die from strokes and heart attacks. And the grieving parents are denied any recourse.

No one is being held responsible. And apparently Americans don’t care. How is this any different from the Zionist story of Jews being herded into gas chambers?

Americans can’t do anything about the hundreds of billions of dollars Washington sends to Ukraine to conduct Washington’s proxy war against Russia, or about the billions sent to Israel for the slaughter of Palestinians and physical destruction of Gaza, or the billions sent to Taiwan for Washington’s proxy war against China. Meanwhile homeless American veterans sleep on the streets while the Biden regime gives immigrant-invaders pre-paid debit cards and houses them in hotels.

A few Americans might wonder if the billions of dollars could be better used getting the homeless out of the public parks and tent encampments off the sidewalks. But if they write to a representative or senator about the misallocation of resources they will get back a letter explaining that “we have to stop them over there before they get over here.”

The message is: “we are here to serve the military/security complex and Israel Lobby, the funders of our election campaigns, and to replace white Americans with the third world in the interest of diversity.

It is not the big things that Americans notice. They are not personally at risk of being sent to war, and there is no specific tax taken from them to finance Israel’s and Ukraine’s wars.

But you would think that Americans living on credit card debt would at least notice that which dramatically affects them.

Do Americans living on credit card debt comprehend that under the guise of interest charged the credit card companies are taxing their balances at rates ranging from 19.49% to 29.99% based on the credit card company’s estimate of the debtor’s credit worthiness.

In addition to the federal and state income taxes on their income and the Social Security tax and the Medicare tax on income, the credit card companies are imposing a 20-30% tax on debt that is paying for housing, transportation, food, and utilities, as incomes alone in the age of jobs offshoring are insufficient to support living standards for about 40% of the population.

I learned about modern day usury in May when my credit card bill did not show up. Perhaps it went into the spam or junk folders or fell victim to a glitch, all possibilities being joys of the digital revolution. Consequently the amount due on May 18 did not get paid until 4 days later on May 22 when an unpaid bill notice appeared in the email.

The notice told me that I am charged a late payment fee of $29 plus an interest charge of $61.54. So a 4 day late payment cost me $90.54.

The late payment notice told me that my interest rate of 19.49% is charged from the “first day of the billing period until we receive your payment in full.” In other words, the interest was not charged for the 4 late days, but for the 4 days plus the month’s billing period.

The notice also told me that if I missed a second payment, even for one day, during a 12 month period, my interest rate on my unpaid balance would jump from 19.49 to 29.99.

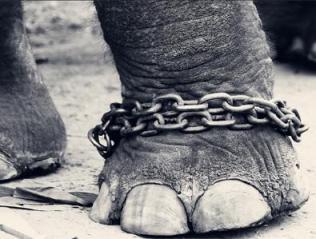

There you have it. This is a system for the enserfment of the American consumer.

If you are able to focus your attention, try to imagine the rapid rise of impossible indebtedness of Americans who can only make the minimum payment. The minimum payment is a tiny percentage of the balance due. For example, a balance of $4,173.66 has a minimum payment of $131.37. The minimum payment leaves a balance of $4,042.29 accumulating interest at double-digit rates.

Assuming he does not miss two payments in 12 months, his interest rate based on creditworthiness (he only makes minimal payments) is 27.49%. So, the interest on the unpaid balance adds $1,100 to his debt. And the growth in debt increases with the interest charged on the rising unpaid balance.

I remember when credit card companies made their money by the 2.5% charge to the businesses that accepted payment via credit card. Those days have vanished. Now credit card companies live extravagantly on interest on consumer credit card debt, while businesses accepting credit card payment charge their customers a fee for paying with a credit card.

As an economist I am really amazed that Keynesian economists, whose policy is based on the American consumer’s ability to spend, stood aside while such extraordinary restrictions on aggregate demand were allowed to be put in place. After paying debt service, people have nothing left to spend.

American consumer indebtedness means that consumers have no discretionary income with which to drive the economy.Their pay is below the cost of living. They live on their credit cards, and the interest payments drain their incomes, leaving them without discretionary income to spend.

There is no possible way, except by falsifying statistics, to get economic growth out of such an economy.

*

Note to readers: Please click the share button above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

Paul Craig Roberts is a renowned author and academic, chairman of The Institute for Political Economy where this article was originally published. Dr. Roberts was previously associate editor and columnist for The Wall Street Journal. He was Assistant Secretary of the Treasury for Economic Policy during the Reagan Administration. He is a regular contributor to Global Research.

Comment on Global Research Articles on our Facebook page

Become a Member of Global Research

Source link