Remember when "developed world" central banks pretended their inflation target was 2%? Well, that lie died a miserable death today - and will do so again for good measure tomorrow - after the BOC cut rates for the first time in 4 years, and less than a year after its last rate hike, from 5.0% to 4.75% even as Canada's inflation remains a very sticky 2.7%.

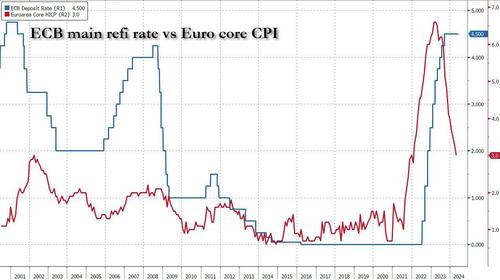

And just to underscore the death of the 2% inflation target, tomorrow the ECB will also cut rates for the first time since March 2016 (and 8 months after the last rate hike), even though core Eurozone CPI remains 3%.

Of course, despite all the posturing, the Fed won't be far behind especially once it becomes clear that the myth of strong US job growth was just a mirage (as explained yesterday), and either in July or September, the Fed will join the party despite core US inflation stuck at a blistering 2.8%.

G7 central banks (today BOC, tomorrow ECB, soon Fed) cutting rates with global core inflation lingering well above %.

— zerohedge (@zerohedge) June 5, 2024

Goodbye 2% inflation target.

It was this long overdue realization that the G7 central banks have officially raised their inflation target by about 1% that helped pushed bond yields to fresh two month lows, and down more some 35bps in just the past week...

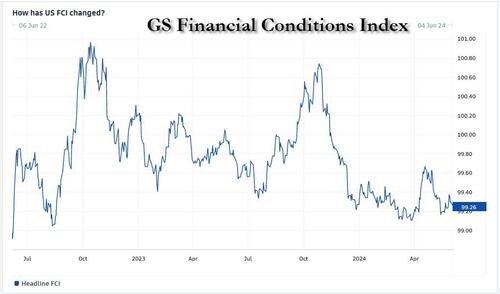

... as financial conditions have eased dramatically (see chart of Goldman Financial Conditions Index below), undoing any jawboned tightening the Fed tried to inject into the market in recent months.

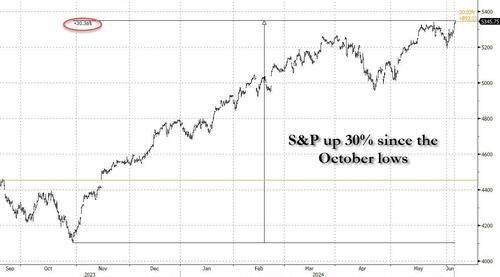

And with the tidal wave of easing about to be unleashed by all central banks, it is no surprise that the S&P just hit a new all time high of 5,350, up a whopping 30% from the October lows.

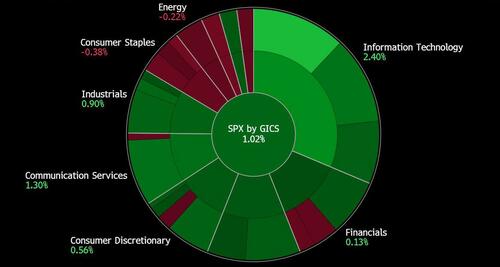

Superficially, there was some intraday variation, with some sectors red (hilariously, energy, which is supposed to power this new AI renaissance continues to get dumped)...

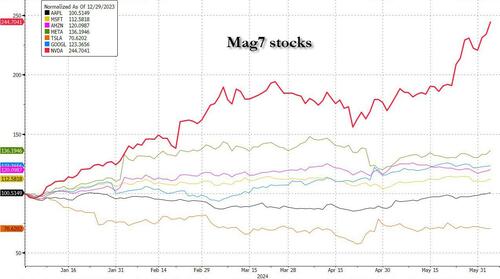

... yet looking below the surface, those hoping that one day... soon... perhaps... the market will broaden out will be disappointed: while the S&P is up 13% YTD, the "Mag 7"" is up 30%, while the S&P493 is up just 6.5%.

And when we talk about the Magnificent 7, we mean really just Magnificent 1: Nvidia is now up a ridiculous145% in just the past 5 months...

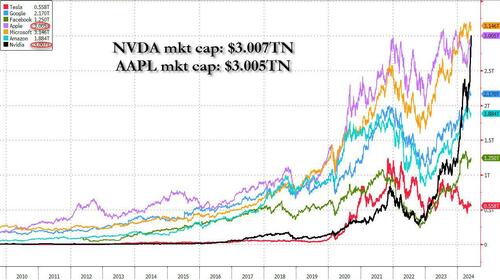

... and moments ago NVDA's market cap rose above $3 trillion, up more than $140 billion today alone, having risen more than $100 billion on 4 of the past 9 trading days...

... but also briefly topped Apple's $3.005 trillion, and this pace of insane meltup - which will require every tech company buying AI chips for the next several decades to justify the valuation - will make NVDA the world's biggest company some time tomorrow!

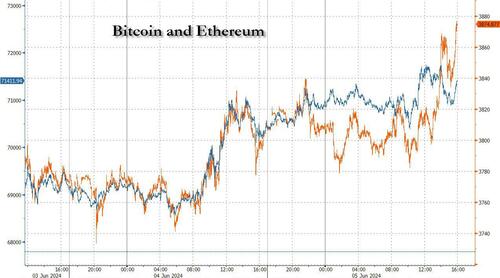

And as we boldly go into yet another absolutely massive asset bubble, one where three companies alone have a market cap of $9 trillion, it is not surprising that cryptos - those assets that sniff out fiat destruction ahead of most - are surging, with bitcoin also on the verge of another record high and trading above $71,000 with ethereum also finally breaking out higher...

... but gold is also starting to move after the recent profit taking, and is up a solid $27 today and fast approaching it own all-time highs.

In fact, the only commodity that is not exploding higher is oil, which instead if getting crushed to boost Biden's approval rating; indeed, oil will not be allowed to spike until the election... after which all hell will finally break loose.

Source link