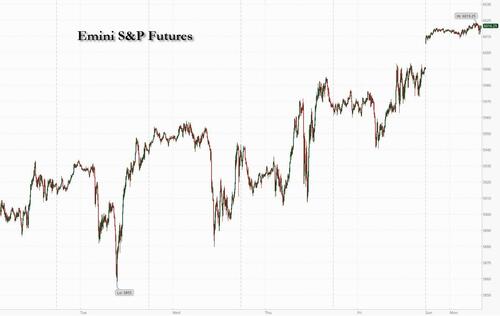

US equity futures jumped, led by a rally in small caps, as Wall Street cheered Trump’s selection of Scott Bessent as the next Treasury Secretary. As of 8:00am ET, S&P 500 futures rose 0.5% to trade at 6,016, while Nasdaq 100 futs gained 0.6% with all Mag 7 stocks higher led by the +2.0% gain in TSLA; Russell 2000 futures benefited the most rallying over 1%. Traders bet that Bessent, who manages macro hedge fund Key Square Group, will follow through on the Trump’s initiatives to lower taxes but also instill a sense of stability into financial markets (a two-pronged task which some say is a Catch 22). 10-year TSY yields dropped by five basis-points to 4.35% (but were off session lows), as Bessent's nomination eased fears about persistent inflation under Trump’s protectionist policies. The dollar declined while Bitcoin rebounded from a weekend drop. There was also broad weakness in commodities: oil, base metals, precious metals (gold -1.7% pre-market) are all lower. It is a holiday-shortened week due to Thanksgiving holidays (US markets will close on Thursday and will close at 1:00pm on Friday) with light catalysts: we will receive the FOMC Minutes on Tuesday and October PCE on Wednesday.

Quantum-computing stocks gained in premarket trading after Amazon Web Services announced a program to help customers get ready for the technology. Macy’s dropped 2% after saying it would delay the release of its third-quarter earnings after an investigation revealed an employee hid tens of millions of dollars of expenses. Here are some of the other notable movers before the opening bell:

M&A also caught traders’ attention on Monday morning after Italy's UniCredit launched a €10 billion ($10.6 billion) all-share offer for domestic rival Banco BPM, opening a second major takeover front as it also pursues Commerzbank AG. Banco BPM shares surged 8.5%. Commerzbank slumped 7.2%, while UniCredit shares were 2.5% lower.

Stocks rebounded last week as data and corporate results pointed to continued resilience in the US economy; another day in the green would extend S&P 500’s winning streak to six days, its longest since September. And they are likely to get that as Bessent’s nomination eased concerns over the incoming president’s inflationary agenda, which had sparked a selloff in government bonds that drove the benchmark Treasury yield to a four-month high. The fund manager and former Soros partner indicated he’ll back Trump’s tariff and tax cut plans but investors expect him to prioritize economic and market stability.

“Markets can now map a road ahead for policies,” said Colin Graham, head of multi-asset strategies at Robeco, who’s positions are overweight on both US stocks and Treasuries. Bessent is “seen as more moderate on tariffs so could be perceived as bond positive.”

In an interview with the Wall Street Journal, Bessent said his first priority will be to deliver on Trump’s various tax-cut pledges. Putting forward tariffs and cutting spending will also be a focus, he said.

“He obviously has promised Trump he’s going to implement the tariffs, but I think it’s going to be in a much more grown-up way, not just sound bites that scare the market,” said Patrick Armstrong, chief investment officer of Plurimi Wealth Management Group. “I think there would be fiscal discipline.”

The recent market moves mark a reversal of some elements that define the so-called Trump Trade, including a surging dollar and rallying Bitcoin. The cooling enthusiasm about these assets comes as traders trim expectations for the president-elect to lower taxes and boosts tariffs, policies that may keep interest rates elevated and support the greenback.

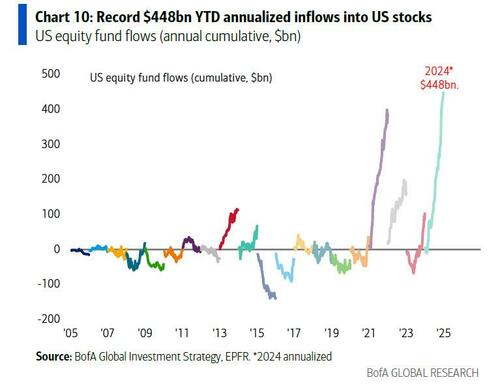

The “secret sauce” for the S&P 500 is a decrease in bond yields, Bank of America's Michael Hartnett said on Friday; hopes for further gains have helped US stock funds attract record inflows this year, annualized at $448 billion, on the prospect of Federal Reserve rate cuts while the economy continues to grow at a healthy clip. The main US equity index has rallied 25% in 2024.

RBC Capital Markets strategist Lori Calvasina tipped the S&P 500 to reach the 6,600 level by the end of 2025, an advance of about 11%, propelled by solid economic and earnings growth. It would only be a fitting end to a bull market that started at 666 in 2009. By contrast, a surge in bond yields would sink stock-market buoyancy and high valuations, according to Plurimi Wealth Management Group Chief Investment Officer Patrick Armstrong.

“There will come a point where multiples just aren’t sustainable if you’ve got 5% Treasuries,” Armstrong said in an interview with Bloomberg TV. “Unexpected inflation is what kills Treasuries and big cap tech at the same time.”

In Europe, the Stoxx 600 rose 0.1%, with consumer products, technology and mining shares leading gains, while retail and the personal care, drug and grocery sectors are the biggest laggards. Here are the biggest movers Monday:

Earlier in the session, Asian stocks advanced as tech heavyweights gained and traders cheered Donald Trump’s pick of Scott Bessent for Treasury secretary. Chinese shares struggled to regain ground after Friday’s losses. The MSCI Asia Pacific Index rose as much as 1.2%, with Samsung Electronics among the biggest contributers following Nvidia CEO Jensen Huang’s remarks on AI chip certification. Exporters lifted Japanese equities higher amid expectations that corporate activity in the US may expand under Trump’s incoming administration. Sentiment in the Asian region got a boost after news of the nomination of Bessent, who is seen as market friendly given his Wall Street background. Also helping risk appetite was a report last week showing business activity in the US expanded at the fastest pace since April 2022.

In FX, the Bloomberg dollar index fell by the most in over two weeks. Traders betting on Trump’s fiscal policies had pushed the dollar up for eight straight weeks through Friday. The euro rose against the greenback, after ECB governing Council member Francois Villeroy de Galhau said ECB policy will develop regardless of what happens at the Federal Reserve.

In rates Treasuries remain higher after mostly erasing Monday’s opening gap up in response to President-elect Trump’s pick of Bessent to head the department, a choice viewed as promoting stability in the US economy and financial markets. Yield curve is flatter ahead of this week’s auctions of 2-, 5- and 7-year notes Monday through Wednesday. US yields remain richer by 1bp-4bp across maturities with 2s10s and 5s30s spreads tighter by ~2bp. 10-year is around 4.35% vs session low 4.324% reached during European morning; bunds and gilts in the sector lag by 5bp and 3bp. In Europe, shorter-dated German government bonds fell as traders trimmed their bets on ECB interest-rate cuts, reversing some of Friday’s post-PMI moves. German two-year yields rose 5 bps, providing a tailwind to EUR/USD which adds 0.7%.

In commodities, oil prices decline, with WTI falling 0.6% to $70.80 as Israel said it’s potentially days away from a cease-fire deal with Lebanon’s Hezbollah. Gold also fell $45 to $2,670/oz after jumping the most in 20 months last week. Bitcoin climbs back above $98,000.

Today's economic data calendar includes October Chicago Fed national activity index (8:30am) and November Dallas Fed manufacturing activity (10:30am). The Fed speaker slate empty for the session. Looking ahead, traders will closely parse the Federal Reserve’s November meeting minutes Tuesday, consumer confidence Wednesday and personal consumption expenditure data on Friday to help assess the outlook for rate cuts next year. Key earnings include Dell, Crowdstrike and Workday.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mostly higher following last Friday's gains stateside and as markets reacted to news over the weekend that President-elect Trump picked hedge-fund manager Scott Bessent as Treasury Secretary which is seen as a nod to Wall Street and could potentially reduce the chances of severe tariffs with Bessent seen to have a gradual approach on tariffs. ASX 200 was led by outperformance in real estate and consumer-related sectors amid lower yields which saw financials lag. Nikkei 225 surged and briefly reclaimed the 39,000 level following the Japanese Cabinet's stimulus package approval and as equity markets saw a relief rally on the US Treasury Secretary nomination, although the Japanese benchmark moved off today's highs owing to yen strength. Hang Seng and Shanghai Comp were indecisive in a tight range with headwinds following the PBoC's CNY 550bln drain through its Medium-term Lending Facility operations and amid expectations of further US export restrictions on China, while automakers were supported by reports that the EU is said to be close to an agreement with China to abolish EV import tariffs.

Top Asian News

European bourses have kicked the week off on the front foot with reports suggesting that the better mood is partly a function of Scott Bessent's nomination as US Treasury Secretary; Euro Stoxx 50 +0.4%. Within Europe, sectors are now mixed. Opened with a strong positive bias but this has dissipated somewhat throughout the morning. Basic Resources outperform, with Real Estate cheering lower yields though Banks in turn are pressured. Stateside, futures in the green, ES +0.5%, following the Bessent nomination; Bessent is expected to prioritise delivering Trump tax cuts and maintaining the dollar's position as the global reserve currency, while he said enacting tariffs and cutting spending will also be a focus. On tariffs, Bessent is seen as more of a gradualist.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As we start what is likely to be another relatively quiet week ahead with Thanksgiving Day on Thursday, I hope those of you in the UK survived storm "Bert" without incident. My golf ball wasn't a big fan of the 50-60mph gusts. As the wind dies down expect whatever action we have this week to be packed into the early part of it. On that front US core PCE on Wednesday will be the highlight with durable goods the same day. The minutes of the last FOMC come out the night before so that will also be interesting given the meeting started the day after the election with the result known. On the same day November US consumer confidence will also be interesting given the election. It is expected to climb but the UoM consumer sentiment reading on Friday dipped a little although the headline stat from the report was that 5-yr inflation expectations hit 3.2%, only matched in one month since the pandemic (November 2023), and before that you'd need to go back to 2011 to see the last time we were at 3.2%. The other main global highlights are the flash November CPIs in Europe on Thursday/Friday and the Tokyo CPI in Japan the day before.

Looking at more detail into the core US PCE deflator, DB expect +0.29% vs. +0.25% last month which if correct would take the YoY rate from 2.65% to 2.81%. The second print of Q3 GDP (no change at 2.8% expected) on the same day could risk some revisions to PCE inflation, so there is some uncertainty. Clearly this release will have implications for what is proving to be a tight decision in December as to whether the Fed will cut. At the moment the market is pricing in a 60% probability.

Linked into Fed pricing, the market in Asia this morning is reacting constructively to the nomination of Scott Bessent for Treasury secretary. This was announced late on Friday (after the US close) and basically takes us back to the direction of travel just over a week ago before various other candidates skipped ahead in the market's pricing. On Polymarket.com he was as high as a 89% probability on November 12th and as low as 11% last Wednesday and still 14% at the lows on Friday. Bessent, a hedge fund CEO, is known to be a fiscal hawk so this should ease some of the more extreme deficit fears as he has advocated a 3% deficit by 2028. In practise that will be extremely tough but for now the market can be a bit relieved. He is also thought to be less extreme on trade policy than some of his rivals for the job. He has recently been quoted in the FT suggesting Trump's tariff policy position could be changed after negotiations with various countries, and he has previously told CNBC that "I would recommend that tariffs be layered in gradually". We will see how influential his views will be on this front. Remember a week ago Elon Musk suggested that appointing Bessent would be a disappointment as it would amount to "business-as-usual". The market will probably be more appreciative of this trait for now. This morning yields on the 10yr US Treasuries are -5.1bps lower, while S&P and Nasdaq futures are +0.45% and 0.54% higher respectively. The dollar is around -0.6% lower and base metals are generally higher although gold (-1.6%) has lost some of its risk premium after a good rebound last week.

Asian equities have generally started the week well with the Nikkei (+1.51%) and the KOSPI (+1.41%) outperforming and with the S&P/ASX 200 (+0.28%) also trading higher. Bucking the trend are Chinese stocks with the Hang Seng (-0.32%) and the Shanghai Composite (-0.32%) lower.

Reverting back to the other highlights this week. For the flash European inflation prints for November, which start on Thursday with Germany, with the French, Italian and Eurozone-level print following on Friday, our European economists detail their expectations and recent trends in data here. They see Euro Area HICP accelerating to 2.27% YoY (2.0% in October), with country-level forecasts including 2.63% for Germany, 1.66% for France and 1.27% for Italy. Other notable data in key Eurozone economies includes the Ifo survey (today) and retail sales in Germany (Friday) as well as consumer confidence in Germany and France on Wednesday. Q3 GDP numbers are also due in Canada, Sweden and Switzerland on Friday. In Asia, indicators to watch include industrial profits in China and October CPI in Australia (DB forecast 2.4% YoY vs 2.1% in September) on Wednesday. The rest of the day-by-day calendar is at the end as usual.

Looking back at last week now, there were significant moves on Friday after the flash PMIs came in beneath expectations across Europe. That led investors to dial up the likelihood of a 50bp ECB rate in December, with the probability nearly tripling from 17% on Thursday to 49% by the close on Friday. In turn, that meant sovereign bonds rallied across the continent, with the 10yr German bund ending the week -11.4bps lower (-7.6bps Friday) at 2.24%. In addition, the euro fell significantly against the US Dollar, falling another -1.16% (-0.53% Friday) to $1.042, which is its weakest closing level since November 2022.

The US saw a different pattern however, as investors dialled up their hawkish expectations in response to economic data. That followed some strong PMI numbers, whilst the University of Michigan’s long-term inflation expectations series rose to 3.2% as we discussed earlier. So that meant the rate priced in for the Fed’s December 2025 meeting was up another +9.4bps last week to 3.926%, its highest level in four months. And with investors pricing in a more hawkish profile, the 2yr Treasury yield moved up for a 5th consecutive week, rising +7.0bps (+2.4bps Friday) to 4.37%. That said the 10yr yield was slightly lower over the week, falling -3.9bps (-2.2bps Friday) to 4.40%.

Equities generally had a better time across the board, with the S&P 500 recovering from the previous week’s losses with a +1.68% advance (+0.35% Friday). Similarly in Europe, the STOXX 600 ended a run of 4 consecutive weekly declines to rise +1.06% (+1.18% Friday). However, there was more weakness in Asia, where the Nikkei fell -0.93% (+0.68% Friday) and posted a second consecutive weekly loss.

Finally, several other assets had a strong week, with gains for several commodities including Brent crude oil (+5.81%), copper (+0.53%) and gold (+5.97%). Indeed for gold, It was the strongest weekly performance in the last year. It was shaping up to be a decent week for HY credit on both sides of the Atlantic but a late sell-off in Europe created some divergence. US HY spreads tightened -8bps (unchanged Friday), but Euro HY spreads saw their largest 1-day move wider on Friday (+7bps) since late September. That move left the index +6bps wider on the week, and can be partially attributed to the weaker than expected PMI numbers even if European equities rallied on the news.

Source link