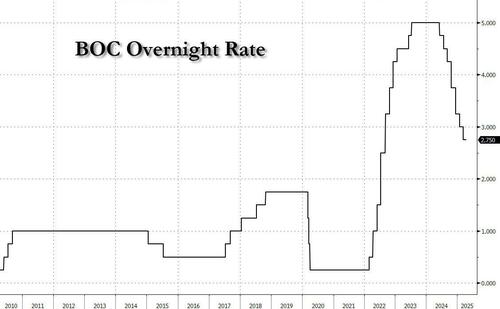

The Bank of Canada kept rates steady at 2.75% as expected, with the central bank saying it would support economic growth while ensuring that inflation remains well anchored.

Here are some more highlights from the decision:

TARIFFS:

INFLATION:

In the policy statement, the central bank provided modest forward guidance. It said the governing Council will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.

“What happens to the Canadian economy and inflation depends critically on US trade policy, which remains highly unpredictable,” Governor Tiff Macklem said in prepared remarks. “Given this uncertainty, point forecasts for economic growth and inflation are of little use as a guide to anything.” Some more comments Macklem:

The uncertainty around Trump’s trade policy prompted the central bank to publish two sets of forecasts, instead of a single projection, to capture different possibilities. It released the scenarios Wednesday as it paused their easing campaign for the first time since last June.

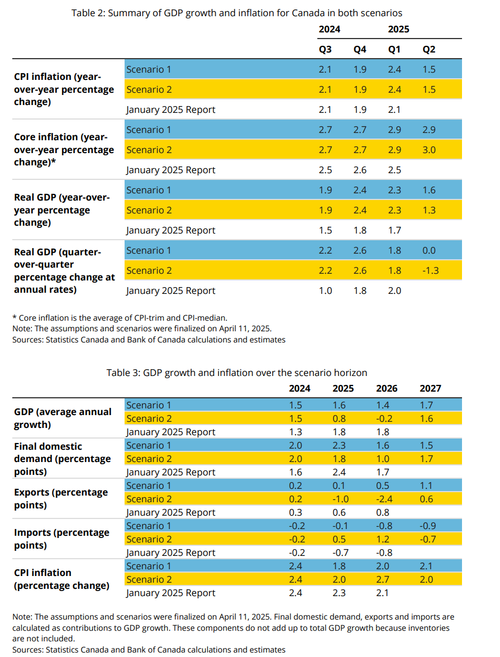

In the first scenario, policymakers assume most of Trump’s tariffs get negotiated away. His 25% levies on steel and aluminum and Canada’s associated retaliation remains, as does a 10% US tariff on Chinese goods and Chinese retaliation equivalent to a 1% increase in its weighted average tariff rate on US products. China’s tariffs on some Canadian agricultural products, pork and seafood also stay in place. But even in this scenario where most tariffs are scrapped, the process is unpredictable and businesses and households remain cautious. The uncertainty around trade policy weighs on activity.

In the second scenario, the central bank assumes the imposition of US tariffs including 25% levies on motor vehicles and parts, with Canada’s associated retaliation. It sees Trump adding a 12% tariff on many Mexican and Canadian goods - the White House outlined this figure on April 2 but exempted the countries for the time being. The scenario sees Canada retaliating with 12% tariffs on C$115 billion of US goods. It also assumes the US puts a 25% tariff on goods imported from all other countries, including China. The "all out" trade war scenario also pitches the globe into a long-lasting trade war, and Canada’s GDP contracts in the second quarter, and the economy spends a year in what the bank called a “significant recession,” which permanently lowers the standard of living in the country.

As shown in the table above, the four straight quarterly contractions average about 1.2%. Exports fall sharply until mid-2026, and tariffs permanently reduce US demand for Canadian products. Canadian exporters reduce production and lay off workers, leading to higher unemployment and a slowdown in household spending. Business investment declines due to weak economic activity. A lower Canadian dollar raises the cost of imported equipment and machinery. Growth gradually returns in 2026 but remains soft through 2027.

Inflation in Canada averages around 2% until early 2026, before rising above 3% because of upward pressures on prices from tariffs. It then returns to the 2% target in 2027 as weak demand limits ongoing inflationary pressures. Globally, tariffs drive up inflation, especially in the US, starting in the second quarter of this year.

Consumers and businesses affected by tariff-related price increases may begin to expect that prices will continue to rise at an elevated pace, leading to an upward drift in longer-term inflation expectations. These expectations can become self-fulfilling if they feed through to wage demands and if businesses change how they set prices - a significant risk, given the recent experience of high inflation, the bank warns.

“As we considered monetary policy, we used these two scenarios to reflect uncertainty about US trade policy,” Macklem said. “What happens with inflation will depend on what happens with tariffs. Monetary policy will ensure inflation remains well controlled and support economic growth as Canada confronts this unwanted trade war.”

In kneejerk reaction, the USDCAD tumbled 0.3% and Canada's 10y yield rose 2bp on the decision to hold vs almost split market pricing heading into the decision between a 25bps cut and a hold. The pair immediately fell from 1.3923 to 1.3886 before extending further to a trough of 1.3873 around four minutes later. Furthermore, the Bank refrained from providing economic forecasts, but instead provided tariff scenarios amid trade tensions with the US, in which annual growth was lowered across both tariff scenarios, whilst 2025 annual inflation lowered was lowered and 2026 inflation forecasts diverge across scenario 1 and 2.

Source link