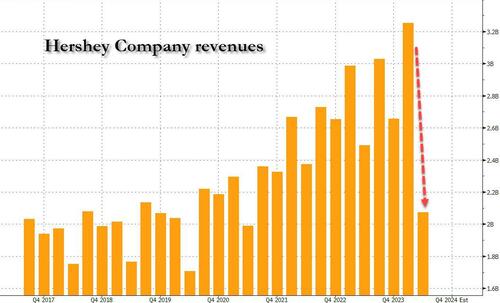

The stock of iconic US chocolate maker Hershey tumbled after the company slashed its sales and earnings outlook for the year as shoppers continue to reduce purchases of higher priced chocolates and candies.

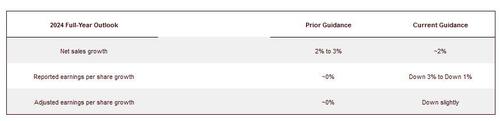

The maker of Reese’s and Dot’s Pretzels said Thursday that it now expects net sales growth to be around 2%, from the previous range of 2% to 3%, and that adjusted earnings per share will be "down slightly"” from unchanged before.

Q2 sales plunged 17% to $2.07 billion, sharply missing the $2.31 billion estimate. Adjusted EPS of $1.27 per share also missed expectations.

In the earnings press release, CEO Michele Buck made a stark observation about just how hard hit the US middle class is, admitting that "consumers are pulling back on discretionary spending,"

Record high cocoa prices have hit Hershey’s margins and forced the company to raise their prices further — even as consumers cut down on brand name purchases at the supermarket. Hershey said that that higher commodity costs eroded profitability in the period, offsetting productivity improvements and higher prices.

There may be a trace of good news for Willy Wonka fans: the constant hammering of confectionery companies may be ending soon; earlier this week, Oreo-maker Mondelez projected cocoa prices will fall.

“We soon expect the market correction to a more sustainable price,” CEO Dirk Van de Put said during the company’s earnings call on July 30. The outlook for next season’s main crop is “encouraging” and a clearer indication on price trends could come by September, Chief Financial Officer Luca Zaramella added.

The company’s shares dropped 1% after gaining 6% year to date through Wednesday’s close, compared with a 9.5% gain for the S&P 500 Consumer Staples Index.

Source link