Smaller is better...at least in the world of building EVs for the Asian market.

And while less scrupulous publications might take this opportunity to make stereotypical jokes about height, we'll do no such thing and instead will simply report that according to the IEA's Global Electric Vehicle Outlook 2024, released Tuesday, China dominated the EV market in 2023.

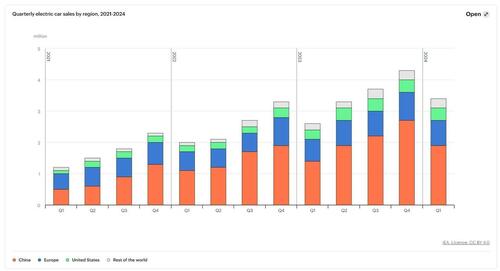

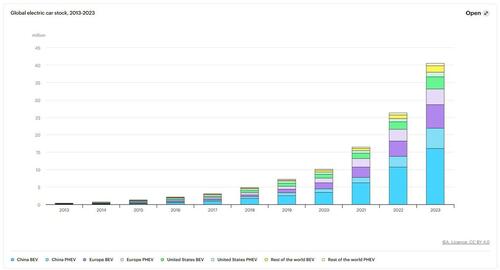

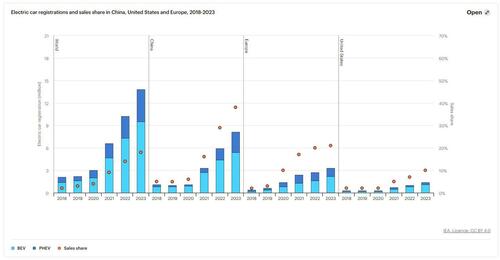

In fact, it made up 60% of global sales, according to a new report from Reuters. The report forecasts that by 2030, electric vehicles will represent one-third of all cars in China.

The latest IEA report highlights China's increasing dominance in the global electric vehicle market, particularly across Asia's burgeoning economies. China is capitalizing on its extensive industrial capabilities to expand its EV influence, promoting more affordable electric vehicles in nations like Thailand, Vietnam, and Indonesia, the report says.

The key to China's success has been managing cost, the IEA report notes: "In China, we estimate that more than 60% of electric cars sold in 2023 were already cheaper than their average combustion engine equivalent."

It continued: "However, electric cars remain 10% to 50% more expensive than combustion engine equivalents in Europe and the United States, depending on the country and car segment."

"In 2023, 55% to 95% of the electric car sales across major emerging and developing economies were large models that are unaffordable for the average consumer, hindering mass-market uptake," the IEA report continued, according to Reuters.

"However, smaller and much more affordable models launched in 2022 and 2023 have quickly become bestsellers, especially those by Chinese car makers expanding overseas."

The report emphasizes China's growing edge due to making affordable EVs, which is proving successful across Asia.

European and U.S. automakers, by contrast, target wealthier customers with costlier, luxury EV models.

In Asia, countries like Thailand, Vietnam, and Indonesia are rapidly adopting EVs, supported by favorable policies and incentives, enhancing the market share of Chinese manufacturers.

In 2023, EV sales soared in these regions despite broader market contractions. Additionally, China faces its challenges, including potential EU tariffs and an oversupply in its EV market. The IEA report suggests that for widespread EV adoption, European and U.S. manufacturers need to focus on lowering costs and improving infrastructure.

You can read the IEA's full report here.

Source link