Update (1420ET): Moody’s Ratings downgraded Boeing’s credit rating to Baa3 from Baa2 - just one notch above 'junk' status (with a negative rating outlook) - with headwinds related to the Commercial Airlines segment expected to persist at least through 2026

The downgrades reflect the inadequate performance of Boeing's Commercial Airplanes segment ("Commercial Airplanes"), which has prevented free cash flow generation from reaching the levels Moody's had previously expected.

The negative outlook incorporates Moody's view that the headwinds buffeting Commercial Airplanes will now persist at least through 2026. Annual free cash flow will fall short of the $4.3 billion of debt coming due in 2025 and also the $8.0 billion coming due in 2026.

Moody's anticipates that Boeing will issue new debt to fund these shortfalls. The pace at which Commercial Airplanes improves will dictate how much of any new debt will be used for funding the upcoming debt maturities versus being available for operations should free cash flow generation remain tempered. New debt issuance will also further delay credit metric's multi-year march toward levels commensurate with a low investment grade rating.

RATINGS RATIONALE

Moody's had maintained the Baa2 senior unsecured rating since April 2020 until today because of the company's strong business profile and its belief that the financial performance of the Commercial Airplanes segment was going to be well along its path to recovery by now. The duopoly in large commercial aircraft manufacturing, diversification benefits of the defense and services segments and the importance of Boeing to the U.S. Department of Defense as a prime contractor will continue to support the strong business profile. However, there have been a number of documented shortcomings, including poor quality on the 737's tail fittings and rivets and fasteners on the rear pressure bulkhead by key supplier Spirit AeroSystems, Inc. ("Spirit") and the door plug blowout on a 737-9 since March 2023. These events and their related consequences have prevented the increases in the 737 monthly production rate that would have driven stronger free cash flow generation.

The Baa3 rating reflects the still strong business profile, which continues to mitigate the ongoing weak performance in Commercial Airplanes that Moody's expects will constrain free cash flow generation for 2024 and 2025. Backlog was $529 billion on March 31, 2024, up from $520 billion coming into 2024. The Baa3 rating contemplates that credit metrics will remain weak for an investment grade rating through 2026. Timely remediation of the findings of the Federal Aviation Administration ("FAA") audit completed in January 2024 should lead the way to eventually higher production rates. Current 737 monthly production trails the current FAA cap of 38 as Boeing takes actions to improve the quality of its 737 assembly operations. Internal investments in training, digitization of assembly procedures and increased inspections among other actions have slowed the 737 line's flow and productivity. No longer allowing Spirit to ship 737 fuselages with defects as of March 1, 2024 has also contributed to the slow down in production. Approval by the FAA of updated assembly documentation procedures and compliance therewith will be the key gating item for expanding production above 38 per month. At that time, the supply chain will need to be functioning effectively to support future rate increases. This will remain a key watch item.

The negative outlook captures the material degree of execution risk in Boeing's plan to restore compliance and higher quality to its commercial aircraft assembly operations.

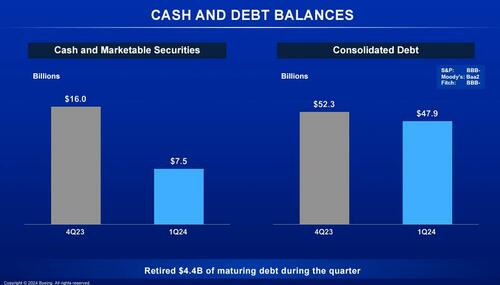

Moody's expects that liquidity will remain sufficient. Because the March 31, 2024 cash balance of $7.5 billion fell below $10 billion, Moody's anticipates that Boeing will issue new debt to maintain a desired stronger cash position near $10 billion and de-risk its maturity profile through 2026 in the event free cash flow falls short of its expectations.

In the Baa3 rating, Moody's contemplates a debt-funded acquisition of Spirit AeroSystems, Inc. As such, Moody's does not expect that it would initiate a review for downgrade of Boeing's ratings should an agreement be announced. However, a purchase price of Spirit's equity that is substantially higher than its recent peak of near $36 per share would be unexpected and could have negative implications for the Baa3 rating.

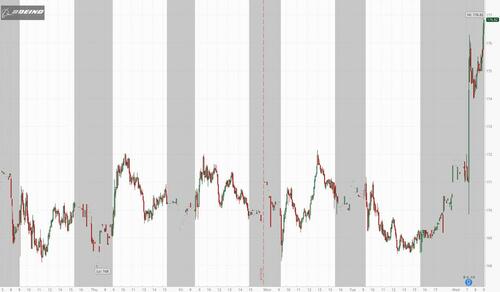

And after all that Boeing shares have reversed their early strong gains into a sizable loss...

* * *

As we detailed earlier, having been hammered like a nail for much of 2024 as a result of incident after incident involving its flying paperweights (most recently this morning), Boeing stock enjoyed a modest rebound this morning when the airplane maker reported revenues, EPS and cash flow that were all stronger than expected, while assuring investors that "demand across its portfolio was incredibly strong."

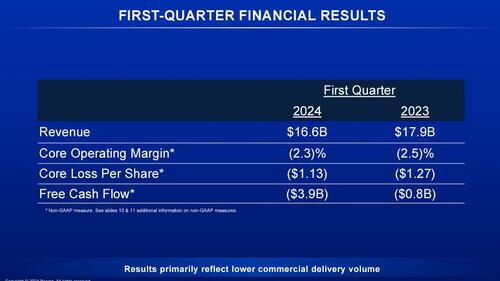

Here is what the company reported for Q1:

The latest loss reflected slower 737 Max production, lower 737 deliveries and compensation to customers after a door panel blew out on a commercial flight.

“Our first-quarter results reflect the immediate actions we’ve taken to slow down 737 production to drive improvements in quality,” said chief executive Dave Calhoun.

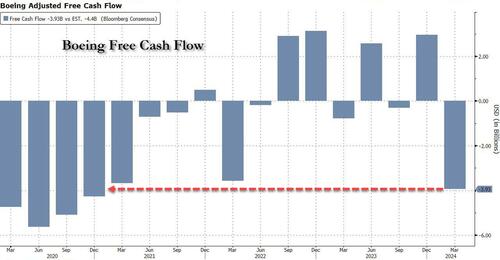

But while Boeing is "driving improvements", its cash flow is imploding and in Q1 plunged the most in three years. Well, nobody said DEI comes cheap...

And with Boeing incinerating cash at a near record pace, which fell by $8.5BN, even as maturing debt declined by just $4.4BN, net debt actually rose by $4.1BN!

A closer look at the various divisions, staring with Commercial Airplanes, which saw revenue tumble from $6.7BN to $4.7BN

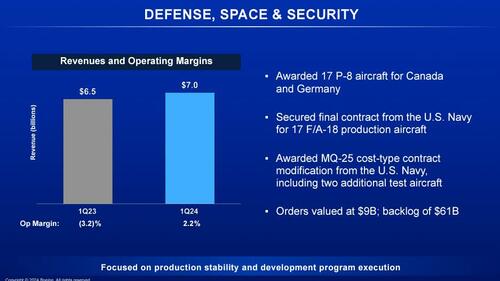

... and Defense, Space & Security, where thanks to the myriad US wars, revenue rose from $6.5BN to $7.0 BN

As Bloomberg notes, while the defense business posted a slim, $151 million operating profit for the first time in more than a year, the division is still grappling with cost overruns on fixed-price defense contracts, a hangover from its strategy of bidding aggressively to secure military contracts last decade. “Results also reflect $222 million of losses on certain fixed-price development programs,” the earnings release stated, without elaborating.

In any early morning message, Boeing CEO Dave Calhoun touted the progress Boeing is making in tackling its quality breakdowns. He touted a 500% increase in employee “Speak Up” submissions compared to 2023. Speak Up is a program that Boeing started in 2019 to encourage employees to internally report potential safety issues. In total, more than 70,000 employees have participated in these "quality stand downs."

The company has been hyping the program in recent months, as it faces allegations from whistleblowers who say they were punished in the past for raising concerns. That includes recent claims from a union that represents Boeing employees, which on Tuesday alleged the company retaliated against two engineers who raised concerns about its 777 and 787 jets in 2022.

“Near term, yes, we are in a tough moment. Lower deliveries can be difficult for our customers and for our financials. But safety and quality must and will come above all else,” Calhoun said.

The gloriously incompetent and virtue signaling Boeing chief also acknowledged his plans to step down as CEO “around the end of the year,” adding he would spend his remaining time working to rebuild confidence in Boeing, and to earn that idiotic comp package he received for burning the stock price to the ground.

Turning to M&A, Boeing confirmed last month that it’s in talks to buy back fuselage maker Spirit AeroSystems but there was no update on the deal in the earnings materials. In the meantime, Boeing is providing a $425 million cash advance to Spirit to help stabilize its operations while deliveries slow and the supplier works to improve quality control

This latest bailout by Boeing of one of its most important suppliers may signal the acquisition is taking longer to negotiate, RBC analyst Ken Herbert wrote in a note. The deal talks have hit a snag over pricing for factories that make components for Airbus SE jets, Bloomberg reported this week.

Looking forward, Boeing hasn’t provided any hints for its near- and longer-term prospects in the prepared materials published this morning so investors will have to wait for CEO Dave Calhoun’s appearance on CNBC or a later earnings call to learn more. Of particular interest: whether the planemaker still expects to generate $10 billion in annual free cash at some point during 2025 or 2026, as it had targeted before the latest crisis. The company suspended its annual financial guidance back in 2019, when the 737 Max tragedies sparked a global grounding that battered Boeing’s finances. Much of that detail seems uncertain right now with the FAA having a big say over production of the cash-cow jet. Boeing CFO Brian West said in March that the company still expects to generate cash for the year in the low-single-digit billions of dollars.

Still, while the results were terrible they were not as terrible as Wall Street's apocalyptic expectations - and that's even with the US engaged in multiple illicit wars - and BA stock managed to stage a modest short squeeze in premarket trading, which is not saying much: the bounce comes after a sharp selloff in the stock this year that made Boeing one of the worst performers in the S&P 500 Index. Also, whether the surge can stick is a different matter.

The company's Q1 investor presentation is here.

Source link