US equity futures are lower, as are European and Asian markets, with sentiment after the latest batch of earnings after yesterday’s close were mostly mixed or negative (particularly Fedex and Nike, both of which guided lower again). S&P500 futs are down 0.2%, off session lows, with the index facing an additional test on Friday in the form of a huge option expiration quad-witching. Nasdaq futures dropped 0.3% with all Lag 7 names lower led by NVDA -1.2%, and TSLA -0.7%. Micron reversed an earlier gain after reporting earnings after hours and was down 3%-premarket amid margin weakness. 10Y Treasury yields are down 4bps while the dollar reversed an earlier gain. In commodities, oil markets are already feeling the effect of the first effort to target a vast private processing industry, with traders preparing for significant disruption after Washington’s move to sanction a Chinese refiner over its Iranian links. London’s Heathrow airport will be closed all day Friday and service interruptions are likely to continue for days after a nearby fire cut power to the hub and brought travel to a standstill. Today, the macro data calendar is largely quiet, with eyes on any additional headlines from the White House.

In premarket trading, TSLA stock was down even as Elon Musk sought to reassure Tesla employees that despite “rocky moments,” they should “hang onto” their stock. Other Mag 7 names were also mostly lower (Alphabet -0.2%, Amazon -0.2%, Apple -0.7%, Microsoft -0.2%, Meta +0.2%, Nvidia -0.7% and Tesla -0.1%). Nike tumbled 6% as the company signaled further declines in revenue and profitability due to an ongoing merchandise reset and the impact of US tariffs on products from China and Mexico. FedEx was just as ugly, sliding 7% after the parcel delivery company lowered its full-year guidance for a third consecutive quarter, citing inflation and uncertain demand for shipments. Here are some other notable premarket movers:

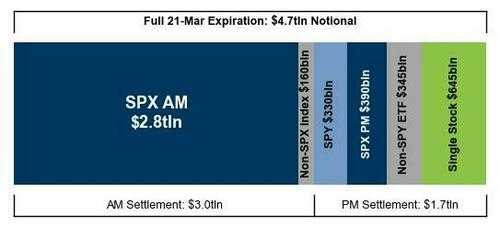

The S&P 500 is up slightly this week, following four weeks of losses. As previewed yesterday, stocks face a big test today in the form of another massive quad-witching , an event that can stoke volatility as options contracts worth $4.7 trillion head for expiry, including $2.8 trillion of S&P index and $645 billion of single stock options. Goldman doesn't see the gamma picture getting meaningfully better as we continue to be well below most call overwriting strikes. Interesting to note that since the close on March 10, S&P is up 48pts, but VIX spot is down more than 8pts. This demonstrates the vol destruction the past week, even as the market itself has not recovered much. Further, we have seen fixed strike vol compression every day this week as vol supply has not let up for even 1 day

Not helping matters was the latest batch of dour earnings from FDX and NKE which added to concerns over a worsening global economic outlook, especially ahead of Trump’s April 2 deadline for a series of broad reciprocal tariffs. While the Federal Reserve has indicated it sees room to cut interest rates, many economists fear the inflationary impact of tariffs will hinder central banks from delivering support to slowing economies.

“The Fed revised their growth forecast lower earlier this week, so the whole street is moving their forecast lower. But they could have further to go,” said Michael Metcalfe, head of macro strategy at State Street Global Markets. “We just need to see whether what we’ve seen so far this year is the start of something more serious in terms of slow growth.”

Despite the challenges, investors haven’t entirely given up on equities with US stock funds enjoying the largest weekly inflows this year on a view that the trade war won’t derail the economy or equity market, BofA's Michael Hartnett said.

Meanwhile, the Turkish lira headed for its biggest weekly crash in nearly two years, shrugging off an emergency rate increase in the face of mounting political tensions. Istanbul stocks were halted again, after plunging as much as 7%, having shed $30 billion in value this week.

European stocks decline, with the Stoxx 600 down 0.7%. Regional airline stocks underperform after London’s Heathrow airport was shuttered by a major fire nearby. Here are some of the biggest movers on Friday:

Earlier in the session, Asian stocks fell as a selloff in Chinese shares extended amid a lack of catalysts, while traders braced for US President Donald Trump’s upcoming tariffs. The MSCI Asia Pacific Index declined as much as 0.7%, with Alibaba and TSMC among the biggest drags. Benchmarks in Taiwan, mainland China and Hong Kong declined, while South Korea gained. MSCI’s regional gauge is still headed for a nearly 2% advance this week. Chinese shares in Hong Kong posted their biggest two-day drop since October as traders digested earnings and awaited further policy catalysts.

“With the ‘Two Sessions’ now behind us, market attention has shifted to looming tariff risks set to take effect in less than two weeks, which may prompt investors to adjust their positioning amid the uncertainty,” said Jun Rong Yeap, market strategist at IG Asia.

In FX, the Bloomberg Dollar Spot Index rose 0.2% but was off session highs. The yen reversed a 0.3% drop against the greenback and was now higher. The pound and the euro lose 0.2% each. Spot gold drops $13 to around $3,032/oz.

In rates, treasuries inch higher, pushing US 10-year yields down about 2 bps to 4.22%. Euro-area government bonds also advance with traders now pricing in two more quarter-point European Central Bank reductions this year. Gilts fall, underperforming peers across the curve, after UK government borrowing topped estimates in February. UK 10-year yields rise 4 bps to 4.69%.

In commodities, European natural gas futures rise over 2% after an attack on a pumping station in Russia’s Kursk region. Oil prices dip, with WTI down 0.4% near $67.81 a barrel. Gold held near record highs, as several banks raised their price forecasts for the haven asset. Gold funds have seen the biggest four-week inflow ever, the BofA data showed.

Looking to the day ahead, data releases include the UK GfK consumer confidence for March whilst in France there’s the manufacturing confidence for March and retail sales for February. Additionally, Eurozone consumer confidence for March and Italy’s current account balance for January will also be published. Outside of the Eurozone, we have Canada retail sales for January. Otherwise from central banks, we’ll hear from the Fed’s Williams and the ECB’s Escriva.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks ultimately traded mixed following the choppy performance stateside in the aftermath of the Super Thursday deluge of central bank announcements and ahead of quad witching. ASX 200 was just about kept afloat by notable outperformance in Consumer Staples as shares of Coles and Woolworths rallied after a report by the competition regulator which noted the supermarket retailers along with discount rival Aldi, were among the most profitable supermarket businesses in the world. Nikkei 225 initially traded higher on favourable currency moves but then reversed course after hitting resistance ahead of the 38,000 level and as the mostly firmer-than-expected Japanese inflation data supported the case for the BoJ to continue policy normalisation in the future. Hang Seng and Shanghai Comp were pressured despite the lack of fresh catalysts and as earnings results trickled in, while trade uncertainty continued to cloud over risk sentiment and NYT recently reported that Elon Musk is set to get access to a top-secret US plan for a potential war with China although President Trump later refuted this.

Top Asian News

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As London basks in temperatures warmer than Ibiza, a renewed focus on trade fears derailed a recovery in risk assets yesterday, with the S&P 500 closing -0.22% lower last night, though it’s still up +2.56% from last Thursday’s close, having so far only spent that one day in -10% correction territory. Yesterday was also the first day in a while where European stocks bore the brunt of the negativity with the FTSE-MIB (-1.32%) and the DAX (-1.24%) leading the declines. The Stoxx 600 (-0.43%) was helped by exposure to UK stocks with the FTSE (-0.05%) outperforming even after a slightly hawkish hold from the BoE (more later).

European markets had seen a sharp slide lower just before 9am GMT yesterday with no real explanation but by mid-morning they had stabilised and range traded into the close. There was no associated story but there was a lot of chatter about Mr Trump’s social media post from the early hours of the London morning that suggested the Fed should be cutting rates as “.... US Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”. In an era of analysing every nuance of every post, the clear suggestion was that this implied that tariffs would cause some economic pain ahead. And while markets recovered during the US morning session, they then turned lower again with the S&P falling from +0.63% at the peak to close down -0.22%. So a modest but fairly broad-based decline, with 65% of the S&P lower on the day and the equal-weighted version of the index down -0.37%.

Bonds also had a topsy-turvy session, with 10yr Treasuries yields a mere -0.5bps to 4.24% by the close after having traded as low as 4.17% amid the earlier risk-off tone. The reversal of the bond rally was helped by a decent batch of US data. Existing home sales saw an unexpected acceleration in February (4.26m vs 3.95m expected and 4.08m previous), although there may be some residual seasonality in the data as sales have seen large February spikes for the past three years. Meanwhile, the latest initial jobless claims (223k vs 224k expected) painted a steady picture of the US labour market.

Looking forward to today, the vote on the debt brake reform in the Bundesrat starts at 9.30am CET this morning with news at the start of the week that Bavaria will support the bill meaning that its safe passage probability is even higher than it was in the Bundestag where it passed comfortably on Tuesday. Assuming it passes, it is theoretically possible that the AfD and the Left could seek an abstract judicial review at the Federal Constitutional Court as soon as the new Bundestag is constituted, which sits for the first time next Tuesday, but the Left have said they won’t file a complaint alongside the AfD. The potential legal challenges have steadily fallen away over the last couple of weeks and the story will likely move onto coalition talks next week with the expectations that this will be completed before the end of March and Friedrich Merz to be sworn in as chancellor shortly after Easter.

As for the BoE, our economist Sanjay Raja, believes the on-hold decision (at 4.5%) was on the hawkish side with the MPC's vote tally and messaging highlighting growing concern around the disinflation progress in the midst of weaker demand. The biggest surprise was that only one member voted for a cut with 8 voting for unchanged. We thought there would be 2 doves. Sanjay still thinks there’ll be four 25bps cuts this year but his conviction levels have fallen. The risk is now that they could pause between May and November when CPI is expected to push up against 4% YoY. Ultimately, Sanjay thinks that beyond that the labour market will cool, pay settlements fall, tariffs will bite, and a terminal rate of 3.25% will be hit. See his report here. The hawkish lean left the probability of a cut in May at 64% down from 72% at the prior close. 10yr Gilts slightly underperformed, climbing +1.0bps with 2yr yields +3.5bps in contrast with German and French 2yr yields which were -2.3bps and -2.5bps lower, respectively.

Elsewhere in Europe, the SNB cut rates by 25bps as expected to 0.25%, their lowest since September 2022, but signalled that it doesn’t anticipate further easing as things stand. And in Sweden, the Riksbank kept rates on hold at 2.25% and also reiterated that it expects stable rates ahead. In other central bank news, Bank of Canada Governor Macklem said that the hotter inflation print the previous day “got our attention”.

Sticking with Canada, the Globe and Mail reported that new Prime Minister Mark Carney is expected this weekend to call a snap election for late April. An election is due by October at the latest. The former Bank of England and Bank of Canada governor took over from Trudeau as the head of the Liberal party earlier this month, and while the Liberals had been more than 20pts behind the opposition Conservatives in opinion polls at the turn of the year, the latest polls now show them in a slight lead in a dramatic turnaround since Trudeau’s decision to step down and amid increased tensions with the US.

Turkish markets remained in the headlines yesterday as Türkiye's central bank raised its overnight lending rate by 2pp to 46% in a surprise meeting. The Turkish lira saw modest rebound (+0.25%) and has been trading in a narrow range close to 38 on the dollar, hinting at a concerted effort to stabilise the currency after its initially sharp sell-off on Wednesday.

In commodities, Brent crude oil prices (+2.13%) rose to their highest level since the end of February at $72.29/bbl after the US for the first time sanctioned a Chinese refinery for allegedly buying Iranian oil, raising the prospect of stricter US sanctions enforcement against Iran. Meanwhile, copper (+0.03%) hovered within 1% of its record high from last May, after extending its YTD gains to +26% YTD on risks of US duties and stronger China data.

Asian equity markets are sharply lower in China but generally slightly higher elsewhere. The Hang Seng (-2.14%) is leading losses in the region followed by the CSI (-1.30%) and the Shanghai Composite (-1.06%). Elsewhere, the Nikkei (+0.17%) is trading slightly higher with the KOSPI (+0.06%) and the S&P/ASX 200 (+0.16%) also hanging on to gains. US stock futures are a fraction lower and 10yr US yields around a basis point higher.

Coming back to Japan, Japan’s core inflation came in at 3.0% y/y in February (v/s +2.9% expected) but lower than January’s figure of 3.2%. At the same time, headline inflation rose +3.7% y/y in February (v/s +3.5% expected) easing from a two-year high of+ 4.0% seen last month, thus staying above the BOJ’s 2% target for 35 straight months. The “core-core” inflation rate climbed to +2.6% y/y from +2.5% in the month before and maybe a touch above expectations especially as the print nearly rounded up to 2.7%. Following the data release, yields on the 10yr JGBs are +1.3bps higher trading at 1.52%. See our economist’s take on the inflation release here.

Now to the day ahead, the Bundesrat is voting today on the huge fiscal package ahead of the new Bundestag session starting next Tuesday. Data releases include the UK GfK consumer confidence for March whilst in France there’s the manufacturing confidence for March and retail sales for February. Additionally, Eurozone consumer confidence for March and Italy’s current account balance for January will also be published. Outside of the Eurozone, we have Canada retail sales for January. Otherwise from central banks, we’ll hear from the Fed’s Williams and the ECB’s Escriva.

Source link