Two days ago, when China reported another month of dismal import and export activity, with both missing estimates...

... we reminded readers that at a time when China is scrambling - and failing - to convince the world that it will unleash a historic fiscal and monetary stimulus (just not right now, and not tomorrow, but maybe some time next year so start buying Chinese stonks or something), it will also have to devalue the yuan if it hopes to actually kickstart its mercantlist economy.

*CHINA NOV. EXPORTS IN USD TERMS RISE 6.7% Y/Y; EST. +8.7%

— zerohedge (@zerohedge) December 10, 2024

*CHINA NOV. IMPORTS IN USD TERMS FALL 3.9% Y/Y; EST. +0.9%

... and let's not forget China desperately needs a yuan devaluation

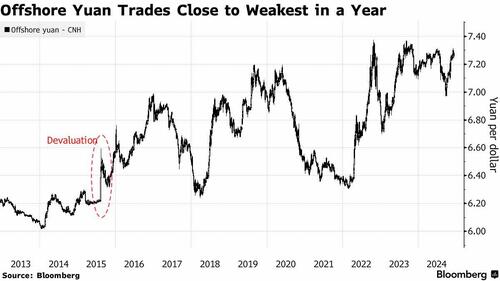

Turns out we were right once again because just under a decade since China's infamous 2015 yuan devaluation, Beijing is getting ready for round two.

According to Reuters, Beijing policymakers are mulling letting the yuan depreciate, possibly to around 7.5 per dollar, in response to the threat of a trade war with the US.

Letting the yuan , depreciate could make Chinese exports cheaper, blunting the impact of tariffs, and creating looser monetary settings in mainland China.

Reuters spoke to three people who have knowledge of the discussions about letting the yuan depreciate but requested anonymity because they are not authorized to speak publicly about the matter.

Following the news, which had been rumored both here and elsewhere in recent weeks, the China’s yuan slid the most in a week, while regional peers also slumped, with the New Zealand dollar falling to the weakest in more than two years, while the Australian dollar hit levels last seen in November last year.

Pressure on the yuan had intensified since the re-election of Donald Trump, who has threatened to impose tariffs on China and other countries, and many investors have already speculated Beijing will abandon its current policy of maintaining a stable currency to compensate for any impact this could have on its economy.

“There is a compelling logic embedded in these comments,” said Jane Foley, head of FX strategy at Rabobank in London. “China’s economy is already weak, inflation is low, and it will have to position itself for Trump tariffs.”

Of course, a yuan devaluation will carry huge costs. A rapid depreciation could lead to aggressive capital outflows, triggering even more currency declines, and a surge in bitcion similar to the one observed in 2016 when, in response to China's 2015 devaluation, the crypto currency saw its first dramatic explosion higher and has never looked back. The downward spiral tends to dent appetite for China stocks and bonds, risks destabilizing financial markets and hurting growth, while sending gold and bitcoin to new all time highs.

On the other hand, it's not like mercantilist China, whose economy was and remains entirely dependent on exports, has much of a chance. The world’s second largest economy has long been hammered by a prolonged property crisis and souring consumer sentiment. To rejuvenate growth, China earlier this week signaled bolder economic support next year, embracing a “moderately loose” monetary policy and pledging “more proactive” fiscal policy.

The yawning yield gap between Chinese sovereign bonds and Treasuries is also putting pressure on the yuan. China’s 10-year benchmark yield fell to a fresh record low this week, below 1.9%, amid bets on more interest-rate cuts from the PBOC.

Even before the Retuers report, strategists at BNP Paribas saw the yuan falling to 7.45 by the end of 2025, according to a note this week, while Nomura said this month the currency can drop to 7.6 in offshore trading by May. Similarly, JPMorgan expects the offshore yuan to weaken to 7.5 in the second quarter.

“For any macro trader, this is a case of when and by how much yuan weakens in the first half of next year — and not so much if,” said Viraj Patel, strategist at Vanda Research in London. “When Chinese authorities start ‘mulling’ things over, we all know what comes next.”

Still, economists including Karsten Junius, chief economist at Bank J Safra Sarasin, said that it was “too early” for China to step into the market to weaken the yuan before the US announces any trade restrictions.

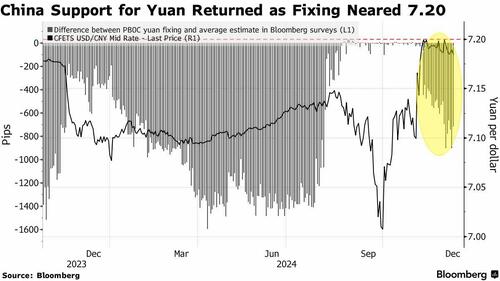

The Reuters report also refocused trader attention on China’s daily reference rate for the managed currency — Beijing’s preferred tool to guide yuan expectations. That’s the gauge around which the yuan is allowed to trade in a 2% range.

The PBOC has consistently set the so-called fixing stronger than 7.2 since the US election, despite wild swings in the greenback and increasing predictions by analysts that the central bank would buckle. Allowing a breach risks sending a signal to traders that the PBOC is comfortable with further yuan weakness, while holding the line suggests it may dig in for a fight.

“A moderate depreciation is an increasingly likely scenario as long as the move is not excessive versus non-greenback currencies,” said Gary Ng, senior economist at Natixis. “However, the market should still be wary of sudden intervention if the move is too big within a short period of time.”

Khoon Goh, head of Asia Research at Australia & New Zealand Banking Group, said that while authorities in Beijing may be open to allowing the yuan to be flexible, they may not want a premature over-reaction based on speculation.

This will not be the first time that policymakers face the question of whether to prioritize currency stability or boost exports. During the last China-US trade war under Trump’s first administration, Beijing allowed the yuan to weaken past the psychological milestone of 7 for the first time since the global financial crisis.

Of course, it all started in August 2015, when amid a collapse in exports, Beijing devalued the yuan in a shocking move to aid growth and reform its foreign-exchange market. That quickly backfired with capital outflows surging, prompting the central bank to burn through its reserves to stabilize the currency, and also sparked the first big move higher in bitcoin, as we observed at the time.

This time, Beijing would be mindful of creating too much weakness and volatility in the currency at a time when it wants to increase the yuan’s reserve status, said Foley at Rabobank. “The authorities would be looking for some equilibrium between these factors.”

And sure enough, news of a potentially weaker yuan triggered a knee-jerk risk-off reaction across markets, from FX to commodities. European stocks also fell in early trade, with energy and miners among the worst performers, although once the US tech bubble got running much of this initial skepticism was promptly forgotten. Oil prices trimmed gains as a depreciating yuan raises concerns about China’s ability to sustain crude demand that’s already weak, given the likely added cost of oil imports priced in dollars. Copper and gold also fell but have since recovered. Meanwhile, the euro also dropped, indicating traders may be developing the Trump trade into a tariff-risk hedging trade. The dollar gained.

Source link