Authored by Charles Hugh Smith via OfTwoMinds blog,

What the cheerleaders are actually claiming is the process of adding zeroes to "money" is limitless, but there are limits on the utility of devaluing currency, too.

How prosperous would the world be if we hadn't collectively borrowed and spent $315 trillion----333% of global GDP? We all know the answer--not very prosperous at all, for production, consumption and profits would all be mere fractions of their current totals if we could not borrow money and could only spend cash on hand. Global Debt Hit $315 Trillion In Q1 2024.

All this money that's been spent/invested has effectively been mined / extracted from future resources, labor and capital. The basic idea is that the interest that must be paid on this debt will be paid out of earnings generated by the productive use of resources, labor and capital in the future. Once the debt matures and the principle must be returned to the lender / bond purchaser, this principle must also be mined / extracted from assets available in the future.

Mining / extraction is the appropriate analogy because nothing is unlimited in the real world. Imagination--yes, it's unlimited. Denial and delusion: yes, both are limitless. But tangible resources that can be recovered at costs the economy can bear, productive labor and capital are not limitless. If we mine the future too intensively, there won't be enough left in the future to spend/invest at the level we enjoy today.

The fundamental assumption behind mining the future is that the pool of resources, labor and capital will continue expanding forever, effortlessly funding the interest and principle due on today's borrowing and leaving more than enough to consume and invest in the future.

But what happens when the resources, labor and capital available to mine in the future shrink? If the productive economy contracts, there will be fewer resources and less labor and capital available to split between servicing the ballooning debt and the consumption / investment needed to support the future economy.

Two mind tricks enable our faith in the sustainability of ever-expanding debt to fund our spending / investing today. One is the inaccurate assumption that Moore's Law--the constantly accelerating advancement of technological / digital mojo and efficiencies--apply to the entire real world: just as computing power has risen 10-fold every few years, so too will all other technologies.

This leads to the comforting but false belief that there will never be any resource constraints because technology will leap every boundary: we'll simply dig deeper and more efficiently to extract the minerals and energy we need to fund debt, consumption and investment.

This conveniently ignores the chemical and physical limits of the real world. A rocket powerful enough to lift a payload into orbit and on to the Moon is not 100 times smaller now than it was in 1969, or even 10 times smaller: it is roughly the same size due to the chemical / energy density limits of the liquid fuels needed to power the rocket.

Engineering advances do not cancel out the fact that digging / drilling deeper in remote, hostile environments costs more in energy, labor and capital than the easy-to-extract resources we've already consumed. Setting aside the mind trick of "money," it takes more energy and physical materials to extract resources far from paved roads and deep-draft harbors, in remote, difficult terrain and far deeper than easy-to-extract minerals and energy we've already taken and consumed.

As the productive labor force shrinks, there are fewer workers and wages to support debt service. If the resources, labor and capital we're mining are contracting, that will not only constrict additional borrowing in the future, it will also leave insufficient reserves to fund both debt and consumption.

The second mind trick is adding a zero to all "money" via currency devaluation / inflation. Here's how devaluation magically reduces the burden of debt: say household income is $10,000 per year and the home mortgage is $100,000. Add a zero (over a few decades, of course, so nobody notices the trick) to the income, which is now $100,000 a year for performing the exact same hours of labor as in the past. Now the mortgage has shrunk from 10 times income to 1-to-1. That makes servicing the debt much less of a burden on the household, and on the economy.

If the interest earned over the decades exceeded the rate of inflation / devaluation, the owners of the debt made up for the stupendous decline in the purchasing power of their principle when it is finally paid in full. The mind trick of reducing the burden of debt service by adding a zero to "money" ceases to work if the interest paid to lenders falls under the rate of inflation/devaluation, as lenders catch on and refuse to originate loans that destroy capital, albeit slowly enough few notice in the short-term.

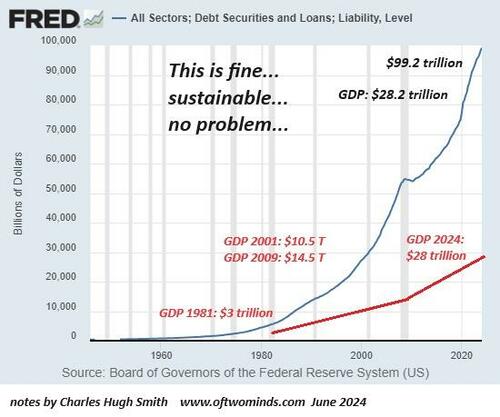

As this chart of total debt in the US (public and private) shows, devaluing the currency soon outpaces the expansion of the real-world economy that's being mined to fund our spending today. Over time, the expansion of "money" accelerates inflation/devaluation into a self-reinforcing feedback that pushes interest rates above the point at which the economy can support both debt service and consumption and investment: something has to give, and that something isn't debt service--it's consumption and investment.

Welcome to the world of stagflation, a world in which mining the future is no longer sustainable as the pool of future earnings and resources available to mine is shrinking, even as our voracious appetite for borrowing more now to fund more spending today expands.

Many people reckon there's a third trick that's completely painless: a debt jubilee that wipes out all debts and re-sets the system so we can start mining future earnings and resources again with gleeful abandon. But this isn't how reality actually functions. Every debt is somebody else's income-producing asset, and in a world of $315 trillion in debt, that's a lot of assets that will be written down to zero by the debt jubilee and a lot of income that will drop to zero.

That money goes to money Heaven, never to return. In the happy story, lenders and bond buyers pile right back in and start funding trillions in new debt to start the cycle anew--no harm, no foul, right? Not quite.

We seem to be forgetting that the $315 trillion in assets and trillions in interest income went to money Heaven. Where is all the cash going to come from to fund new issuance of debt? And who would be dimwitted enough to loan money at low rates of interest, knowing that when things get iffy--which they inevitably will-- another debt jubilee will wipe out all of one's debt-based assets overnight?

The short answer is no one. Interest will be set high enough to offset the risk of a future debt jubilee sending all the money that was loaned out to money Heaven.

The net effect is borrowers will have to mine even more from the future to afford the higher interest. As resources become costlier to extract and the demographics already set in stone reduce the workforce that supports all future debt service, consumption and investment, all the mind tricks no longer work.

The future will need all the available resources, labor and capital for its own use, leaving little to none for us to mine today to fund our profligate consumption and gambling (sorry, "investing"). Cash will be King, and borrowing from the future to spend freely today will no longer be possible.

Impossible! Shout the cheerleaders of mining the future: the real world will always expand in endless growth. Sorry, but there are no guarantees that the limits of chemistry and physics can be jumped. What the cheerleaders are actually claiming is the process of adding zeroes to "money" is limitless, but there are limits on the utility of devaluing currency, too.

* * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Source link