US futures, the dollar and treasury yields are all lower post-Debate and pre-CPI but off session lows. As of 8:00am, S&P futures are down 0.1%, recovering from a loss of 0.5% earlier; Nasdaq futures were down 0.2% with Mag7 and Semis lower as Energy stocks rebound from yesterday's drubbing. Treasuries had minimal moves during the debate, but yields are 3-4bps lower now, hitting fresh 2024 lows. USD is lower and commodities are higher led by Energy, Ags, and Precious, with oil rebounding from Tuesday's rout. The macro data focus today is on the CPI print (full preview here) and the 10Y bond auction.

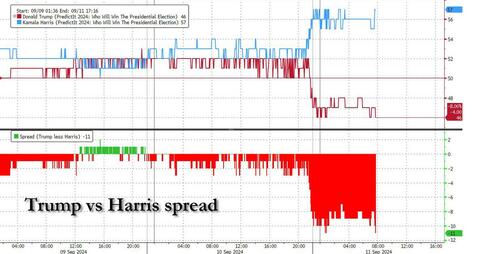

Betting markets indicate a Harris victory in the debate as her odds to win had her leading Trump by 1-point as the debate started to now 11-points this morning, a signal that many expect her candidacy to earn a boost from Tuesday’s proceedings. Her odds of winning the election increased on the betting website PredictIt to 57%, compared with 53% before the debate. The reaction in assets confirmed this shift in sentiment: the dollar is weaker and US domestic equities are broadly lower. Stocks in renewable energy producers rose, gaining strength from the debate and Harris’ advocacy of green energy. Meanwhile, Trump’s support of the crypto sector and the Democrat's endless feud, fueled a pullback in the price of Bitcoin.

“Markets may want to wait on new opinion polls in the coming days to take more decisive positions on the election,” ING Groep NV currency strategists including Francesco Pesole wrote in a note to clients. “For now, indications that Harris won this debate, even if by a small margin, can keep a lid on the dollar.”

The threat of far-reaching tariffs is shaping up to be among the biggest risks to markets. While Trump placed tariffs on more than $300 billion of Chinese goods as president and sought to block countries from buying Huawei Technologies Co. equipment for 5G networks, Harris’ stance is lesser known after she joined the ticket late.

“Historically I would have said: don’t waste too much time thinking about a presidential election,” said Ronald Temple, chief strategist at Lazard Asset Management. “But I think it is consequential because you are talking about a huge amounts of tariffs. Right now the market is not pricing a global trade war.”

In premarket trading, GameStop tumbled 10% after the video-game retailer reported second-quarter net sales that disappointed. Baird said the results demonstrated the ongoing challenges to the company’s retail business model. Dave & Buster’s jumped 13% after the restaurant chain reported second-quarter profit that came in ahead of estimates. Analysts highlighted the company’s margin performance. Here are some other notable movers:

Worries over a global slowdown in growth have resurfaced with oil trading below $70 and global bond yields retreating to a two-year low this week. Investors’ attention is on the US consumer price index due later Wednesday, expected to show another month of muted increases, and the Fed policy meeting next week.

“We do think that the downside risks for growth are higher than the upside risks for inflation,” Cameron Dawson, chief investment officer at NewEdge Wealth, said in an interview with Bloomberg TV. “If you look at wage growth, there’s really no signs that wage growth is picking up.”

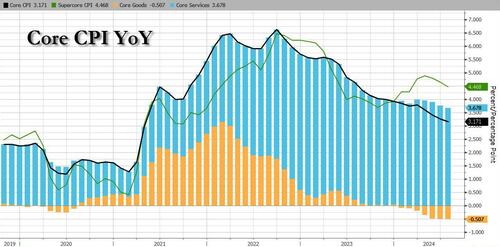

As discussed in our preview, the CPI report later will probably show US consumer prices climbed in August at the slowest pace in more than three years, but the question for policymakers is whether the data warrants an outsized interest rate cut of 50 basis points, or whether a quarter-point interest-rate cut is enough. Traders are fully pricing a smaller cut, while still betting on at least one 50 basis-point Fed rate cut this year — just probably not before the Nov. 5 election.

European stocks tick higher as investors await sensitive US inflation data due later on Wednesday for clues about the Federal Reserve’s near-term policy moves. The Stoxx600 was up 0.6%, as mining stocks and retailers outperform, with Zara-owner Inditex rallying after reporting rising sales in the third quarter. Telecoms and health care stocks lag. Here are the most notable European movers:

Asian equities fell for the third successive session as weakness in Japan deepened amid a strengthening yen. Chinese stocks resumed their decline. The MSCI Asia Pacific Index fell as much as 0.7%, with Toyota Motor, Samsung Electronics and Commonwealth Bank of Australia among the biggest drags. Chinese shares in Hong Kong and the mainland closed lower as investors continued to fret over the outlook for Asia’s largest economy and as sentiment remained muted around the US presidential debate. In Japan, the Topix index fell for a sixth straight day, the longest streak since July 2023, as concerns over the impact of a stronger local currency on exporters’ earnings lingered. Other major markets including Australia, South Korea and Taiwan also closed lower.

“We are strategically underweight China equities in global and EM equity baskets, due to the structural slowing of growth and low EPS prospects,” Alex Ng, head of research at Fortress Hill Advisors, wrote in a note on Smartkarma. “Further targeted policies from China authorities could cause intermittent trading-driven short-covering, but aggressive game-changing policy would be required to sustain a rally.”

In FX, the Bloomberg dollar spot index falls 0.2%. NZD and GBP are the weakest performers in G-10 FX. The yen extended gains, partly spurred by hawkish commentary from a BOJ official, boosting the yen to as high as 140.71 per dollar before it pared some gains to around the 141 level. Swiss franc see haven demand ahead of US CPI data.

In rates, treasuries are slightly richer across the curve with gains led by long-end after benchmark yields touched new YTD lows during European morning. Long-end yields remain richer by ~2bp after falling as much as 4bp, marginally outperforming shorter maturities; 10-year at 3.625% outperforms bunds in the sector while trailing gilts. $39b 10-year reopening at 1pm New York time is poised to draw lowest yield since May 2023; WI yield is ~33.5bp richer than last month’s, which tailed by 3.1bp in a soft reception. Gilts outperform bunds and Treasuries across the curve.

In commodities, west Texas Intermediate crude rebounded on Wednesday after plummeting as much as 5% in its previous session. WTI crude oil futures are up more than 2% from Tuesday’s lowest closing level since December 2021. Crude has tumbled by almost a fifth so far this quarter on concerns that slowing growth in the US and China, the leading consumers, will crimp demand at a time of robust and expanding supplies. Spot gold rises roughly $9 to trade near $2,525/oz. Spot silver gains 1.4% near $29. Bitcoin drops.

Looking at today's calendar, the August CPI data are due at 8:30am New York time. The session also includes 10-year note reopening, following strong demand for Tuesday’s 3-year note auction.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded cautiously after the two-way price action stateside and as participants await US CPI data. ASX 200 trickled lower as weakness in tech and financials overshadowed the gains in commodity-related stocks. Nikkei 225 was pressured amid currency strength and after BoJ's Nakagawa kept the door open for further hikes. Hang Seng and Shanghai Comp conformed to the downbeat mood with the former dragged beneath the 17,000 level amid heavy losses in energy stocks, while there was very little to spur a turnaround.

Top Asian News

European bourses, Stoxx 600 (+0.2%) began the session modestly in the green and generally traded near session highs throughout the European morning; in recent trade sentiment in the complex has slipped slightly, with indices displaying more of a mixed picture. European sectors hold a strong positive bias; Retail takes the top spot, propped up by post-earning gains in Inditex (+4%). Healthcare is found at the foot of the pile, continuing the losses seen in the prior session. In terms of individual movers, Commerzbank (+17%) soars after UniCredit (+1.9%) bought shares in the Co. from the German Government. US equity futures (ES -0.4%, NQ -0.4%, RTY -0.7%) are lower across the board, with slight underperformance in the economy-linked RTY as traders digest the Presidential Debate; CNN opinion polls suggest that 63% of voters thought candidate Harris won the debate.

Top European News

FX

Fixed Income

Crude

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

One of the themes from our new chart book is the US election, and last night saw Kamala Harris and Donald Trump go head-to-head in what may well be their only TV debate of this election. If you just base it off PredictIt markets, Harris will have come out the happier as her probability of winning the Presidency has edged up from 52% pre-debate to 55% as I type this.

It's clearly impossible to isolate the direct impact of the debate but S&P 500 (-0.52%) and NASDAQ 100 (-0.65%) futures moved lower through the debate, and 10 year USTs yields have moved -2.5bps lower overnight with the dollar also slightly weaker. Bitcoin, which is seen as a Trump trade, has fallen -2.5% since the start of the debate. So the market for now seems to have some agreement with the probabilities above as to how the debate went. We will see how it resonates from here.

Elsewhere it's a softer Asia session with the Hang Seng (-1.49%) leading losses and with the Nikkei (-0.81%) also losing ground as the Japanese yen has strengthened +0.77% against the dollar and is rising for the second consecutive day. It's trading at 141.39 against the dollar, hitting its strongest level since 02 January after the BOJ Board Member Junko Nakagawa in her speech signalled the readiness of the central bank to continue raising interest rates if its price and economic outlooks are met.

Ahead of the debate, markets saw a mixed session though increased rate cuts hopes and an improved tech mood helped the S&P 500 +0.45% higher by the close, albeit one that's been reversed this morning. Treasuries continued their advance amid a further retracement in oil prices and an earlier risk-off mood as global banks had a difficult day after an earnings expectations warning from JPM. In all, there wasn’t a single catalyst but the macro back-and-forth continued as markets try and work out whether the Fed are likely to cut by 25bps or 50bps next week. We’ll get another piece of the jigsaw today with the US CPI release, but if it’s anything like the jobs report last Friday, it’s entirely plausible that it fails to resolve the debate either way, and markets are still left wondering about the decision going into the weekend.

In terms of what to expect from the CPI print, our economists are expecting headline inflation to come in at +0.20% for the month, which would bring year-on-year CPI down to +2.6%. That would be the lowest annual inflation rate since March 2021, so it would cement the view that inflation risk is receding and the Fed are now in a position to cut rates again. Meanwhile for core CPI, they see that coming in at +0.23% for the month, leaving the annual rate unchanged at +3.2%. Our economists point out that one area to focus on will be rental inflation, where there was a surprise move higher in July, so the question is whether that was a one-off or not. Their forecast is that primary and owners’ equivalent rents should come in at +0.32% and 0.30%, respectively, falling back from their levels in July and closer to those seen in June.

Of course, the big question is what the release might mean for the Fed’s decision, which is now just one week away. Currently, markets are still pricing in a decent 32% chance that the Fed will kick off with a 50bp cut. That probability had come down over the previous few sessions, particularly after payrolls was still running at +142k, which isn’t where you’d expect to be in a recession. Moreover, the speakers we did hear from on Friday kept their options open, and other central banks like the ECB and the Bank of Canada haven’t been pursuing 50bp cuts either. So if the Fed did move at the faster pace, that would (so far at least) leave them as the outlier in terms of how quickly they’re easing policy.

While September Fed pricing was little changed, the total amount of rate cuts priced over the next 12 months rose to a new high of 240bps (+8.2bps on the day). From the Fed’s perspective, one trend that’s helping to remove inflationary pressures has been the sharp decline in oil prices over recent weeks. In fact, yesterday saw Brent crude oil (-3.69%) close beneath $70/bbl for the first time since December 2021. That continues a declining trend for oil recently as it was only on July 5 that Brent crude peaked at almost $88/bbl intraday, so we’ve seen a significant move in the last couple of months. The losses have been driven by a range of factors, but fears of a sharper downturn for the global economy have been significant, given the correlation between oil and broader economic demand.

With inflationary pressures subsiding, that in turn helped to lower sovereign bond yields on both sides of the Atlantic yesterday. For instance, the 10yr Treasury yield (-5.7bps) closed at 3.64%, which is its lowest closing level since June 2023 and with another -2.5bps fall this morning after the debate. Similarly, the 2yr yield (-7.4bps) was down to 3.60%, the lowest since September 2022. Unsurprisingly, that happened alongside a clear decline in inflation expectations, and yesterday saw the 10yr inflation swap close at just 2.24%, which is its lowest level since January 2021, before inflation began to spike higher in a serious way that year. Those moves were also echoed in Europe, where yields on 10yr bunds were down to just 2.13% by the close, which we haven’t seen since January 05.

In the meantime, equities had a topsy-turvy day, with the S&P 500 recovering from trading -0.5% lower around the European close to end the session +0.45% higher. Tech stocks drove the advance, with the NASDAQ up +0.84% and the Magnificent 7 +1.51% higher, the latter led by a +4.58% rise for Tesla. Oracle (+11.44%) was the best performer in the S&P 500 after reporting stronger growth in its cloud services business the previous evening. However, the gain for the S&P 500 was limited by a slump among energy companies (not helped by the fall in oil prices) and banks in particular. The S&P 500 banks subindex was down -2.88% yesterday, which is its worst daily performance in nearly four weeks. JPMorgan (-5.19%) led this decline, posting its worst day since April after its President said that, given current rate expectations, net interest income next year “will be lower” than estimated by analysts. Other financial bosses were generally also cautious at the industry conference where the JPM news emerged from.

The poor performance of banks came even after a significant update yesterday from the Fed on the Basel III endgame proposal, in a speech from Fed Vice Chair for Supervision Barr. Under the re-proposals he outlined, aggregate common equity tier 1 capital requirements for global systemically important banks (G-SIBs) would only rise by 9%, rather than 19% as planned before. For large banks that aren’t G-SIBs, they would see a 3-4% increase in capital requirements. With watering down of the original proposals having been largely expected, it was companies’ commentaries that dominated, leaving a more cautious backdrop for US banks.

Finally in Europe, there were losses across the major indices. That included a -0.54% decline for the STOXX 600, marking its 5th decline in the last 6 sessions. The Stoxx banks index (-1.49%) was dragged down along with US peers. Germany’s DAX (-0.96%) underperformed, led by a -11.15% decline for BMW as the automaker warned its profit this year would be impacted by a major recall and weak China demand. Other European indices also retreated, including the FTSE 100 (-0.78%), the CAC 40 (-0.24%).

To the day ahead now, and the main data highlight will be the US CPI release for August. Otherwise, we’ll get the UK GDP reading for July. And in the US, a 10yr Treasury auction is also taking place.

Source link