by WorldTribune Staff, April 23, 2024

Joe Biden's economic policies have shattered the dreams of millions of Americans who dream of buying their own home.

Housing specialist Redfin reported that rising home prices and mortgage rates “are making it harder to believe in the American dream of homeownership. Lack of affordability is the most commonly cited reason renters don’t believe they’ll ever own a home.”

Housing specialist Redfin reported that rising home prices and mortgage rates “are making it harder to believe in the American dream of homeownership. Lack of affordability is the most commonly cited reason renters don’t believe they’ll ever own a home.”

Nearly two in five (38%) of U.S. renters don’t believe they’ll ever own a home, up from roughly one-quarter (27%) from less than a year ago, the report said.

First-time home buyers must earn roughly $76,000 to afford the typical U.S. starter home, up 8% from a year ago and up nearly 100% from before the pandemic, according to a recent Redfin analysis.

Home prices have skyrocketed more than 40% since 2019. The current average 30-year fixed mortgage rate is 6.82%. While that’s below the 23-year-high of nearly 8% hit in October, it’s still more than double the record low rates dropped to in 2020.

Home prices have risen 7% in the last year alone, and monthly mortgage payments have risen more than 10%, which helps explain why renters today are more likely than they were last year to say they don’t see themselves owning a home anytime soon.

Many renters say they can't fathom owning a home because they are already struggling to afford their monthly housing costs. Nearly one-quarter (24%) of renters say they regularly struggle to afford their housing payments, and an additional 45% say they sometimes struggle to do so.

The median U.S. asking rent is roughly $2,000, near the record high hit in 2022.

“Housing costs are high across the board, but renting is a more affordable and realistic option for many Americans right now–especially those who have never owned a home and aren’t able to tap into equity from a previous sale,” said Redfin Chief Economist Daryl Fairweather. “While owning a home is usually a sound longterm investment, the barriers to entry and upfront costs of buying are higher than renting. Buying typically requires a sizable down payment and approval for a mortgage–things that are difficult for many people today, when the typical down payment is near $60,000 and mortgage payments are sky-high. The sheer expense of purchasing a home is causing the American Dream of homeownership to lose some of its shine.”

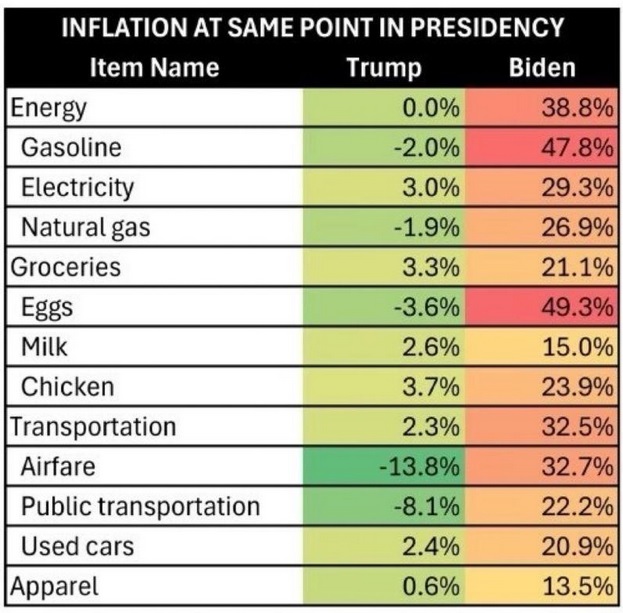

Former President Donald Trump took to Truth Social to post a chart comparing inflation from the same time he was in office compared to today's Bidenflation numbers:

According to the latest NBC News poll, voters trust Trump more than Biden to deal with inflation and the cost of living, their top concerns in 2024.

In another Truth Social post on Tuesday, Trump wrote:

“The Dollar has just hit a 34 year high against the Yen, a total disaster for the United States. When I was President, I spent a good deal of time telling Japan and China, in particular, you can’t do that. It sounds good to stupid people, but it is a disaster for our manufacturers and others. They are actually unable to compete and will be forced to either lose lots of business, or build plants, or whatever, in the “smart” Countries. This is what made Japan and China into behemoths years ago. I put limits on both (and others!), and if they violated those limits, there was hell to pay. Biden has let it go. Watch them now pick apart the U.S. It will be an open field day. Don’t let this happen Crooked Joe. Wake up and smell the roses!”

Source link