Authored by Mike Shedlock via MishTalk.com,

Bank of America has an interesting report on who’s living paycheck to paycheck (PTP). It’s not just the poor. Blame the Fed.

Please consider Paycheck to Paycheck: What, Who, Where, Why?

What Does It Mean?

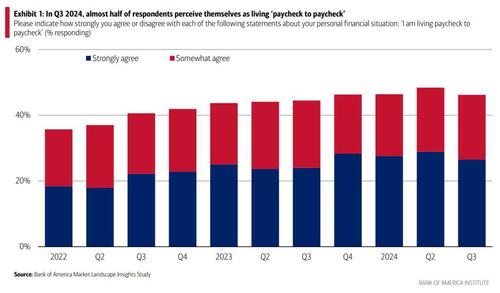

The term ‘living paycheck to paycheck’ is a fairly frequently heard expression but can be somewhat nebulous and is not always clearly defined. Broadly, one can imagine it refers to individuals or households that regularly spend nearly all of their income, leaving little to nothing left over for savings.

By that widely used definition, over 40 percent of respondents agreed or somewhat agreed to living PTP.

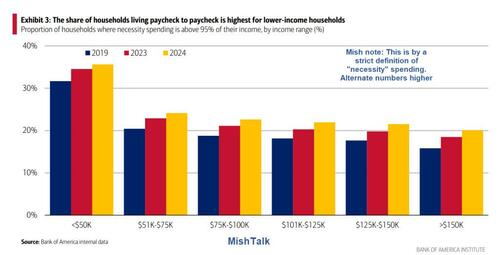

BofA restricted that definition as shown in the lead chart.

BofA refines PTP as “households where necessity spending is more than 95% of their household income, leaving them relatively little left over for ‘nice to have’ discretionary spending or saving.”

Even by that definition, which I endorse, the percentage of PTP households is staggering.

More surprising is that the proportion of households appearing to live paycheck to paycheck falls only slowly as incomes rise. Around 20% of households with incomes above $150K also appear to be living paycheck to paycheck. How can this be? One reason is that higher-income households may have bought larger, more expensive, homes and consequently have bigger mortgages. And often along with bigger homes come bigger insurance costs, property taxes and utility bills. It is also possible that as household incomes rise, some households may have more varied sources of income that are hard to capture – such as cash from sales of equities paid into brokerage accounts.

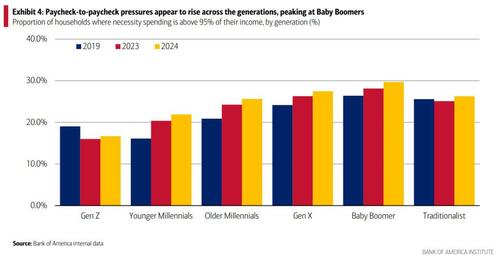

Generational Paycheck to Paycheck

That chart struck me as odd. But perhaps not. Zoomers and Younger millennials are priced out of a home and forced to rent.

Then again, anyone with a mortgage should have been able to refinance at 3 percent or lower, putting extra money in their pockets every month.

How Old Are the Youngest Boomers?

AI Response: As of June 2024, the youngest baby boomers are 60–69 years old. The baby boomer generation is defined as people born between 1946 and 1964.

Some experts have given the youngest baby boomers, born between 1954 and 1964, a new name, “Generation Jones”, because they are so different from older boomers.

Has anyone heard the name “Generation Jones?”

Regardless, boomers are at retirement age. The kids are gone. So why are boomers living PTP?

One possible answer that BofA did not explore is Boomers have many assets and are prepared for the future. Besides, you can’t take it with you.

Other possible answers, such as being totally unprepared for retirement, are much more troubling.

Which is it? I suspect both reasons are in play, and that leads to the high PTP percentage shown.

The Housing Factor

Note the Hidden Costs of Homeownership.

Bank of America aggregated deposit data suggests that fewer households are moving between cities. In the second quarter of 2024, moves across cities fell 4% year-over-year (YoY) after a 15% YoY decrease this time last year. Those that are moving, however, are skewing towards Gen Z and lower-income households, likely as more households move out of necessity as opposed to choice.

Some households are likely deferring moves due to increased “hidden” costs of homeownership (e.g., insurance, property taxes). Bank of America aggregated payments data suggests these costs are up significantly YoY, especially in the Sun Belt. And a study by the Federal Reserve Bank of San Francisco suggests that this area is affected by another “hidden” cost: climate change.

Gen Z and lower-income movers are likely searching for affordability, particularly in the rental market. We find those metropolitan statistical areas (MSAs) with relatively more affordable rents are seeing the fastest population growth in Q2 2024.

The fewer overall movers and the skew to younger/lower income movers is depressing consumer spending on moving-centric categories such as furniture. But if moving rebounds, we could see a tailwind to these areas of spending.

Housing is a big factor in PTP. Insurance has soared and so have property taxes except where capped.

The home ownership rate is only 35 percent for 25–30-year-olds, compared to 66 percent across all ages according to the Census Bureau.

New Record Highs on Home Prices

On September 28, I commented Yet Another Record High for Case-Shiller Home Prices

And a quick check on Mortgage News Daily shows that 30-year mortgage rates have surged back up to 6.85 percent from 6.11 percent on September 11.

I have been talking about housing since the start of this blog in March of 2003. The Fed keeps making the same mistake over and over.

Fed Hubris

Flashback March 4, 2021: Fed Hubris: Housing Prices Show the Fed is Making the Same Inflation Mistake

Prior to 2000, home prices, Owners’ Equivalent Rent (OER), and the Case Shiller national home price index all moved in sync.

This is important because home prices directly used to be in the CPI. Now they aren’t. Only rent is. Yet, OER is the single largest CPI component with a hefty weight of 24.05% of the entire index.

The BLS explains this away by calling homes a capital expense not a consumer expense.

However, that explanation ignores easily observed and measurable inflation. And it’s inflation, not alleged consumer inflation, that is important.

BIS Study on CPI Deflation

Note that a BIS Study finds that routine consumer price deflation is not damaging in the least.

Specifically, the BIS concludes “Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive!”

Worst of all, in their attempts to fight routine consumer price deflation, central bankers, led by the Fed, create very destructive asset bubbles that eventually collapse, setting off what they should fear – asset bubble deflations.

A $150,000 House in 1988 Now Costs $707,500 Thank You Fed

Using Case-Shiller data of repeat sales, on August 10, 2024, I noted A $150,000 House in 1988 Now Costs $707,500 Thank You Fed

Mess Entirely of Fed’s Making

This is a mess entirely of the Fed’s making. And it’s what happens when the Fed, and economists in general do not count home prices as inflation.

Home prices are not directly in the CPI or PCE. The latter is the Fed’s preferred measure of inflation.

Economists consider home prices a capital expense not a consumer expense. The problem is simple: Inflation is not just a consumer price concern!

The Fed ignored obvious inflation in the Great Recession and did so again in the Covid recession.

Dual-State Economy

And so here we are. The Fed is directly responsible for a dual-state economy of the haves vs the have-nots.

The haves are the asset holders. They have largely benefitted from massive asset bubble inflation. The have-nots are those who want to buy a home but are priced out due to inflation.

The Fed created this setup via QE and mortgage security purchases driving interest rates to zero and mortgage rates below 3 percent.

Existing homeowners refinanced putting extra money in their pocket every month.

The have-nots are trapped renting, while most of the haves are trapped in their homes unwilling to trade their 3 percent mortgage for a 6.85 percent mortgage.

Meanwhile, the cost of insurance, maintenance, and property taxes on that home have jumped so much that 20 percent of people making over $150,000 a year are living paycheck to paycheck.

End the Fed

I believe I have made the case to end the Fed. Rather, the Fed made the case against itself.

This idea was a discussion focus on this blog and the Mises Institute in a series of recent posts.

Please see Fed “Playing With Fire” Take Two, Who Starts the Business Cycle? for a discussion of ideas and alternatives on ending or reigning in the Fed.

Source link