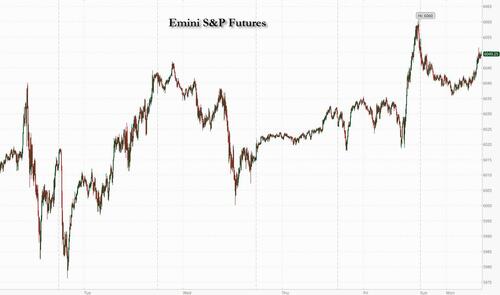

Futures are lower to start the new month as the US Dollar pushed higher, partially in response to Trump’s mandate that BRICS drop non-USD FX ambitions but also because the crisis swirling around the French government deepened, dragging on the euro. As of 8:00am ET, S&P futures are down 0.1%, but well off session lows, even as data showed Black Friday sales grew at a faster pace in the US this year; Nasdaq 100 futures are flat. The muted action comes after the S&P recorded its strongest month of the year, rising +5.7%, and is up 8 of the past 9 days. Pre-market, Mag7 are mixed, Semis are weaker, and Software is stronger; Financials are flat. Treasuries fall as traders prepare for US data that may influence the outlook for interest rates. Crude oil is higher, leading Energy to outperform the rest of the commodity complex which is seeing weakness in Ags and Precious. Today’s macro data focus is on ISM-Mfg and Construction Spending but the key this week is Friday’s NFP print to shape Dec Fed rate cut expectations.

In premarket trading, Stellantis fell 9% after CEO Carlos Tavares’s surprise departure leaves the maker of Jeep SUVs and Peugeot cars without clear leadership at a time of significant upheaval in the industry. Here are some other notable premarket movers:

“A Trump presidency is going to put upward pressure on the US dollar given some of the policy stance, the tariffs and others, that he’s been talking about,” said Jun Bei Liu, a portfolio manager at Tribeca Investment Partners Pty Ltd.

In Europe, the Stoxx 600 reversed an earlier decline to rise 0.3%. The yield premium on 10-year French debt over its German counterpart has widened ~4 bps versus Friday’s close. French stocks and government bonds have recovered off their worst levels but still underperform their regional peers after the far-right National Rally indicated in the strongest language yet that it could topple the government. The CAC 40 index was down 0.4% after falling more than 1% at the open, and the euro slumped. Among individual stocks, Stellantis sinks after announcing its CEO is departing. Top gainers include Portugal’s Galp after successfully drilling a Namibian well and Akzo Nobel following a broker upgrade. Here are the biggest movers Monday:

“There’s certainly a political instability and the securities, the French government bonds, are pricing that instability,” Ecaterina Bigos of AXA Investment Management told Bloomberg TV. “Political instability creates uncertainty, but what is more important is what is France going to do to bring that deficit down?”

Earlier in the session, Asian stocks gained, supported by signs of economic stabilization in China while a rally in tech stocks mirrored similar gains in the US. The MSCI Asia Pacific Index rose as much as 0.9% to head for highest level since Nov. 11, with benchmark heavyweights like TSMC, Hitachi and Toyota Motor leading the advance. A gauge of technology stocks was the index’s best sector performer. Chinese shares in Hong Kong and the mainland rose as new data showed better-than-expected improvement in manufacturing activity, an indication that the economy may be further stabilizing after Beijing began introducing a stimulus package in September. Japan’s Topix gained, led by banks, after Bank of Japan Governor Kazuo Ueda said interest-rate hikes are “nearing” as inflation and economic trends develop in line with the central bank’s forecasts.

Modest strength “in HK and China markets is a mix of factors,” said Billy Leung, an investment strategist at Global X ETFs in Sydney. “Positive economic data, such as OK PMI figures, has provided support.” Tech sector gains are a follow-through from last week as US curbs on sales of chip technology to China seem “to be softer than anticipated,” he added.

In FX, the Bloomberg Dollar Spot Index rose 0.5% after US President-elect Trump threatened the BRICS nations with tariffs if they sought to create a new currency as an alternative to using the greenback; the EURUSD fell 0.6% after France’s far-right party threatened to topple the government amid a stand-off over the nation’s budget. French bonds and stocks lagged behind European peers.

In rates, treasuries are also weaker after gapping lower at the Asia open, erasing a portion of Friday’s late rally that was aided by month-end index rebalancing. Yields are 2bp-4bp higher across a flatter curve after ending November at monthly lows, with 5-, 10- and 30-year below 200-day average levels for first time since late October. US 10-year yields higher by 4 bps to 4.21%. With no coupon auctions slated until Dec. 10, focus is on the first major economic indicators for November — including ISM manufacturing Monday and employment report Friday — along with comments by Federal Reserve officials including Chair Powell Wednesday, as a Dec. 18 rate cut is only about half priced into swaps.

The treasury market ended November with a 0.78% gain after benchmark yields retreated from multimonth highs reached in the days following the Nov. 5 US presidential election; market-implied odds of a Federal Reserve interest-rate cut in December rebounded to about 60% Friday.

In commodities, oil prices advanced, with WTI rising 0.8% to $68.60 a barrel. Spot gold fell $6 to $2,637/oz. Bitcoin falls 3% to near $95,000.

Looking at the US economic data calendar we get November final S&P Global US manufacturing PMI (9:45am) and October construction spending and November ISM manufacturing (10am). Fed speaker slate includes Governor Waller (3:15pm) and New York Fed President Williams (4:30pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new trading month mostly higher as participants reflected on Chinese PMI data in which the official headline Manufacturing and Caixin Manufacturing PMIs both topped forecasts, while markets await a deluge of releases this week. ASX 200 eked mild gains with outperformance in tech making up for the slack in defensives and with data providing some encouragement. Nikkei 225 saw two-way price action but ultimately gained with the help of a weaker currency and encouraging Chinese data. Hang Seng and Shanghai Comp were varied with outperformance in the mainland following the latest Chinese PMI data including the official releases over the weekend which showed headline Manufacturing PMI topped forecasts but Non-Manufacturing PMI disappointed, while Caixin Manufacturing PMI surpassed the most optimistic analyst expectations and printed its highest since June.

Top Asian News

European bourses began the session entirely in the red, but quickly after the cash open most indices caught a bid to display a mostly positive picture in Europe. The CAC 40 (-0.4%) is the underperformer given the political uncertainty surrounding the region. European sectors opened with a strong negative bias, but sentiment has since improved to show a mixed picture in Europe. Basic Resources takes the top spot, despite losses in base metals prices; sentiment in the sector might be buoyed by better-than-expected Chinese NBS & Caixin Manufacturing PMIs. Autos is by far the clear underperformer, dragged down by losses in Stellantis after its CEO Tavares resigned. US Equity Futures are very modestly on the backfoot, giving back some of the gains seen in the prior session which saw the S&P notch its best month of the year.

Top European News

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Given it’s the start of the month, we’ve just released our usual monthly performance review for November. For the month as a whole, US markets saw a strong out-performance, with the S&P 500 up to a new record and posting its strongest monthly performance of 2024. European sovereigns also did well as investors priced in faster rate cuts from the ECB. But there were a few weaker spots, with French assets underperforming given the country’s budget situation, whilst the Euro posted its largest decline against the US Dollar in 18 months as investors contemplated the prospect of further tariffs. Moreover, the dollar’s strength and weakness elsewhere meant that virtually all non-USD denominated risk assets were negative in the month in USD terms.

Staying with performance themes, on Saturday it was two years since ChatGPT was launched and I don't think it's an understatement to say the +183% gain for the Mag-7 since then, and the +48% increase for the S&P 500, might have played a significant part in the US avoiding a recession when the pressures in that direction were most acute. Financial conditions and the wealth effect have a big impact on the US economy. Who knows what would have happened if ChatGPT hadn't been launched then and the technology didn't emerge for a couple of years. For the record Nvidia is up a cool 717% since then.

Over the weekend Mr Trump has been active on social media with a warning to the BRICS countries that any attempt to replace the Dollar will see them face 100% tariffs. As ever with Mr Trump it seems to be a shot across the bows but likely wouldn't ultimately be great for the US economy if implemented. As we mentioned last week a 25% tariff on Mexico and Canada could lift US inflation by around one percent in 2025 so this felt like an opening salvo to negotiations and indeed Trump spoke to Sheinbaum last Wednesday and had dinner with Trudeau on Friday. The former meeting discussed flows of migrants and the latter the Fentanyl coming in through the Canadian border. The mood music after both contacts seemed positive so the dance of tariff threats and then negotiations has already started. Expect a lot more of this over the months ahead. With regards to the BRICS comments, it seems to further point to Dollar strength being a theme of the new administration as against Trump 1.0 where initially they tried to talk the Dollar down. The Dollar index is up +0.5% this morning in Asia.

Another interesting weekend development was Zelenskiy being open to a cease-fire that ceded control of land it has lost to Russia in return for NATO security guarantees over the remainder of the country. Although such a guarantee would be difficult to negotiate it does show that as Trump nears the office, the direction of travel will likely move towards peace talks even if the war escalates in the background as both sides try to strengthen their hands ahead of the inauguration.

As we start a new month (with Liverpool 9 (nine) points ahead at the top of the Premier League), it is set to be a busier week after the lull of Thanksgiving, with a lot of focus on various important US employment data culminating in payrolls on Friday, a number that could influence the fairly tight December 18th Fed decision. The US ISM indices (today and Wednesday), some global PMIs, and the University of Michigan's consumer survey (Friday) are also due with inflation expectations within the survey fascinating after last month saw the joint highest (3.2%) for the 5-10yr expectations series since 2011. From central banks, speakers include Fed Chair Powell and ECB President Lagarde (both Wednesday).

In terms of the US employment data, DB's forecast for Friday's payrolls is +215k (consensus +200k) with private payrolls at +185k (consensus +200k). Last month the data printed at +12k and -46k, respectively, with weather and strikes impacting the numbers. For private payrolls it was the first negative print since December 2020 during the winter Covid wave. The US econ team's forecast assumes 75k of positive payback split equally between weather and returning strikers. DB and consensus expect the unemployment rate to hold at 4.1%. Prior to this we have JOLTS (tomorrow), ADP (Wednesday) and the employment components of today manufacturing ISM and Wednesday's services equivalent. JOLTS is always one month behind payrolls (e.g. October) so it will be influenced by the weather disruptions we had that month.

Over in Europe, a number of economic activity indicators are due for the main economies including factory orders (Thursday), industrial production and the trade balance for Germany (both Friday). Industrial production (Thursday) and the trade balance (Friday) are also due for France. Otherwise there will also be November CPI prints in Switzerland (Tuesday) and Sweden (Thursday).

In Asia, Japan's wages and consumption activity are out on Friday. In Australia, Q3 GDP will be released on Wednesday (our economists preview it here). Briefly rounding off with geopolitics, South Africa took over the G20 presidency from Italy yesterday and the OPEC and non-OPEC ministerial meeting (online) will be held on Thursday as supply remains in focus.

Also watch France today as the National Assembly starts to review social security within the budget bill. If Barnier uses article 49.3 to push through the bill without a vote, it is feasible a no-confidence motion could come as early as today if the premier doesn't take into account the demands of the far-left and far-right. Le Pen in particular has been very hawkish over the weekend, suggesting that her extra budget demands need to be met today.

Asian equity markets have started the final month of 2024 on a positive note, following another record high on Wall Street on Friday with China’s surprisingly strong PMI data also supporting risk sentiment. As I check my screens, Chinese stocks are among the best performers with the Shanghai Composite (+1.03%) leading gains while the CSI (+0.70%) and the Hang Seng (+0.23%) are also trading in positive territory. Elsewhere, the Nikkei (+0.72%) and the KOSPI (+0.42%) are also trading higher. S&P 500 (-0.17%) and NASDAQ 100 (-0.16%) futures are moving lower though and 10yr UST yields are +4.6bps higher after a strong rally last week.

Coming back to China, manufacturing activity continued to expand among smaller manufacturers in November after the Caixin/S&P Global manufacturing PMI came in at 51.5, hitting a 5-month high and beating Bloomberg’s median estimate of 50.6 and picking up from the prior month’s 50.3. This private gauge comes after the official PMI data, released on Saturday, also expanded to 50.3 in November from 50.1 the previous month. Meanwhile, Chinese 10yr sovereign bond yields fell below 2% per cent during early trading, its lowest level in more than two decades on rising speculation that the PBOC would ease monetary policy further. China’s long-term sovereign bond yields (30yr bonds) have been declining all year and on Friday went below Japanese yields for the first time.

Looking back at last week now, and the S&P 500 climbed to a new record by the end of the holiday shortened week (a +1.06% gain over the week, +0.56% Friday). Outside the US, the story was a lot less rosy as President-elect Trump announced he was planning to impose tariffs on China, Canada and Mexico. Europe’s STOXX 600 managed to eke out a +0.35% gain (+0.58% Friday), but other markets were softer with the Nikkei falling -0.20% (-0.37% Friday) and the MSCI EM index down -0.80% (-0.10% Friday).

For sovereign bonds though, the picture was a lot more positive, with Treasuries rallying following Scott Bessent’s nomination as the next US Treasury Secretary. By Friday, that meant the 10yr Treasury yield was down -23.2bps over the week (-9.5bps Friday). Yields on 10yr bunds also fell back as the German inflation reading came in beneath expectations, falling back -15.5bps last week (-3.9bps Friday) to 2.09%, which is their biggest weekly decline since the market turmoil at the start of August.

Otherwise last week, there was a clear underperformance among French assets given the budget situation and speculation about the government’s survival. That meant the CAC 40 lost ground for a 6th consecutive week, falling by -0.27% (+0.78% Friday). Moreover, the Franco-German 10yr spread widened by +0.4bps over the week to 80.6bps, albeit off the mid-week highs when it approached 88bps.

Finally, oil prices fell back, in part because of the agreement of a ceasefire between Israel and Hezbollah. By the close on Friday, Brent crude was down -2.97% over the week (-0.46% Friday) to $72.94/bbl. And those losses were echoed among other commodities, with gold down -2.69% (+0.20% Friday) to $2,643/oz.

Source link