One word describes today's 2Y auction: blowout. From the 5th stop through in the past 6 auctions, to the record foreign demand, everything about today's sale of 2Y paper - the last of the year - screamed record demand.

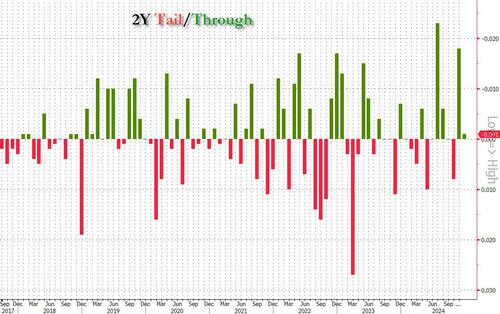

The auction stopped at a high yield of 4.335%, up from 4.274% last month and the highest since July, thanks largely to the Fed's recent hawkish pivot which send yields surging even as the Fed has cut rates by 100bps since September; the auction also stopped through the 4.336% When Issued by 0.1bps, the 5th stopping through auction in the past 6.

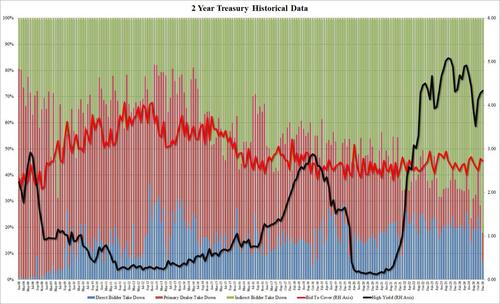

The bid to cover was 2.729, down from 2.775 in November but above the 2.68 six auction average.

But the most striking feature of today's auction was the blowout foreign demand: the Indirect Bid, a proxy for international purchasing, soared to 82.1% up from the already high 71.6%, and the highest foreign award on record by a wide margin.

And with Dealers taking 11.3%, Directs plunged to just 4.34%, the lowest since the summer of 2009.

Overall, this was a stellar auction, and one where clearly bidders - especially foreign ones - decided that the selling had gone on long enough and loaded up to the gills.

Source link