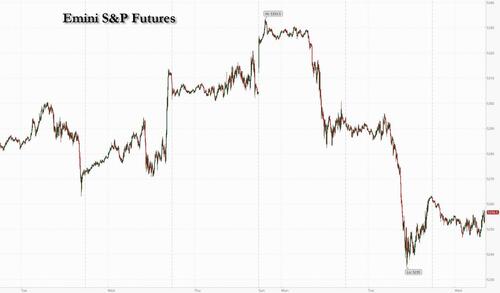

US futures are down small with Tech underperforming and small-caps flat, as rates held at 4 month highs, and Brent is about to rise above $90. As of 8:00am, both S&P and Nasdaq futures are down -0.2%, with yields higher pre-market ahead of Powell’s 12.10pm ET speech; despite his dovish rhetoric at the Mar 20 Fed Meeting press conference investors are nervous of a hawkish pivot according to JPM. This comes amid a surge a commodity prices and a spike in geopolitical tensions; pre-market all 3 commodity complexes are higher with gold the notable laggard despite USD being flat (although gold lagging these days means it hasn't hit a new all time high in the past 15 minutes). Today’s macro focus is on ADP (has not been predictive of the brutally manipulated NFP print), ISM Services and 2x Fedspeakers, including Powell.

In premarket trading, Mag7 and Semis are under pressure with Intel tumbling over 5% after the chipmaker said losses have deepened at its factory business and the unit may not reach a break-even point for several years. Here are some other notable premarket movers:

Global stocks are suddenly struggling to extend the previous quarter’s strong gains, with MSCI’s all-country index down for a third straight day, and Wall Street also heading for a weaker open, with contracts on the S&P Global index down 0.2% as 10-year Treasury yields crept higher again, rising to about 4.37%, up more than 15 basis points from last week’s close, after traders pared expectations for the timing and scope of US rate cuts this year and as commodity prices soared. The dollar held near seven-week highs against a basket of Group-of-Ten currencies.

The spotlight now is on Fed Chair Jerome Powell, who last week said the central bank is awaiting more evidence that inflation is in check and who speaks again today at 12:10pm ET. A strong monthly US jobs print on Friday, coming on top of a robust reading on US manufacturing, could further dent policy-easing expectations.

"Given the risk that payrolls data may affirm a higher-for-longer outlook for Fed rates, it is not surprising that risk appetite has taken a step back,” said Jane Foley, head of FX strategy at Rabobank in London.

Swap traders currently price less than three Fed rate cuts in 2024, with a high chance that policy easing is delayed beyond June. Pacific Investment Management Co. is among the asset managers that are positioning for the Fed to deliver fewer cuts than other major central banks. That’s despite comments Tuesday from San Francisco President Mary Daly and the Cleveland Fed’s Loretta Mester, who threw their weight behind three cuts this year.

Rising commodity prices, meanwhile, are fanning inflation expectations, with Brent crude futures holding above $89 a barrel. Copper advanced for a third day, while palm oil is at the highest since November 2022, raising the risk of higher global food inflation. Adding to the concerns, Taiwan’s strongest earthquake in 25 years cast uncertainty over chip production, as the world’s largest chipmaker, Taiwan Semiconductor, evacuated factory areas. Shares in the firm slipped 1.3%.

In Europe, the Stoxx 600 equity index held flat and bond yields slipped after a below-forecast inflation print. That cemented expectations that the European Central Bank will kick off its policy-easing campaign in June, possibly ahead of the Federal Reserve. European markets rebounded as bonds caught a bid following yesterday’s global rates selloff after the latest Euro area CPI data came in cooler than expected. Baskets tied to a recovery/reflation scenario continue to perform well. Rising Yields/Value are leading, Momentum/Quality are lagging; Cyclicals over Defensives. UKX -0.4%, SX5E +0.5%, SXXP +0.1%, DAX +0.3%.

Earlier in the session, Asian equities declined, driven by losses in technology stocks, amid speculation that major global central banks will keep interest rates higher for longer. The MSCI Asia Pacific Index fell as much as 0.8%, to a two-week low, with virtually all markets in the red. Chip-related stocks were among the biggest drags on the region after Intel posted widening foundry losses and TSMC evacuated production lines following Taiwan’s biggest earthquake in 25 years. EV makers led a gauge of tech stocks lower in Hong Kong after Tesla missed expectations for deliveries.

“I think people are just mindful of what happens with rates, especially with the Fed,” Catherine Yeung, investment director at Fidelity International, told Bloomberg TV. “Investors are treading water and looking for opportunity,” she said.

Asian equities have struggled in the first week of the new quarter, with Japan and China failing to build on recent gains. Pessimism returned following Tuesday’s strong rally in Hong Kong, as a recent slew of upbeat Chinese economic data failed to provide further momentum. The yuan slid to a four-month low against the dollar in onshore trading Tuesday.

In FX, the Bloomberg Dollar Spot Index is little changed in another quiet session for FX. The onshore yuan fell toward the weak end of its allowed trading band.

In rates, treasuries fell and kept US equity futures subdued as investors awaited another batch of economic data and a flurry of Fed speakers later today including Powell. US 10-year yields rise 2bps to 4.37%, close to Tuesday’s year-to-date high of 4.40%. ISM services will be closely watched after the manufacturing gauge topped estimates on Monday. Fed Chair Powell is also due to deliver remarks on the economic outlook. Bunds rise as data showed euro-area inflation slowed more than expected in March. European stocks inch higher.

In commodities, oil prices advance, with WTI rising 0.3% to trade near $85.40 and Brent just shy of $90. Spot gold falls 0.3%.

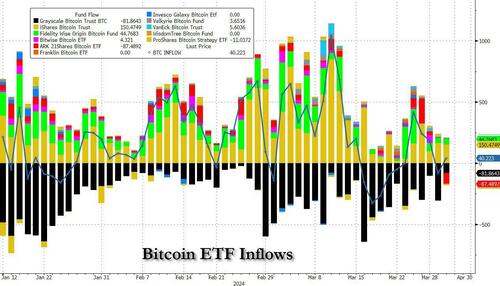

The Bitcoin sell-off from the prior day has cooled, with the coin now holding around USD 66.5k after the latest ETF flows data showed a reversal to yesterday's GBTC-driven outflow.

Looking to the day ahead now, data releases in the US include the ADP’s report of private payrolls for March, and the ISM services index for March. Otherwise from central banks, we’ll hear from Fed Chair Powell, along with the Fed’s Bowman, Goolsbee, Barr and Kugler, as well as the ECB’s De Cos.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to losses in the US where treasuries bear-steepened and oil prices ramped up. ASX 200 was led lower by tech and real estate as the rate-sensitive sectors suffered from firmer yields. Nikkei 225 briefly dipped beneath 39,500 with index heavyweight Fast Retailing among the worst hit after lower Uniqlo same-store sales, while Japan also issued a tsunami warning after a powerful earthquake struck Taiwan. TAIEX was pressured after Taiwan's most powerful earthquake in 25 years which collapsed at least 26 buildings. Hang Seng and Shanghai Comp. conformed to the downbeat mood across the region amid tech weakness and mixed US-China headlines with the US asking South Korea to toughen controls on semiconductor technology exports to China. However, the losses in the mainland were cushioned after an improvement in Caixin Services PMI data and Biden-Xi phone talks.

Top Asian News

European bourses, Stoxx600 (+0.2%), were mostly but modestly firmer at the open, and trade remained directionless up until the EZ CPI; following the print, stocks trudged higher. European sectors hold a negative tilt, though with no overarching theme or bias. Banks and Tech take the top spots, whilst Real Estate continues to be hampered by the yield environment. US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.3%) are all marginally lower continuing the downside seen in the prior session. Intel (-4.6%) suffers pre-market after reporting its Foundry had an op. loss for 2023 at USD 7bln.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets continued their rocky start to Q2 yesterday, with bonds and equities both selling off for a second day running. That’s been driven by a succession of hawkish developments, which have led to growing questions about how soon the Fed will be cutting rates, particularly given the resilience of both growth and inflation. All eyes will now be on Fed Chair Powell’s remarks today, but in the meantime, the 10yr Treasury yield was up another +4.0bps yesterday to 4.35%, marking its highest level since November. And equities also struggled in response, with the S&P 500 (-0.72%) posting its worst daily performance in 4 weeks.

These moves have come on the back of several headlines in recent days, which have seen investors price out the number of rate cuts likely to happen this year. On Friday, we had the latest PCE inflation print for February, which is the measure the Fed officially targets. And even though the monthly print was broadly as the consensus expected, it still meant that core PCE over the previous 3 months was running at an annualised rate of 3.5%. Then on Monday, the ISM manufacturing was back in expansionary territory for the first time since October 2022, whilst the prices paid indicator was the highest since July 2022. Yesterday, that was then followed up by a fresh rise in oil prices, which saw Brent Crude close at nearly $89/bbl, its highest since October, and Bloomberg’s Commodity Spot Index (+0.79%) also hit a 4-month high. And with all that happening, there’ve been clear signs that investors are raising their inflation expectations as well. For instance, 5yr US inflation swaps were up another +2.5bps yesterday to 2.53%, closing at their highest level since November.

This backdrop has led to a significant selloff for sovereign bonds around the world, with a sharp rise in yields. In the US, it saw the 10yr Treasury yield rise +3.9bps to 4.35%, which built on its +10.9bps move the previous day. And 30yr yields were up +4.7bps to 4.50%, with both reaching their highest levels since November. Meanwhile in Europe, there were even bigger moves as they caught up from the previous day’s holiday. For example, yields on 10yr bunds (+10.0bps), OATs (+11.1bps), BTPs (+12.5bps) all saw significant rises. And here in the UK, 10yr gilts (+15.1bps) saw the biggest rise in yields after multiple data releases came in stronger than expected. That included mortgage approvals, which were up to a 17-month high in February of 60.4k (vs. 56.5k expected). Moreover, the final UK manufacturing PMI for March was revised up to 50.3 (vs. flash 49.9), which is the first in expansionary territory since July 2022.

The main exception to that bond selloff came at the front-end of the US Treasury curve, where the 2yr yield was down -1.6bps to 4.69%. That came as market pricing for a June cut moved up slightly relative to Monday, with futures now pricing in a 66% chance of a cut by June. In part, that followed fairly balanced remarks from Fed speakers. San Francisco Fed President Daly said that three cuts this year was “a very reasonable baseline” but that as of now “growth is going strong, so there’s really no urgency to adjust the rate”. Cleveland Fed President Mester also said she still saw three cuts in 2024 but that “it’s a close call” whether fewer cuts would be needed, and noting earlier that “At this point, I think the bigger risk would be to begin reducing the funds rate too early.”

Today, we’ll hear from Fed Chair Powell who’s giving a speech on the economic outlook, so the focus will be on whether he offers any new commentary about the timing of potential rate cuts. We’ve also got the ISM services index today, along with the jobs report on Friday, so there’s still plenty of data this week that will shape the market narrative.

For equities, the concern about rates staying higher for longer led to a sizeable selloff, with the major indices losing ground on both sides of the Atlantic. That meant the S&P 500 (-0.72%) saw its worst daily performance in 4 weeks, and the STOXX 600 (-0.80%) saw its worst performance in 7 weeks. The decline was a broad-based one, with almost 80% of the S&P 500 losing ground on the day. Small caps underperformed for the second session in a row, with the Russell 2000 down -1.80%. But losses among US tech stocks were also a factor, and the Magnificent 7 (-0.90%) fell to a two-week low. That came as Tesla fell -4.90% after it reported lower-than-expected sales, with its first year-on-year decline in vehicle deliveries since 2020.

That negative tone has continued overnight, with all the major indices in Asia moving lower this morning. That includes the Nikkei (-0.64%), the KOSPI (-1.19%), the Hang Seng (-0.74%), the CSI 300 (-0.28%) and the Shanghai Comp (-0.24%). And over in the US, futures on the S&P 500 (-0.17%) are pointing towards further losses today. Alongside that, Taiwan has been hit by an earthquake overnight of 7.4 magnitude, the strongest there in 25 years. Separately on the PMIs, the final composite PMI in Japan was up to a 6-month high of 51.7 in March, whilst the Caixin composite PMI from China was up to a 10-month high of 52.7.

Whilst there was a lot of focus on the hawkish narrative yesterday, we did get a downside inflation surprise from Germany yesterday, which follows other downside surprises from Europe over recent days. The release showed CPI was down to +2.3% using the EU-harmonised measure (vs. +2.4% expected), and using the national definition, it was down to its lowest since May 2021, at +2.2%. So adding some encouraging signs ahead of the Euro Area March inflation print this morning. Alongside that, we also got some positive news from the final Euro Area manufacturing PMI, which was revised up four-tenths from the flash reading to 46.1.

Finally in the US, there were several data prints for February out yesterday, including the JOLTS report of job openings. That showed openings were at 8.756m (vs. 8.73m expected), which was basically in line with the downwardly-revised 8.748m in January. Indeed, it was the smallest monthly change in job openings since the pandemic. Elsewhere, the report showed that the quits rate of those voluntarily leaving their job was stable at 2.2%, where it’s been since November.

To the day ahead now, and data releases from the Euro Area include the flash CPI print for March, along with the unemployment rate for February. Meanwhile in the US, there’s the ADP’s report of private payrolls for March, and the ISM services index for March. Otherwise from central banks, we’ll hear from Fed Chair Powell, along with the Fed’s Bowman, Goolsbee, Barr and Kugler, as well as the ECB’s De Cos.

Source link