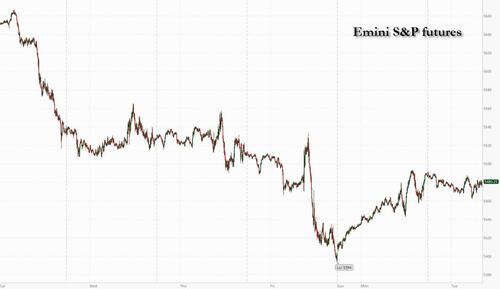

US equity futures rose, trading near session highs after they rebounding off overnight lows as markets head into a crunch period, with key inflation data on Wednesday followed by the Fed's interest-rate decision next week. As of 8:00am ET, S&P futures were up 0.1% trading in a narrow range after the underlying gauge rose 1.2% on Monday, rebounding from its worst start to the month in data going back to 1953; Nasdaq futures were down 0.2% as Mag7 and Semis are weaker while Financials rise following a Bloomberg report of lower capital requirements. Treasury yields rose a second day, higher by 1-2 bps while the USD held Monday's gains. Commodities are mixed with metals up, energy down, and Ags mixed. The macro data in focus is on the Small Biz Optimism print (which dropped to 91.2 from 93.7, missing estimates) and the Presidential Debate.

In premarket trading, Oracle jumped 8% after reporting quarterly profit and bookings that topped estimates, signaling that artificial intelligence demand continues to boost its cloud computing business. Apple shares slid 1% after the iPhone maker lost its court fight over a $14.4 billion Irish tax bill. Here are some other notable premarket movers:

As Bloomberg notes, the market mood has been cautious as investors look to balance US recession fears and the likelihood of a soft landing, amid worries the Fed may be falling behind the curve as the labor market cools. Meanwhile, US political risk is back at the forefront, with former President Donald Trump squaring off in a debate with US Vice President Kamala Harris later Tuesday. Meanwhile, according to Nate Silver, Trump's chance of winning just hit 64.4%, the highest yet.

#Latest @NateSilver538 Forecast (9/9)

— InteractivePolls (@IAPolls2022) September 9, 2024

🟥 Trump: 64.4% (new high)

🟦 Harris: 35.3%

——

Swing States: chance of winning

Pennsylvania - 🔴 Trump 65-35%

Michigan - 🔴 Trump 55-45%

Wisconsin - 🔴 Trump 53-47%

Arizona - 🔴 Trump 77-23%

North Carolina - 🔴 Trump 76-24%

Georgia - 🔴… pic.twitter.com/Cw23W9WmSK

“We need to see what actually plays out and will have the possibility of impacting markets,” Grace Peters, global head of investment strategy at JPMorgan Private Bank, said on Bloomberg TV. “We will be watching tariffs, trade policy, taxes.”

Amid the rising uncertainty hedge funds have been unwinding their positions to get cash ready for volatility ahead of the Nov. 5 vote, according to Goldman Prime Brokerage data. At Newton Investment Management, head of fixed income Ella Hoxha is avoiding assets exposed to “a weaker cyclical backdrop, potentially wider credit spreads and weaker commodity currencies,” she said in an interview with Bloomberg TV. Since Friday, the firm has been boosting safe assets including US Treasury and Japanese government debt, she said.

European stocks declined but still traded within Monday’s levels. Heath care, autos and energy are the worst-performing sectors in Europe’s Stoxx 600 while the commodity-heavy FTSE 100 lags regional peers with a 0.6% drop. The ECB’s policy meeting later in the week is also weighing on risk appetite. The central bank meets Thursday, where it is expected to deliver a second interest rate cut this year to tackle a faltering economy.

Earlier, Asian stocks were also mixed as a reversal of early losses in China offset declines in Japan and Korea. The MSCI Asia Pacific Index traded in a tight range, with health-care firms among the biggest drags. Japan’s Topix reversed earlier gains to drop for a fifth day as the strong yen weighed on investor sentiment. Chinese stocks rose in late trading, closing slightly higher, though the CSI 300 Index is still hovering near its lowest close since January 2019. Latest data releases have added to worries over spiraling deflation in Asia’s largest economy, while the progress in US legislation that would blacklist some Chinese biotech firms adds to headwinds for the nation’s equities.

In FX, the Bloomberg dollar spot index inches marginally higher ahead of the Trump-Harris presidential debate. Pound steady at $1.30 after UK pay growth cooled to a two-year low in the three months through July. JPY underperforms G-10 FX after a Bloomberg report said that Bank of Japan officials see little need to raise the benchmark rate when board members gather next week. Morgan Stanley sees the euro sliding toward parity with the dollar within months amid risks of aggressive ECB policy easing. The US bank expects the single currency to slump to $1.02 by year-end, a roughly 7% depreciation from its current level of $1.1037. The call is the most bearish among currency analysts surveyed by Bloomberg.

In rates, treasuries are slightly cheaper across the curve amid comparable losses for bunds and gilts following several European bond sales skewed toward longer-dated maturities. Yields are higher by 1bp-2bp across the curve, the 10-year around 3.715% and slightly cheaper vs bunds and gilts in the sector, with curve spreads little changed. Coupon auction cycle begins at 1pm New York time with $58b 3-year new issue, followed by $39b 10-year and $22b 30-year reopenings Wednesday and Thursday. WI 3-year yield at around 3.515% is ~29.5bp richer than last month’s, which stopped through by 0.2bp following a selloff. Calendar events are limited ahead of the presidential debate slated to start at 9pm New York time.

In commodities, Brent crude underperforms commodities with a 1.2% drop to near $71 a barrel. Spot gold falls roughly $5 to trade near $2,502/oz.

Bitcoin continues to edge higher, now sitting above USD 57k whilst Ethereum holds around USD 2.3k.

Looking to the day ahead now, the main highlights will be the TV debate tonight between Kamala Harris and Donald Trump. Otherwise, data releases include UK unemployment and Italian industrial production for July, whilst in the US there’s the NFIB’s small business optimism index for August. Finally from central banks, we’ll hear from Fed Vice Chair for Supervision Barr.

Market Snapshot

Top overnight news

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly took impetus from the gains on Wall St where the major indices rebounded amid light newsflow ahead of looming key events, although Chinese markets lagged amid mixed Chinese trade data. ASX 200 was led higher by strength in financials and utilities but with gains capped after weak consumer and business surveys. Nikkei 225 edged higher albeit with trade contained in the absence of any major pertinent catalysts. Hang Seng and Shanghai Comp were mixed as the former was indecisive with Alibaba the biggest gainer after its Stock Connect inclusion, while WuXi AppTec was at the other end of the spectrum after the US House passed the Biosecure Act which would prohibit the US government from contracting with certain biotech firms. Conversely, the mainland lagged behind regional peers amid mixed Chinese trade data and after protectionist measures by the US House which also voted to pass the Countering CCP Drones Act that would bar new drones by DJI from operating in the US.

Top Asian News

European equities, Stoxx 600 (+0.3%) began the session flat/mixed but quickly turned positive as sentiment improved since the cash open. Since, sentiment has deteriorated and indices now sit towards the bottom end of today's ranges. European sectors are mixed; Real Estate takes the top spot, with Tech also on a firmer footing. Healthcare is the clear underperformer, dragged down by AstraZeneca (-5%) after its lung cancer drug trial failed to significantly improve survival. US equity futures (ES -0.2%, NQ -0.2%, RTY -0.2%) are entirely in the red, paring some of the gains made in the prior session; the NQ marginally lags, hampered by Apple (-1% pre-market), after a EU tax order. EU to lower proposed tariffs on Tesla's (TSLA) and other EVs from China. Tesla's tariff rate reportedly to fall to under 8% from 9%, according to Bloomberg sources. Apple (AAPL) has lost fight against EUR 13bln EU tax order to Ireland, according to Reuters; Apple said EU regulators are trying retroactively to change the rules. EU top court dismissed Alphabet's (GOOG) fight EUR 2.42bln EU antitrust fine.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

This week I celebrate 20 years since I left gardening leave, a climb to the top of Kilimanjaro, and my one and only ever half marathon behind, and started at DB. How time flies. It's been an eventful and enjoyable ride so far and how long it lasts likely depends on a combination of DB's tolerance and when my kids leave the payroll. The latter date may be greater than the former! We will see.

There have been far more eventful days in those past 20 years than yesterday but after the September stresses so far, risk assets have recovered over the last 24 hours, with the S&P 500 (+1.16%) posting a decent advance after its worst weekly performance since SVB’s collapse. There wasn’t a single catalyst for the recovery, but in a constantly flip-flipping macro narrative the sense yesterday was that last week’s fears about a sharper US downturn were overdone, and the headline data (including payrolls at +142k) still wasn’t consistent with a recession. In the meantime, with confidence growing about the outlook, that led investors to dial back the chance that the Fed would deliver a 50bp cut next week. Tonight we see the long awaited Trump vs Harris TV debate take place at 9pm EST time. So it will be all over a couple of hours before we go to press tomorrow and is the only confirmed debate between the two candidates exactly 8 weeks today until polling day. The election has moved down the pecking order of macro topics of late after dominating mid-summer, likely as Harris reversed what was looking like a strong polling momentum towards a red sweep before Biden stood aside.

In recent days, the general perception from polls, betting odds and forecasting models is that Trump has regained a bit of ground relative to where things stood after the Democratic convention. In particular, there was a lot of focus on a national New York Times/Siena poll, which showed Trump ahead of Harris by 48-47%, and that’s considered a high-quality poll. Now that’s been at the upper end of the recent range for Trump, and the RealClearPolitics average still has Harris ahead by 1.2pts. But given the Republicans have the slight advantage in the Electoral College, Harris likely needs to be a bit further ahead of Trump in the national vote to be confident of victory. Perhaps with tonight's debate and once we know for certain whether the Fed are going to ease 25 or 50bps next week, we'll be back to talking about the election more.

Back to the last 24 hours and the more positive momentum shift was down to sentiment rather than any new data, but investors got a reminder that growth is certainly not currently falling off a cliff given the updated Atlanta Fed’s GDPNow update. The latest reading yesterday included Friday's jobs report, which lifted the Q3 growth estimate from an annualised +2.1% rate to +2.5%. If realised, that would be the 8th quarter in the last 9 where growth is running at an annualised pace above 2%. Along similar lines, the New York Fed’s Staff Nowcast stood at +2.6% for Q3 on Friday, so still pointing well away from recessionary levels. Adding to the generally resilient cyclical data, yesterday’s US consumer credit release for July (+$25.5bn) showed the strongest monthly rise since October 2022.

Against that backdrop, risk assets posted a recovery on both sides of the Atlantic. For equities, that saw the S&P 500 (+1.16%) post its biggest daily gain in three weeks, after a run of four consecutive declines. This was a broad rebound, with all but one of the 24 industry groups higher on the day, and more cyclical sectors including consumer discretionary (+1.63%), industrials (+1.56%) and information technology (+1.42%) leading the way. The Magnificent 7 advanced +1.37% amidst strong gains from Nvidia (+3.54%) and Tesla (+2.63%). Meanwhile in Europe it was much the same story, with the STOXX 600 (+0.82%) finally making up some ground after falling every day last week.

Elsewhere, as optimism grew on the economy, it led investors to price in a greater chance that the Fed would only cut rates by 25bps next week. Indeed, futures were giving a 50bp cut a 31% probability by the close, which is its joint lowest level over the past two weeks. In turn, that led to a rise in front-end Treasury yields, with the 2yr yield up +2.2bps to 3.67%. However, there was a fresh move lower for the 10yr yield, which fell -0.9bps to 3.70%, which is its lowest closing level since June 2023.

When it comes to next week’s Fed decision, the last big piece of data beforehand will be tomorrow’s CPI release for August, which could help tilt the balance between 25 and 50, particularly if there were a big surprise in either direction. For our US economists’ CPI preview, and to register for their post-release webinar, see here. We’ll have to wait and see what that brings, but yesterday did see the New York Fed release their latest Survey of Consumer Expectations, where inflation expectations were broadly unchanged. The 1yr expectation series remained at 3.0%, 3yr expectations ticked up two-tenths to 2.5%, and the 5yr expectation was unchanged at 2.8%.

Back in the political sphere, former ECB President Mario Draghi published his long-awaited report into European competitiveness yesterday. Among others it called for additional investments of €750-800bn per year, and it said that some “joint funding of investment at the EU level is necessary to maximise productivity growth”. Overall the report contained a fairly blunt message, and Draghi said to reporters that “For the first time since the Cold War we must genuinely fear for our self-preservation”. The reality though is that Europe is struggling for the political capital to rally around delivering the findings of Draghi's report. So whether the 400 pages in the report can make a difference is a moot political point.

Asian equity markets are relatively quiet this morning with the Hang Seng (+0.09%), Nikkei (+0.01%), and the KOSPI (+0.05%) trading just above flat. Elsewhere, Chinese stocks are lower with the CSI (-0.54%) approaching its lowest close since January 2019 while the Shanghai Composite (-0.53%) is also trading in the red. S&P 500 (-0.14%) and NASDAQ 100 (-0.36%) futures are pulling back a little of yesterday's gains.

Early morning data showed that China’s export growth in August (+8.7% y/y) surpassed market expectations for a +6.6% gain, and up from the +7.0% increase seen in July. However, import growth slowed to +0.5% y/y in August (v/s +2.5% expected), down from a +7.2% advance in the previous month, thus indicating weakening domestic demand, possible import substitution, and an excess of domestic production. The trade surplus stood at $91.02 billion, (v/s $81.10 expected) and up from $84.65 billion in July.

To the day ahead now, and one of the main highlights will be the TV debate tonight between Kamala Harris and Donald Trump. Otherwise, data releases include UK unemployment and Italian industrial production for July, whilst in the US there’s the NFIB’s small business optimism index for August. Finally from central banks, we’ll hear from Fed Vice Chair for Supervision Barr.

Source link