Deutsche Bank released a new note on coming 2025 themes, trends and top picks in the automotive industry this week. Among the standouts from the note were:

Volkswagen (Europe): Volkswagen is addressing cost inefficiencies with bold restructuring efforts, such as plant closures and a canceled labor agreement in Germany. Its new product launches, particularly in premium brands Audi and Porsche, position it to have the youngest portfolio by year-end 2025, enhancing competitiveness.

BMW (Europe): BMW leads German automakers in Battery Electric Vehicle (BEV) adoption, helping it comply with EU CO2 regulations. Additionally, its cash return potential, with €2 billion allocated for share buybacks and plans for more, provides shareholder value.

Michelin (Europe): Despite recent challenges, Michelin is expected to outperform in 2025 due to a recovery in volume growth, strong cash generation, and lower risk exposure compared to other European automotive companies.

Pirelli (Europe): Pirelli continues to deliver earnings and margin growth, despite risks such as tariffs and potential Chinese stakeholder exits. Its strategic focus on high-value-added (HVA) volumes safeguards financial performance.

Tesla (United States): Tesla is at the forefront of autonomous driving technology and cost-efficient BEV production. Its advancements in robotaxi technology and strong compute resources give it a competitive edge that is hard to replicate.

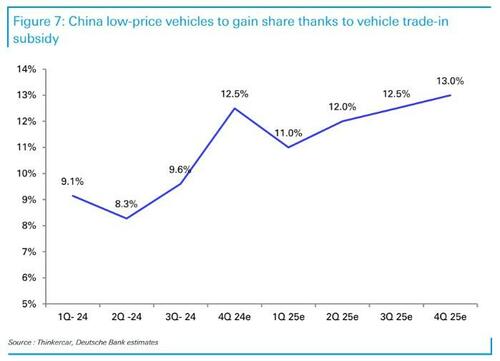

BYD (China, 1H 2025): BYD excels in cost leadership and exposure to the fast-growing low-price vehicle segment in China. It is well-positioned to benefit from government incentives and increased domestic and export demand.

In the note, the bank concludes that the automotive sector is set for another challenging year in 2025, with continued volatility, pricing pressures, and regional disparities in demand. While the industry grapples with muted growth in Europe and North America, there are pockets of opportunity driven by electrification, restructuring efforts, and innovative advancements in autonomous driving technology.

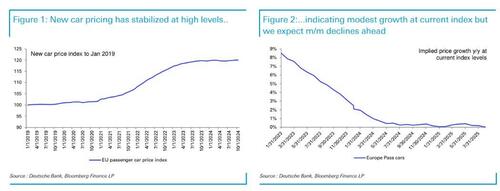

In Europe, companies like Volkswagen and BMW are well-positioned to weather the storm. Volkswagen is aggressively restructuring to address high labor costs, a move that includes plant closures in Germany, while also leading in portfolio renewal with new launches across its mass-market and premium segments. BMW, benefiting from its robust Battery Electric Vehicle (BEV) portfolio, is poised to meet stringent EU CO2 regulations and avoid fines. Pricing in the region is expected to decline slightly but remain relatively stable as OEMs resist aggressive incentives.

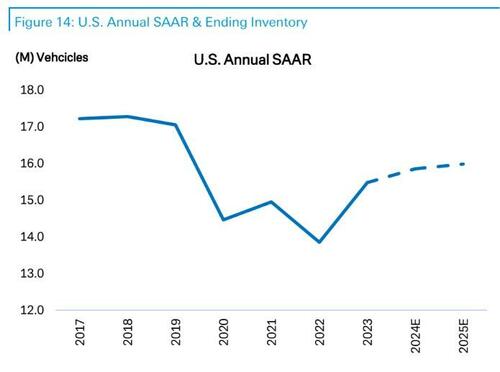

The U.S. automotive landscape faces uncertainties tied to the new administration’s policies on emissions and EV incentives. Tesla continues to dominate the autonomous driving space, leveraging its scale and technological edge to outpace competitors. Pricing in the U.S. is also under pressure, with GM maintaining disciplined inventory management to mitigate declines, while other OEMs like Ford face challenges in balancing inventory and demand. Companies such as Autoliv and Dana are positioned to capitalize on opportunities in safety systems and cost-efficient restructuring, respectively.

China presents a contrasting narrative, with double-digit growth expected in passenger vehicle volumes driven by government incentives and local OEMs like BYD and Geely gaining market share. Electrification in China remains a strong growth driver, particularly in the BEV segment, though volumes are still below initial forecasts due to policy adjustments. Exports from Chinese automakers are also expected to grow by 12% in 2025, supported by new overseas plants, expanded product portfolios, and entry into new markets.

Across the industry, electrification continues to be a pivotal theme. Europe leads in BEV adoption, fueled by tightening CO2 regulations, while China’s growth is underpinned by strong government support. In the U.S., electrification momentum is closely tied to federal policies, with potential shifts in EV incentives under the new administration. However, high electrification costs and the risk of regulatory fines in Europe remain challenges for profitability.

Pricing pressures are expected to persist across all regions. In the U.S., high inventory levels and muted demand are driving slight declines in new car pricing, while in Europe, pricing is softening as demand stabilizes. The used car market, which saw a surge during the pandemic, offers limited support as prices normalize. In China, competitive dynamics continue to exert downward pressure on prices, especially in the low-cost vehicle segment.

Restructuring emerges as a critical theme, particularly in Europe. OEMs are focusing on cost-cutting measures to address declining demand and high operational costs. Volkswagen’s aggressive restructuring plan is an example of the industry’s efforts to realign capacities and improve competitiveness. Such measures are expected to play a significant role in reshaping the automotive landscape in 2025.

Amid these challenges, certain companies stand out. Tesla continues to lead in autonomous driving and robotaxi advancements, setting a high bar for competitors. Volkswagen and BMW are poised for growth through portfolio renewal and emissions compliance, while BYD and Geely dominate the low-cost vehicle segment in China. Michelin and Pirelli remain strong players in the tire market, balancing challenges with consistent cash flow and innovative strategies.

The note concludes that while 2025 promises to be another volatile year, selective investments in OEMs with strong balance sheets, innovative electrification strategies, and effective restructuring plans offer significant upside potential. Regional dynamics, policy shifts, and advancements in technology will play pivotal roles in shaping the future of the automotive industry.

The full note can be found by premium subscribers in the in the usual place.

Source link