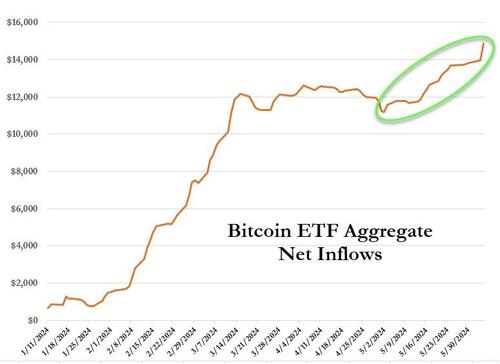

After a period of flat to negative flows, the spot ETFs have added $3.7 billion in assets over the past month, to make the aggregate net inflows since inception almost $15 billion.

Yesterday completed the sixteenth straight day of net inflows with a second-best-ever $887 million flood of money into the crypto assets.

It’s the highest net inflows the funds have seen since March 12, when they took in a record $1.04 billion. Bitcoin hit an all-time high of $73,679 a day later on March 13.

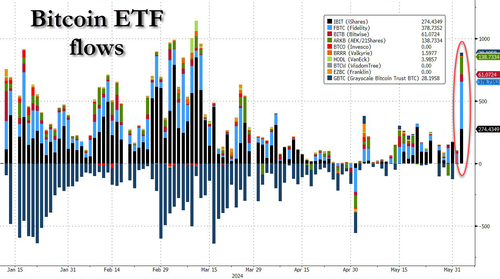

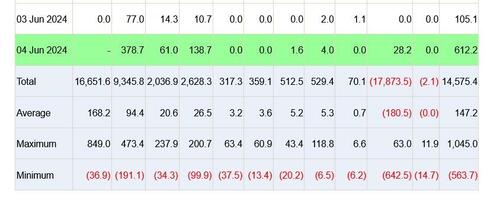

The Fidelity Wise Origin Bitcoin Fund (FBTC) saw the largest inflow at $378.7 million, while BlackRock’s iShares Bitcoin Trust (IBIT) was second with $275 million, according to early data from Farside Investors and X account HODL15Capital.

Farside data reported the Grayscale Bitcoin Trust (GBTC) saw a rare inflow day at $28.2 million, the seventh time it’s seen an inflow since it converted from a closed-end fund to a spot ETF in January.

As CoinTelegraph reports, ETF Store president Nate Geraci hit back at Bitcoin critics on X who he said claimed the Bitcoin ETFs would see little demand.

“I was told several months ago that all of the ‘degen retail’ investors who wanted to buy had already done so [and] there was nobody left,” Geraci wrote.

“How can this be?”

Bloomberg ETF analyst Eric Balchunas wrote on X that it was “big-time flows all around today for The Ten” - the Bitcoin ETFs bar Hashdex’s, which joined the market months after the others had launched and has struggled to see inflows.

“The ability to bounce back with renewed interest after a couple nasty selloffs is rare for hot sauce type strategies,” Balchunas said in a post on X.

“[It] shows staying power.”

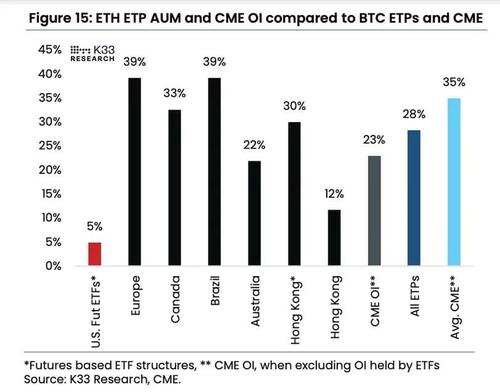

Meanwhile, Ethereum-based exchange-traded funds (ETF) that can directly hold ether (ETH) are soon arriving in the U.S. and could attract $4 billion of inflows in the first five months, crypto analytics firm K33 Research said in a report.

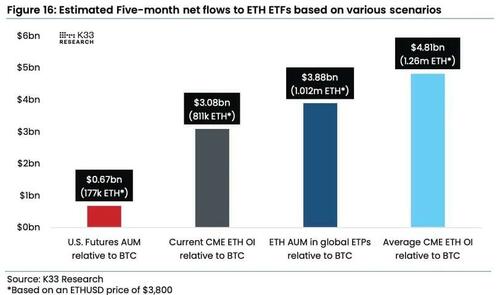

As CoinDesk reports, the company based its forecast by comparing the assets under management in existing ETH-based exchange-traded products around the globe to similar bitcoin (BTC) products and the amount of open interest (OI) in futures contracts on the Chicago Mercantile Exchange (CME), the go-to marketplace for institutional investors.

Ether's OI on CME currently stands at 23% of the size of BTC futures, but it has seen an average share of 35% of BTC futures since ETH futures started trading on CME in 2021, indicating significant institutional demand for ETH in the U.S., per K33.

Applying these ratios to the nearly $14 billion inflows so far into the spot BTC ETFs, K33 puts the estimated ETH ETF inflows between $3 billion and $4.8 billion within the first five months. This estimate is slightly higher than JPMorgan's $3 billion forecast for this year.

Goldman points out that,according to Coinshares, the current AUM for global ETH ETP products is roughly ~20% of BTC ETPs, which serves as a good reference for ETH ETF inflows in the US.

Based on current prices, this would equal 800,000 to 1.26 million of ETH accumulated in the ETFs, or roughly 0.7%-1.05% of the total supply of tokens, creating a supply crunch for the asset, according to the report. Unlike futures-based products, the issuers of spot ETFs will need to buy tokens in the spot market as investors buy ETF shares.

"As seen in BTC, this monumental supply absorption shock should lead to price appreciation in ETH," said Vetle Lunde, senior analyst at K33 Research.

The first 2x Ether Futures ETF $ETHU launched today and did over $5m in volume, which is great for a new launch AND more than all the Ether futures ETFs did combined on their first day BUT still pretty microscopic vs anything bitcoin pic.twitter.com/uAkJ6Z3gLT

— Eric Balchunas (@EricBalchunas) June 4, 2024

Finally, we note, as DeCrypt reports, regulatory certainty could bring a crowd of financial advisors worth $20 trillion into the crypto industry.

Recent tailwinds lifting the prospects for the crypto industry in Washington are far more bullish than the market has priced in, according to Bitwise CIO Matt Hougan.

“If people understood the ramifications of the shift in D.C., the crypto market would be at new all-time highs,” Hougan wrote in a blog post on Tuesday.

Per Bitwise’s latest survey on the matter, a whopping 64% of advisors cited"regulatory uncertainty" as their top challenge in accessing the asset class.

The lack of interest, he says, looks like a juicy bit of alpha—an edge to move ahead of the market—for those in the know about crypto, with $20 trillion in wealth controlled by U.S. financial advisors at stake.

“Imagine, then, how much of that $20 trillion will go into crypto when the biggest barrier gets lifted,” he wrote.

Source link