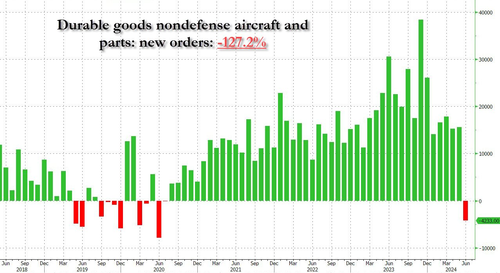

The headline US durable goods new orders print for preliminary June data was a disaster - plunging 6.6% MoM (vs expectations of 0.3% MoM rise!). That dragged goods orders down

Source: Bloomberg

However, through the rose-colored glasses of everything's still awesome, core durable goods orders surprised to the upside (+0.5% MoM vs +0.1% exp, rebounding from May's 0.1% MoM decline)...

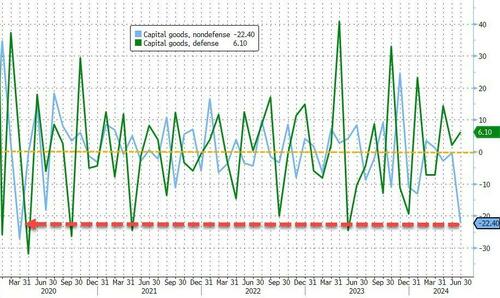

While war spending rose, non-defense spending is plunging...

Source: Bloomberg

So what caused the collapse in headline durables? Just blame Boeing's D(eadly)EI hiring practices again.

Doesn't seem like it's supporting the big AI Capex boom narrative too much?

Source link