This should come as a shock to exactly nobody.

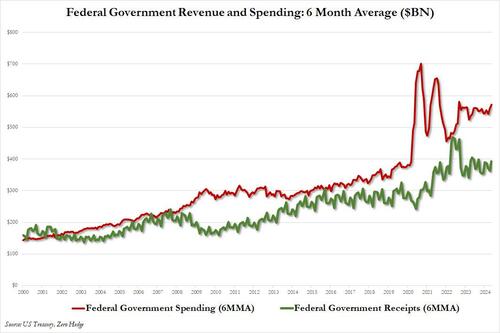

Last week, the Treasury reported that in May, the US government collected $323.6 billion in tax receipts, it spent more than double that, or some $670 billion...

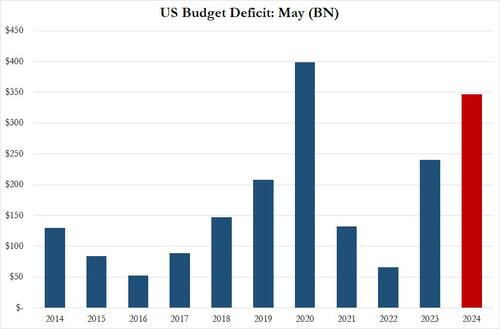

... resulting in a May budget deficit of $347 billion - about $100 billion more than consensus expected - and the second biggest May deficit on record, with only the Covid crisis peak of May 2020 higher.

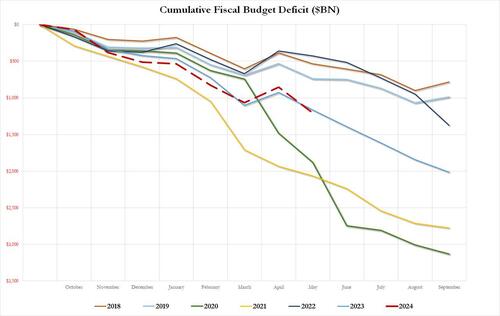

As a result of the blowout May deficit, the cumulative fiscal 2024 shortfall once again surpassed the 2023 total, bringing the YTD deficit total to just over $1.2 trillion more than the $1.16 trillion cumulative deficit througth May 2023, and that's with 4 more months left in the fiscal year.

Now, at this point, someone who still has a functioning brain at the CBO looked at the two llines and realized that with the final 2023 deficit printing just over $2 trillion, the CBO's current forecast of "only" $1.5 trillion for 2024 looked idiotic at best, and like total propaganda garbage at worst.

And so, moments ago - and, again, with just 4 months left in fiscal 2024 - the CBO took machete to its 2024 forecast, and in hopes to avoid looking like a consummate fool, hiked its 2024 budget deficit forecast from $1.5 trillion to $1.9 trillion, confirming that there will be effectively no difference in the fiscal picture between 2023 and 2024.

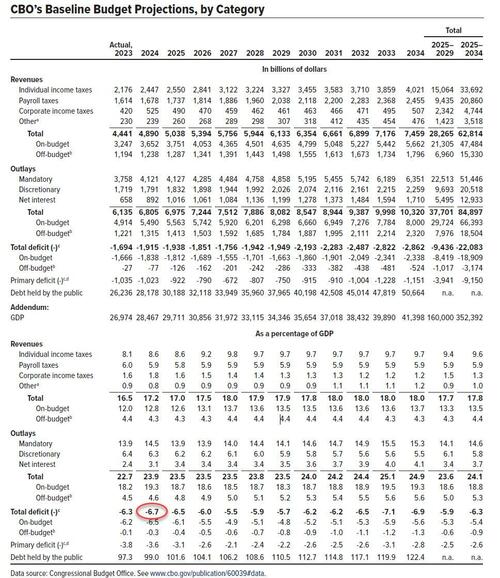

In its latest projections published today, the Congressional Budget Office (CBO) predicted that government spending would continue to, drumroll, rise. The CBO estimate of the budget deficit was $400 billion higher from the office’s last projections released in February, bringing the total to $1.9 trillion, up from its previous $1.5 trillion forecast.

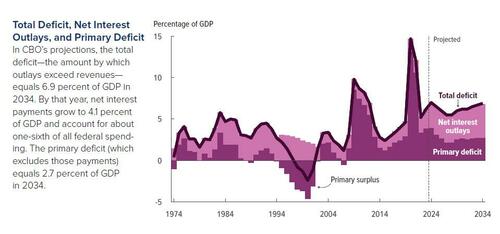

The office attributed the 27% spike to several key drivers, including foreign military aid (i.e. covering up Biden's crimes in Ukraine via constant military aid to the local regime), the Biden administration’s student loan actions, the Federal Deposit Insurance Corporation’s slower-than-expected recovery of payments made in response to bank failures over the past two years, higher outlays for Medicaid and increases in discretionary spending. Oh, and the $1.2 trillion in interest expense on Federal debt isn't helping either, and is one of the biggest reasons why the CBO now expects a 2024 deficit-to-GDP ratio of 6.7%, up from the previous 5.3% pedestrian prediction.

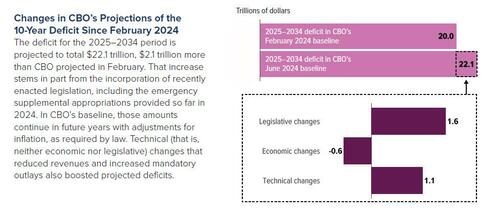

Meanwhile, the cumulative deficit from 2025 to 2034 is projected to reach $22.1 trillion, which is 10% higher than the office previously projected in February, marking a $2.1 trillion increase.

Of course, by the time 2034 rolls along, the actual deficit will most likely be at least 10x more, but since gold will be about $100,000 by then while bitcoin will be the world's digital reserve currency, none of that will matter.

“The largest contributor to the cumulative increase was the incorporation of recently enacted legislation into CBO’s baseline, which added $1.6 trillion to projected deficits,” the CBO said Monday. “That legislation included emergency supplemental appropriations that provided $95 billion for aid to Ukraine, Israel, and countries in the Indo-Pacific region.”

“By law, that funding continues in future years in CBO’s projections (with adjustments for inflation), boosting discretionary outlays by $0.9 trillion through 2034.”

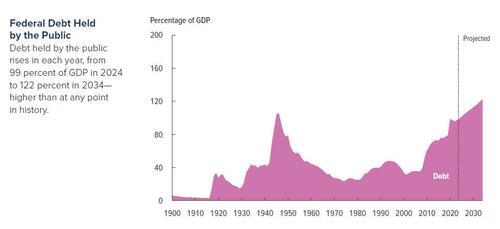

Compared to the past five decades, the budget analysts said deficits over the next 10 years “are about 70 percent larger than their historical average” when measured “in relation to economic output.”

In other words, the US is now well past the Minsky Moment point of no return, and it will all come crashing down once the USD loses its reserve currency status.

As interest costs and spending on programs like Medicare and Social Security continue to rise, the CBO projects federal outlays will reach 24.2% of gross domestic product (GDP) in 2024 and 24.9% of GDP in 2034.

Of course, all of this is irrelevant, because even the CBO now admits that in the long-term, it's game over as there is no inflection point that makes future deficits grind down to zero, even in the most optimistic scenario.

Source link