Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on higher yields, be wrong? Instead of mindlessly assuming such legendary investors are correct, let’s do some homework.

First, though, let’s remind ourselves that Paul Tudor Jones and Stanley Druckenmiller are known for their aggressive trading styles. Therefore, we don’t know whether their bets are short term trades for a quick profit, or longer-term bets on significantly higher yields. Moreover, maybe their negative bond commentary is just “talking their books” to get traders and investors to follow them and boost their profits. Such a proven strategy by famous traders can be a recipe for losses by those who try to mimic their trades.

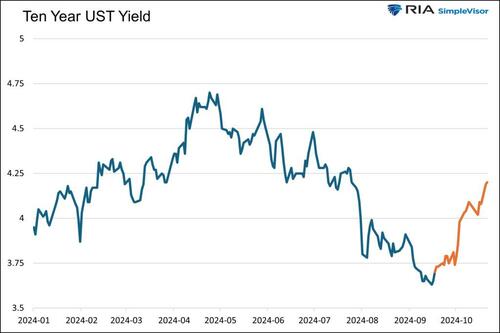

The recent 50-basis point increase in longer-term yields started the day after the Fed cut rates by 50 basis points. Some bond bears claim the Fed will rekindle inflation by cutting rates while the economy remains strong. Others fear that fiscal deficits are out of control, leading to inflation. An emerging group of bond bears, led by Paul Tudor Jones and Stanley Druckenmiller, worry that a Donald Trump Presidency and Republican control of Congress will ramp up deficits, resulting in high inflation.

Let’s address the market narratives and assess their credibility. Doing so will help us decide if following Paul Tudor Jones and Stanley Druckenmiller is a good idea.

Is Another Round Of Higher Inflation Likely?

Below is a review of some possible causes of inflation bandied about by the inflationist crowd.

Will High Inflation Reemerge

At its core, inflation is a function of supply and demand. The 2022-2023 bout of high inflation occurred because demand was grossly elevated by pandemic-related stimulus and unusual consumer behaviors. At the same time, the supply of many goods was significantly curtailed by global lockdowns and crippled supply lines.

Both demand and supply have since normalized. If inflation rises, it will not be for the same causes as the last round of inflation.

A Repeat Of the 1970s Is In the Cards

Some investors argue that consecutive rounds of the 1970s-like inflation are inevitable.

That era and this era are very different, as we recently wrote in a four-part series. Instead of requoting from those articles, we share the links (ONE, TWO, THREE, and FOUR).

“The 2020s aren’t the 1970s by any stretch of the imagination!” – Part Four

Government Spending Will Boost Inflation

Paul Tudor Jones and many others warn that uncontrollable federal deficits will boost inflation. We will also address this topic in the Debunking Deficits section, but before doing so, it’s worth a quick lesson on an economic term called the negative multiplier. To do so, we share a section from our article Stimulus Today Costs Dearly Tomorrow:

As we note, debt increasing faster than economic growth proves that borrowing and spending are unproductive. Unproductive government debt or private sector debt also results in a negative economic multiplier. Essentially, the ultimate expense of the debt outstrips its benefits over the long run.

Economists define the multiplier effect as the change in income divided by the change in spending. Over an extended period, if the change in spending is more significant than the change in income, the effect of said spending is negative. Replace GDP for income and government debt for spending to compute the government’s spending multiplier.

Multiplier = Change Income / Change Spending

Government Multiplier = Change GDP / Change Debt Outstanding

Bottom line: government debt stimulates the economy. However, the debt detracts from growth over time, more than offsetting the initial benefits. If you think the government is suddenly spending productively, then inflation may have an upward bias. However, assuming the government continues to spend unproductively, higher deficits are deflationary and weigh on economic growth.

The U.S. Will Import Inflation

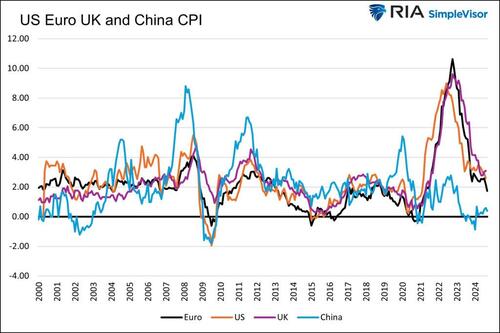

Some say we will import inflation. The first graph below shows that inflation in the Eurozone, China, and the U.K., three of our largest trading partners, is falling alongside that of the United States. China’s inflation is near zero. Japan, not shown, has seen meager inflation with bouts of deflation for the last 25 years.

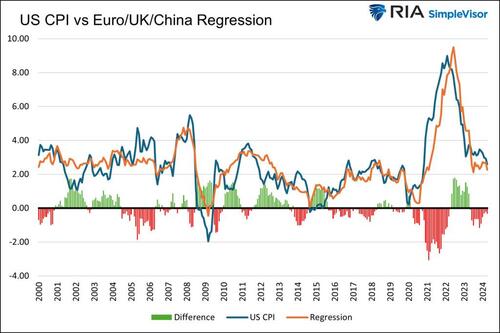

We also ran a multiple regression to forecast U.S. inflation based on the inflation of China, the U.K., and the Eurozone. The second graph shows a significant correlation, with an r-squared of .86. Moreover, the model states that U.S. CPI needs to fall by 0.3% to align with the historical relationship.

Both charts lead to the question of who we will import inflation from.

Debunking Deficits

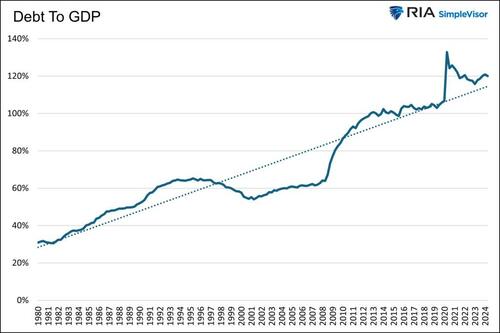

Before we put context to the recent deficit spending, it’s important to caveat that we believe, and have written on many occasions, that the nation’s consistent deficit spending and accumulating debt are a considerable headwind to economic growth. We, in no way, condone the recent deficit spending or the excessive spending for most of the last forty years. We are also well aware that countries with debt-to-GDP ratios above 1.0 have not fared well.

That said, considering bond returns for the next year or two, we must assess the situation for what it is today and not let the narratives and hyperbole surrounding the market sway our decision-making.

We now review a few popular arguments claiming that the trajectory of deficits has changed considerably, and the change is inflationary.

Recent Spending Is Obscene

A common argument from the emerging bond bears is that recent deficits are obscene compared to past ones. Accordingly, bond bears think these increased deficits will be inflationary and require higher yields to satisfy Treasury investors.

While that may be true, the argument lacks context. They fail to mention that the economy has grown significantly over the last few years.

The economy is about $8 trillion, or 33%, larger than it was on the eve of the Pandemic. Therefore, it’s not surprising the amount of debt has grown commensurate with that amount.

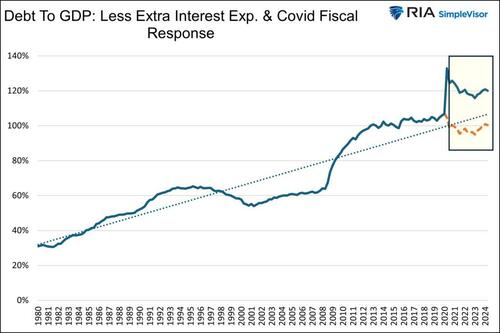

The graph below shows the debt-to-GDP ratio and its trend line since 1980. After the ratio jumped higher on massive COVID-related spending, it settled down slightly above where it was before the Pandemic. Furthermore, it has been flat for the last two years.

Now, let’s take the analysis one step further and theoretically calculate what the current debt growth would look like had the Pandemic never occurred. We admit that this is not a traditional way to assess debt, but it does provide unique context on the debt outstanding compared to GDP.

To do this, we reduce the debt by the estimated $5.6 trillion spent on COVID relief. Furthermore, we assume the interest expense of the Treasury debt would have stayed on the pre-inflation trend. For perspective, this cuts approximately $500 billion of added interest expense in the past year.

The graph below shows the revised debt to GDP in orange. Might it be fair to say that without the Pandemic, current debt issuance would be on par with pre-pandemic debt to GDP levels given the economy’s size? Furthermore, despite the pandemic, spending, debt, and GDP growth have primarily been aligned for the last two years.

Deficit Spending Increases The Money Supply

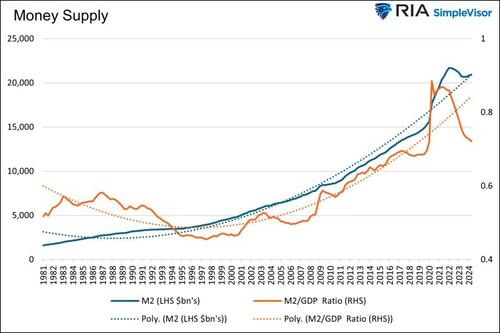

Money is lent into existence. Such is a fact; therefore, larger deficits (borrowing) increase the money supply. However, as the graph below shows, the money supply (M2) is on the pre-COVID trend. More importantly, M2 as a ratio of GDP, a better measure of money supply, is decently below the pre-COVID trend.

Also, for consideration, the supply of money is only part of the inflation equation. The other significant half is the velocity of money, or how often it is spent. Currently, the velocity of M2 is at the same level as at the start of 2020.

The supply and velocity of money have erased the pandemic-related anomalies and are similar to where they stood in late 2019. At that time, inflation was consistently running at 2%. The current supply and velocity of money should not lead one to believe that inflation is set to increase. If anything, the figures argue that inflation will return to the Fed’s 2% target.

We Are Following Japan’s Path

Paul Tudor Jones mentions a similarity between our fiscal situation and Japan’s. He refers to Japan’s excessive government debt and its central bank, which keeps interest rates extraordinarily low to help service the debt.

Japan has a debt-to-GDP ratio of 263%, more than twice that of the U.S. Its central bank has set interest rates at or below zero and relied on massive amounts of Q.E. for the last 20 years. The result is longer-term bond yields, as shown below, of 2% or less and sub-1 % inflation with prolonged periods of deflation.

Following Japan’s path seems awfully bullish strictly from a bond holder’s perspective.

More From Jones

Paul Tudor Jones also believes that inflating away the debt is the only way to resolve the issue without taking strict fiscal steps. Maybe he knows something we don’t, but Japan proves that is not necessarily the case, at least not yet.

Jones also comments that we need to “get to the point where we stabilize debt to GDP to where it is right now.” As we showed earlier, the debt to GDP is stable and not rising.

Donald Trump and a Republican Sweep

Paul Tudor Jones and Stanley Druckenmiller voice concern over inflation and bond yields if Donald Trump becomes the President and the Republicans sweep Congress.

Let’s take their assumption a bold step further and assume Donald Trump immediately attempts to cut taxes, spend like crazy, and rack up massive deficits. Even so, he must contend with Democrats, who will still have nearly 50% of the votes in Congress, and the Republican Freedom Caucus, which wants to curtail government spending and balance budgets. The Caucus and Democrats could be strange bedfellows in that circumstance.

Summary

The bearish arguments we discuss in this article have merit. However, when taken in proper context, we believe some of them are not as worrying as the headlines may seem. Further, as we see in Japan, there is quite likely more monetary policy runway before problems escalate.

We believe the slowing economic growth and lower inflation trends that persisted before the Pandemic are reasserting themselves. It may sound ridiculous today, but we wouldn’t be shocked if investors and the Fed were again worried about deflation in the coming years.

Source link