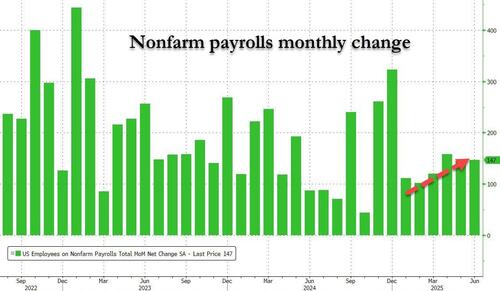

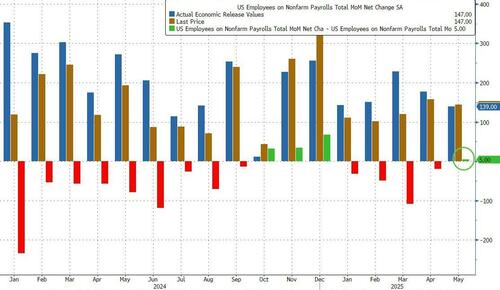

After yesterday's shockingly bad ADP print of negative 33K, the market was braced for the worse, with the whisper number for today's payrolls sliding to 96K, the first sub 100K print and far below the consensus of 106K, and many even contemplating how to trade a stagflationary recession print. In the end, it turned out to be just another headfake by ADP which now has the same credibility as UMich, because moments ago the BLS published a blowout job report: in June, the US added 147K payrolls, blowing away the median estimate of 106K, and higher than the upward revised May print of 144K.

There was just one economist who predicted a higher number among the 79 polled by Bloomberg who expected a higher print: that was Derek Holt at Scotiabank with 160K. Everyone else was below 147K.

Remarkably, and in a dramatic change from the Biden tradition, previous months were revised higher: April was revised up by 11,000, from +147,000 to +158,000, and the change for May was revised up by 5,000, from +139,000 to +144,000.

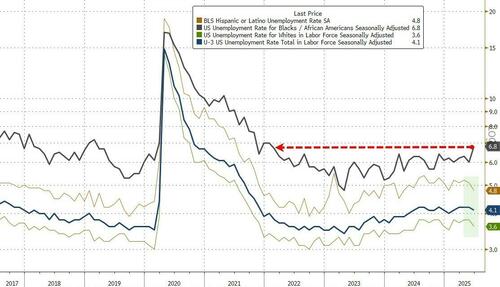

It wasn't just the headline print that surprised to the upside: perhaps an even bigger surprise was the unemployment rate which dropped from 4.2% to 4.1%, denying expectations of an increase to 4.3%, and far below the Fed's recently upward revised estimate of a 4.5%.

Among the major worker groups, the unemployment rate for Blacks (6.8 percent) jumped in June to the highest in 4 years, while the rates for adult women (3.6 percent) and Whites (3.6 percent) decreased. The jobless rates for adult men (3.9 percent), teenagers (14.4 percent), Asians (3.5 percent), and Hispanics (4.8 percent) showed little or no change over the month.

The drop in the unemp rate was the result of a 93K increase in employed workers, offset by a decline in the civilian labor force to 173,380K from 170,510K and a drop in the number of unemployed workers from 7,237K to 7,1025K.

The labor force participation rate changed little at 62.3%in June, lowest in two years, and the employment-population ratio held at 59.7 percent.

There was more good news for the inflation-panicking Fed: average hourly earnings rose just 0.2% MoM, below the 0.3% expected, and down from 0.4%, while the annual earnings growth was 3.7%, down from a downward revised 3.8%, and below the 3.8% estimate.

Elsewhere, the average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.2 hours in June. In manufacturing, the average workweek held at 40.1 hours, and overtime was unchanged at 2.9 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls declined by 0.2 hour to 33.5 hours in June.

Some more details from the report:

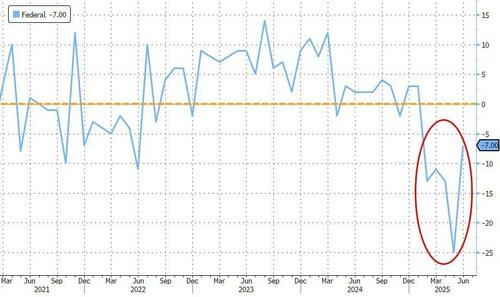

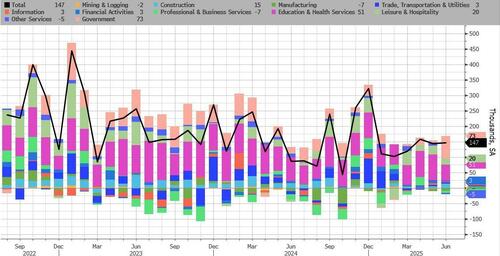

Taking a closer look at the job breakdown we find that in June, job gains occurred in state government and health care. Federal government continued to lose jobs.

Of the above, the continued drop in Federal jobs was by far the best news.

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; leisure and hospitality; and other services.

But wait there's more: whereas in the past the BLS was known to pad the top line number thanks to part-time jobs at the expense of part-time, that was not the case this time as Full-time workers rose by 282K, while part-time workers tumbled by 367K.

Last but not least, and perhaps most important, the number of native-born workers surged by 830K to a record 132.653 million, while foreign-born workers tumbled by 348K to 31.231 million, the lowest this year.

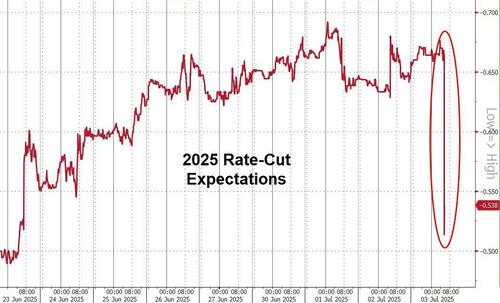

Overall, this was a stellar jobs report - at least relative to expectations - and one which has not only sent yields and the dollar soaring (with traders wrongfooted by the politically-motivated ADP once again), but odds of a July rate cut pretty much gone and odds of later rate cuts in 2025 also sliding rapidly.

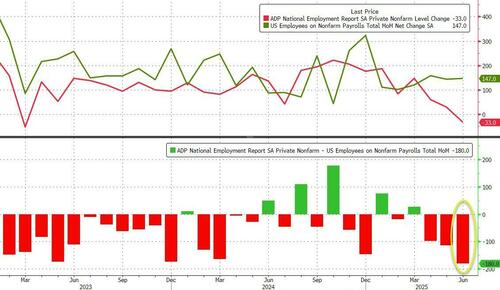

Oh, and finally, never listen to ADP ever again: with a near-record spread of 180K between the two series (-33K for ADP, +147K for NFP), the ADP Private Payrolls report has as much credibility as the marxist cesspool that is the UMich consumer confidence survey.

Source link