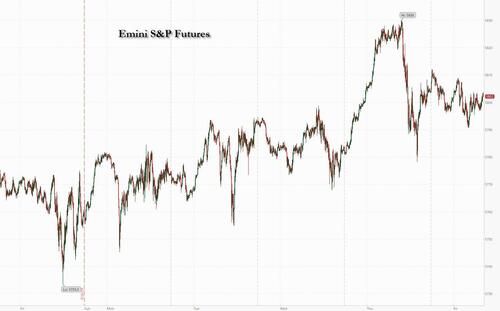

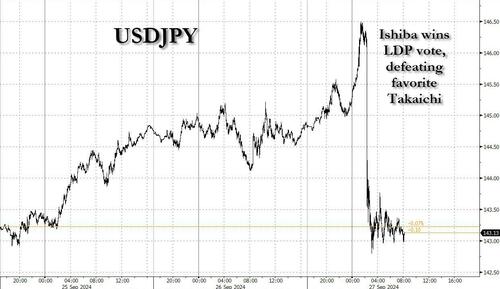

S&P 500 futures are little changed after the cash index hit its 42nd record high for 2024 on Thursday as traders looked to the Fed’s favorite inflation indicator, the core PCE, later Friday for clues on the trajectory of interest rates after a robust GDP data revision. As of 8:00am, S&P futures were down 0.1%, Nasdaq futures dipped 0.2% as megacap tech stocks were mostly lower with NVDA falling -1.3% pre-market. Treasuries rise with 2-, 5-, 10-yr yields 0.41bp, 1.21bp, 1.53bp lower, respectively. The USD reversed its earlier gains as the yen surged as the ruling LDP unexpectedly elected Shigeru Ishiba, a hawkish backer of the BOJ's efforts to normalize policy, as its new leader over the dovish Sanae Takaichi. Commodities are mixed with Oil and Base Metals higher, while Precious Metals are lower. Today, the key macro focus will be the PCE release: Wall Street expects a headline rise of 0.1% MoM vs. 0.2% prior, while the Core PCE is expected to rise 0.2%, the same as last month's sequential increase.

In premarket trading, Costco slipped 1% after the warehouse-club chain reported a narrow miss on revenue estimates. While analysts were positive about otherwise strong earnings, some said a clear catalyst was missing to drive shares higher. Cassava Sciences plunged 12% as the drugmaker and two of its former executives agreed to pay more than $40 million to settle SEC charges that they made misleading statements about the results of an Alzheimer’s drug trial. Here are some other notable premarket movers:

While traders were focused on today's core PCE report for clues on the trajectory of interest-rates, China’s daily stimulus announcements, coupled with mounting bets for more interest-rate cuts from the Fed and the European Central Bank have stoked risk appetite across markets this week.

“The data’s saying soft landing — you have to respect the data — but the forward looking indicators are flagging warning signs,” said Andrew Pease, global head of investment strategy at Russell Investments Ltd. “The descent into a soft landing will always look the same as the start of a recession. And you won’t know till after you’ve got there.”

The biggest overnight event was the surge in the yen, which climbed more than 1% against the dollar as Shigeru Ishiba won the vote for leadership of the nation’s ruling party. Ishiba, a party veteran who has served in several senior roles including defense minister, is seen as supportive of the Bank of Japan’s plan to gradually hike rates.

European stocks edge higher, with the Stoxx 600 at session highs, rising 0.5% on track for its best weekly performance since mid-August after the pledges of economic support by China’s leaders drove up luxury and mining stocks. At the same time, the region’s bond yields and the euro fell, as Inflation in France and Spain slowed more than forecast in September, prompting traders to boost bets on the European Central Bank lowering interest rates again next month. The implied odds of a quarter-point reduction in October now stand at ~78% - up from around 20% last week. Bunds rally as a result, with German 10-year yields falling 5 bps to 2.14%.

“In the next 12 months we still see upside to the European and the US markets,” Nataliia Lipikhina, JPMorgan Private Bank’s head of EMEA equity strategy, told Bloomberg TV. “Central banks are cutting, but at the same time fundamentals remain very strong.”

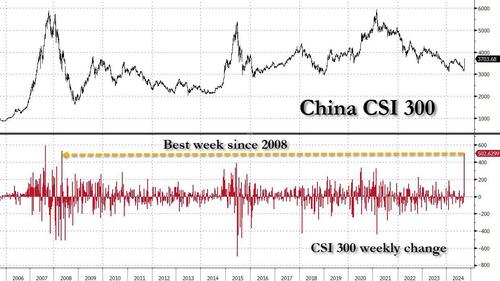

Asia stocks extended weekly advances, with the Shanghai Shenzhen CSI 300 closing +4.5% as China’s central bank stimulus plans continue to be digested. Nikkei 225 and Hang Seng gained 2.3% and 3.6%

Asian stocks rose, capping their best week in nearly two years, helped by an extended rally in China on the nation’s stimulus blitz. The MSCI Asia Pacific Index rose as much as 1.5% on Friday, poised for a weekly gain of 5.7% that would be the most since November 2022. Chinese equities outperformed, with the Shanghai Shenzhen CSI 300 closing +4.5% as China’s central bank stimulus plans continue to be digested. Nikkei 225 and Hang Seng gained 2.3% and 3.6%

The mainland benchmark CSI 300 capped its best week since 2008 as the People’s Bank of China unleashed one of the country’s most daring policy campaigns in decades, with Beijing rolling out a strong stimulus package in a push to shore up the slowing economy and investor confidence and announcing a series of monetary easing measures while top government leaders vowed new measures to stabilize the property sector and boost spending.

With stock turnover reaching 710 billion yuan ($101 billion) in the first hour of trading Friday, the Shanghai Stock Exchange was marred by glitches in processing orders and delays, according to messages from brokerages seen by Bloomberg. Copper rallied back above $10,000 a ton and iron ore broke through $100 a ton.

“If China goes with the ‘whatever it takes’ on the fiscal stimulus, and this has not been yet confirmed, this will be a game changer for China and therefore for the rest of the world, notably Europe which is export led,” Monica Defend, head of Amundi Institute told Bloomberg TV.

By holding the politburo meeting in September rather than December, China’s leaders sent “a signal that the authorities are willing to take more urgent action to achieve the 5% growth target,” senior analysts including Robert Carnell at ING Groep NV said in a note. “We saw a more aggressive-than-expected policy package from the PBOC this week and it is reasonable to expect other policies will soon follow.”

“This policy shift could be a game changer for Chinese risk assets but is contingent on both execution and continuation. The broad market can rally by another high single-digit percentage. Whether it can rally further than our target will depend on whether the government can execute their plan efficiently and announce more fiscal measures to support growth,” wrote Mark Haefele, CIO, UBS Global Wealth Management.

In FX, the Bloomberg Dollar Spot Index reversed earlier gains and was at session lows, after falling by 0.4% yesterday. The euro dropped 0.1%, off its session lows. The yen is the strongest of the G-10 currencies, rising 1.1% against the greenback after Japan’s ruling party picked Shigeru Ishiba as its next leader. “We think the new cabinet under Ishiba will be broadly supportive of the BOJ’s current gradual policy normalization plans, and this should push the yen higher in the coming months,” said Homin Lee, senior macro strategist at Lombard Odier. “Our base case remains another 25 basis point hike by the BOJ in December and further decline in USD/JPY to 135 in 12 months”

In rates, Treasuries hold small gains across the curve with futures off session highs in early US session. US 10-year yields around 3.78% were 2bps lower on the day, trailing German 10-year by ~1bp. Front-end German yields are ~2bp lower on the day with swaps market pricing in roughly 80% chance of a quarter-point move by the ECB in October. German rates outperform as momentum builds for ECB rate cuts following another batch of weak economic data. US session features August personal income and spending data and related PCE price indexes along with a couple of Fed speakers.

In commodities, oil steadied after a sharp two-day drop, with prices still on course for a substantial weekly decline on prospects of more supply from OPEC members Saudi Arabia and Libya. WTI traded near $67.60 a barrel. Spot gold falls $12 to around $2,660/oz, just shy of record highs, and was headed for a third weekly gain after setting successive record highs on optimism the Fed will maintain an aggressive pace of interest-rate cuts this year.

Looking at today's calendar, we get the August core PCE data which includes personal income/spending, trade balance and wholesale inventories (8:30am), September final University of Michigan sentiment (10am) and September Kansas City Fed services activity (11am). Fed speakers scheduled include Collins (9:30am) and Bowman (1:15pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the gains on Wall St where sentiment was underpinned and the S&P 500 extended on record highs owing to China's policy support and strong US data, while Chinese stimulus remained the main driving force overnight. ASX 200 was rangebound with strength in mining, materials and resources was counterbalanced by losses in defensives, while consumer stocks were also pressured with Star Entertainment shares down by more than 40% after its recent substantial FY loss. Nikkei 225 rallied at the open and climbed above the 39,000 level owing to a weaker currency. The index then pared the majority of its early gains as the JPY nursed some of its losses and with participants awaiting the LDP leadership vote, but then caught a second wind in late trade as dovish LPD candidate Takaichi is said to face Ishiba in Japan's LDP runoff. Hang Seng and Shanghai Comp rallied again owing to China's stimulus drive with China to issue USD 284bln of sovereign debt as part of fresh fiscal stimulus, while the securities regulator also issued guidance to promote long-term capital entering the market. Furthermore, the PBoC announced its 50bps RRR cut took effect today and set the 7-day reverse repo rate at 1.50% vs prev. 1.70%, as previously guided earlier this week.

Top Asian news

Japanese LDP Leadership Election:

European bourses, Stoxx 600 (+0.2%) are modestly firmer, with the mood somewhat tentative ahead of US PCE. The gains across indices are relatively broad-based and range from +0.1% to +0.4%. Sub-forecast inflation metrics from France and Spain did little to the equity complex despite a more dovish shift in ECB market pricing. European sectors are mixed; China-exposed sectors (Luxury, Basic Resources) initially outperformed, but Basic Resources has slowly drifted towards the middle of the pack. Banks and Insurance are at the foot of the pile. US equity futures (ES -0.1%, NQ -0.3%, YM -0.1% RTY U/C) are mixed, with the RTY holding modest gains whilst peers remains subdued ahead of the US PCE.

Top European news

FX

Fixed Income

Commodities

Geopolitics - Middle East

Geopolitics - Other

US Event Calendar

Central banks

DB's Jim Reid concludes the overnight wrap

We come to the end of a week where statistically there are more birthdays than any other. So a block happy birthday for probably over 2% of you! For those able to do mental arithmetic I’m sure you can work out why this week is so popular. On that note my daughter was born 10 days early in mid-September and the twins a month early towards the end of August!

Most days this week have felt like a birthday celebration for markets and this has carried on over the last 24 hours as we hit US core PCE day. Multiple factors have helped to boost risk appetite and lift both the S&P 500 (+0.40%) and the STOXX 600 (+1.25%) to new records. First up, we found out just as we went to press yesterday that the Chinese politburo would be offering more support on fiscal spending and the property sector. Details are pending before the week long holiday on October 1st (Tuesday).

This was all greeted positively by global markets and for China-exposed stocks in particular, not least after the stimulus measures from the PBoC earlier in the week. Chinese indices are up a further 2-6% overnight as we'll see below and on course for their best week since 2008.

Europe has certainly out-performed the US since these stimulus announcements have come through. In addition, the latest batch of US data beat expectations yesterday, with the weekly initial jobless claims hitting a 4-month low last week. So that offered further reassurance against any fears of an imminent downturn.

In Asia, yesterday saw the Hang Seng advance +4.16%, which was its best daily performance since March 2023, and this morning it’s up another +3.66%. That means the index is up over +13% this week as a whole, which is its best weekly performance since 2011. Elsewhere the CSI 300 (+2.67%) is on course for its best week since 2008 with the Shanghai Composite (+2.07%) also seeing a notable increase. The Shenzhen Composite is up +5.73%. Meanwhile, industrial profits for August saw a -17.8% drop y/y following a +4.1% increase in July. Separately, the PBOC reduced the seven-day reverse repo rate from 1.7% to 1.5% in a further measure after this week's blitz.

In contrast overnight, the Nikkei (+0.10%) is seeing minor gains with the KOSPI (-0.21%) diverging from the regional trend. S&P 500 (-0.05%) and NASDAQ 100 (-0.15%) futures are edging lower. Early morning data showed that the Tokyo Consumer Price Index (CPI) increased +2.2% y/y as expected in September, down from a +2.6% rise in August. Following the data release, the Japanese Yen (-0.38%) is dipping for the third successive session trading at 145.40 against the dollar as we await the results of the LDP leadership election. The results should be out just after this hits your inbox and could shape domestic monetary policy over the next year depending on who wins.

Back to yesterday and with the latest news from China, that meant it was also another strong day for stocks in the US and Europe with China exposure. For instance, the CAC 40 (+2.33%) saw its best day since November 2022, led by outsized gains for luxury goods stocks including LVMH (+9.88%) and Hermes (+9.10%). Meanwhile the DAX (+1.69%) posted a new record high of its own, as both industrial stocks such as Siemens (+5.33%) and automakers such as BMW (+3.81%) outperformed. And in the US, the NASDAQ Golden Dragon China Index surged by +10.85%.

The equity gains in the US were more moderate than elsewhere, with the S&P 500 (+0.40%) giving up half of its opening +0.8% gain by the close. Energy stocks (-2.00%) saw a sizeable decline as Brent crude fell -2.53% to $71.60/bbl amid improved prospects for Libyan oil supply as well as an FT report that Saudi Arabia may seek to regain its oil market share. On the upside, the NASDAQ (+0.60%) saw a decent gain, led by a +14.73% gain for Micron after its results the previous evening. However, the tech mega caps underperformed with the Mag-7 -0.09% lower on the day.

Even as global investors were absorbing the news from China, they also received another positive set of data from the US, which helped to allay fears about a potential recession. In particular, the weekly initial jobless claims fell to 218k in the week ending September 21 (vs. 223k expected), which is the lowest they’ve been since May. Moreover, there are growing signs that this is becoming an established trend, as the 4-week moving average was down to 224.75k, which is also the lowest since May. And if that wasn’t enough, we also had the annual revisions to US GDP, which showed that recent economic performance was stronger than previously thought. The most recent quarter in Q2 was left unchanged, but Q1 was revised up two-tenths to an annualised +1.6% rate. In addition, full-year growth for 2023 was revised up four-tenths to +2.9%, and 2022 was revised up six-tenths to +2.5%.

With all that data in hand, investors moved to dial back the chance that the Fed would deliver another 50bp rate cut in November, lowering the probability from 62% to 51% by the close. Clearly the main determinant of that is likely to be the next couple of jobs reports, but those releases yesterday helped to push back on the view that the US economy was experiencing a sharper slowdown, which was a significant fear earlier in Q3. And in turn, that meant that the recent run of curve steepening came to an end, with the 2yr yield up +7.0bps to 3.63%, its biggest increase in six weeks, whilst the 10yr yield was only up +1.1bps to 3.80%.

Over in Europe, there was also an interesting Reuters headline yesterday, which said that the doves at the ECB were going to push for a rate cut at the next meeting in October. That comes against the backdrop of weak European data over recent days, particularly from the flash PMIs, and that had already led markets to dial up the likelihood of another ECB cut in response.

Markets didn’t see a big reaction though, with yields on 10yr bunds (+0.7bps) seeing little change. The China news this week might temper some of the momentum that had been building towards an October ECB cut. So a battle between current weak domestic data and potentially better international prospects is emerging.

But even as bunds saw little change yesterday, French OATs were a continued underperformer. In fact, yesterday saw the Franco-German 10yr spread close above 80bps for the first time since the first round of the legislative election, back when uncertainty about the outcome was at its height. On top of that, the French 10yr yield moved above Spain’s yesterday for the first time since 2007, so that was a significant milestone, and I looked at the history of that spread in my chart of the day yesterday (link here) back to the end of WWII.

Finally, yesterday’s other data showed that Euro Area M3 money supply growth picked up to +2.9% year-on-year in August (vs. +2.5% expected), which is the strongest since January 2023. Otherwise in the US, the preliminary August reading for durable goods orders was unchanged (vs. -2.6% expected), and the reading excluding transportation was up +0.5% (vs. +0.1% expected). Finally, US pending home sales were up +0.6% in August (vs. +1.0% expected).

To the day ahead now, and data releases include US PCE inflation for August, along with personal income and personal spending for August, as well as the University of Michigan’s final consumer sentiment index for September. Meanwhile in Europe, data releases include the French and Spanish CPI prints for September and German unemployment for September. From central banks, we’ll hear from the Fed’s Collins, Kugler and Bowman, and the ECB’s Rehn, Lane, Cipollone and Nagel.

Source link