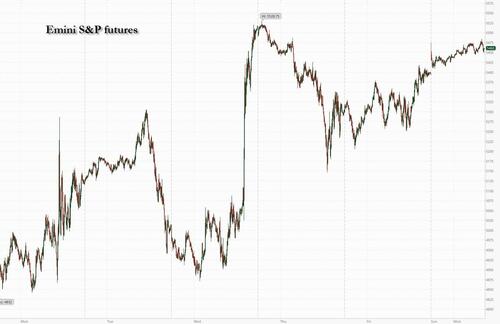

US equity futures are higher, part of a global risk-on rally, after President Trump paused import duties on a range of consumer electronics over the weekend (even as he clarified on several occasions the pause is only temporary). As of 8:00am, S&P 500 futures are up 1.5% while Nasdaq 100 contracts climb 1.9% with Mag7 names are all higher led by AAPL (+4.9%); Semis and Cyclicals outperforming, too; Goldman Sachs was 2.7% higher after its first-quarter earnings. The global risk on rally has meant a broadly positive European and Asian session as well. That said, volatility remains front and center among asset classes, with the VIX holding around 33 and similar gauges for bond and currency swings also staying elevated. The dollar fell for a fifth day as Trump warned that a specific levy for electronics will be announced later; DXY remains at the 100 level, aiding international indices in outperforming the S&P. US bonds retraced some of last week’s losses, pushing 10-year yields down to 4.43% in a bull-steepening move. Commodities are mixed with Energy/Base Metals higher, precious lower, and Ags mixed. Trump is set to give more color on tariffs later today but markets like the delayed implementation at a time when positioning is cleaner. Macro data this week is focused on Retail Sales and Housing data, plus today’s NY Fed Inflation Expectations.

Phone, computer and chip stocks rallied in premarket trading after the tariff reprieve, with Apple gaining more than 5.5% and Nvidia rising about 3%. Other Mag-7 members also edged higher. Shares of semiconductor companies although President Trump subsequently said it is a temporary measure. Analysts see the exemptions as a relief, but caution the situation remains extremely volatile (Advanced Micro Devices +3.8%, Broadcom +2%, Qualcomm +2%). Here are some other notable premarket movers:

The late-Friday reprieve - exempting a range of popular electronics from the 145% tariffs on China and a 10% flat rate around the globe - is temporary and a part of the longstanding plan to apply a different, specific levy to the sector, the White House said. Still, a pause in the duties indicates a willingness by Trump to compromise on a deal, according to some analysts.

While the possibility of a softer policy toward technology companies was enough to lift shares, which have been some of the hardest hit this year, Wall Street strategists continued to warn clients about the troubles ahead. Citigroup Inc.’s Beata Manthey cut her view on US equities, and Morgan Stanley lowered its outlook for earnings.

“Consumer electronics is one of the largest portions of total imports from China to the US and will ease considerably the impact on companies like Apple,” said Derek Halpenny at MUFG. “But this will hardly help restore investor confidence much and the angst in the markets last week over confidence in the US Treasury bond market and the dollar is likely to continue.”

Morgan Stanley strategist Mike Wilson slashed his 2025 earnings estimates for the S&P 500 to $257 from $271, joining a wave of Wall Street banks warning that tariffs will curb profit growth. Citi’s Scott Chronert lowered his prediction for the S&P 500 to 5,800, from 6,500. Goldman’s strategists cautioned that liquidity has deteriorated sharply, contributing to the spike in volatility.

Citigroup strategists led by Manthey wrote that cracks in “US exceptionalism” will persist with the emergence of China’s DeepSeek artificial intelligence model, Europe’s fiscal expansion and rising trade tensions that will hit American companies harder than peers in Japan and Europe. They downgraded US equities to neutral from overweight. “The drivers of exceptionalism are fading, both from a gross domestic product and earnings-per-share perspective,” the strategists wrote. “The US market remains relatively expensive, while EPS downgrades are intensifying.”

“Extreme risk levels have fallen, but there is still no visibility on the end situation, and there is a risk that the twists and turns as countries try to negotiate will mean no end to volatility,” said Benjamin Melman, global chief investment officer at Edmond de Rothschild AM.

As earnings season is kicking into full swing, Goldman’s first-quarter figures also benefited from the same trading boost that peers reported on Friday, with volatility driving stock-trading revenue to a record at JPMorgan. Sure enough, the bank reported stronger than expected Equity S&T data, even as FICC missed. Later in Europe, analysts will focus on the potential fallout from US tariffs when LVMH reports revenue numbers.

Against a backdrop of volatile markets, investors will be seeking clues from Fed policymakers on their appetite for lower interest rates. Neel Kashkari on Sunday signaled confidence that markets will remain orderly as investors sort through shifting trade policies and said the central bank must stay focused on keeping inflation expectations anchored. Christopher Waller will speak about the economic outlook later on Monday.

The upbeat market mood is evident elsewhere as havens slip. In Europe, the Stoxx 600 rises more than 2% with energy and banking shares the best-performers, while real estate and utilities stocks are the biggest laggards. Here are the biggest movers Monday:

Asian stocks rose, led by gains in Hong Kong, as risk sentiment rebounded after the US announced a pause in tariffs on a range of consumer electronics. The MSCI Asia Pacific Index gained as much as 1.9%, with major Chinese technology shares including Alibaba and Tencent among the biggest contributors. The Hang Seng China Enterprises Index climbed as much as 2.7%. Singapore’s benchmark rose as much as 2.3% after its central bank eased monetary policy settings for a second straight review. Key gauges climbed in Japan, South Korea and Australia. A gauge of Asian health-care stocks was the best performing subgauge on the broader MSCI regional index, with analysts expectations that the pharmaceutical sector could receive similar tariff exemptions to the ones applied to consumer electronics. Markets in India and Thailand were shut for holidays Monday. Key points to watch this week include TSMC earnings and South Korean monetary policy on Thursday.

“Trump’s latest move is seen as a concession in his trade tariff policy,” said Belle Liang, chief investment officer for investment and wealth solutions at Hang Seng Bank. “This will likely ease the market’s recent risk-aversion sentiment, and stabilize global markets, including mainland and Hong Kong stock markets.”

In FX, the Bloomberg Dollar Spot Index sank as much as 0.5% to hit its lowest since Oct. 2, before paring some of the losses to trade 0.1% lower on the day; the Swiss franc is the weakest of the G-10 currencies, falling 0.3% against the greenback. China sets the daily reference rate for the yuan at 7.2110 per dollar on Monday, the weakest level since September 2023. While the greenback struggled, yen optimism is spreading among hedge funds and asset managers as US tariffs drive haven demand at a time when traders are reassessing the Bank of Japan’s interest rate hike path. The yen appreciated as much as 0.9% to levels last seen in September. Meanwhile, the euro is emerging as a prime beneficiary of greenback weakness as investors reassess the dollar’s role in the global financial system. Europe’s common currency gained 0.3% on Monday, adding to its fastest rally in a decade and a half.

“Some people believe that rule of law is being degraded in the US and your investment is not that safe in the US,” said Michael Kelly, head of global multi asset at PineBridge Investments. “That could over the long term temper the willingness to invest in the US.”

In rates, treasuries advance, with US 10-year yields falling 4 bps to 4.45%. Treasury yields are 2bp-7bp lower across maturities led by intermediates, steepening 5s30s spread by more than 5bp; US 10-year around 4.435% is down about 5bp with bunds in the sector lagging by 2.5bp and gilts outperforming by 2.5bp. German government bonds also gain although Italian debt outperforms, narrowing the 10-year yield spread by 5 bps after S&P Global Ratings upgraded Italy to BBB+, three notches above junk.

In commodities, Oil prices advance, with WTI rising 0.6% to $61.80 a barrel as traders weighed the latest US moves. Goldman Sachs said the global oil market faces “large surpluses” this year and next as the trade war weighs on demand.

Spot gold drops $16 as Bitcoin rises 1.5% toward $85,000. Remarkably, gold is now outperforming the S&P since the covid crash.

The US economic calendar includes March New York Fed 1-year inflation expectations at 11am. Retail sales, industrial production, housing starts and building permits are ahead this week. Fed speaker slate includes Waller (1pm), Harker (6pm) and Bostic (7:40pm). Chair Powell speaks Wednesday to the Economic Club of Chicago about the economic outlook

Market snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week on the front foot after reports of a tariff reprieve for smartphones and other electronic goods but with gains capped by President Trump's walk-back regarding this, while participants also digested somewhat mixed Chinese trade data. ASX 200 advanced at the open with real estate, health care and tech leading the broad gains seen in nearly all sectors. Nikkei 225 climbed above the 34,000 level with notable strength in pharmaceuticals and electronic goods/component manufacturers. Hang Seng and Shanghai Comp conformed to the positive risk environment amid some tariff-related reprieve with Chinese consumer electronic goods currently 20% fentanyl tariffs instead of the 145% reciprocal tariffs, although President Trump said he would be announcing the tariff rate for semiconductors over the next week and semiconductor tariffs will be in place in the not distant future. Furthermore, participants digest stronger lending data from China and mostly better-than-expected trade figures in which Trade Balance and Exports topped forecasts but Imports showed a wider-than-expected contraction.

Top Asian News

European bourses (STOXX 600 +2%) are entirely in the green, following a mostly positive APAC session as traders react to the latest trade-related updates, which included an "exemption" of some electronic-related goods. European sectors hold a strong positive bias, in-fitting with the risk tone; some of the sectoral movers today are attributed to the weekend’s tariff updates. Tech is one of the best performing sectors today, lifted by a number of semi-conductor names after US President Trump’s administration exempted items from reciprocal tariffs including smartphones, storage devices and some other electronics. The likes of Infineon (+1%) and ASML (+3%) both gain.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

As we enter a shortened week for markets ahead of Easter, most investors will surely be hoping for an easing of the turmoil that has embroiled markets since the US reciprocal tariffs announcement on April 2. Over the weekend, Henry published a note reviewing the key market moves over this period (see here), which by several metrics has been the most volatile outside the peak of the GFC and the initial Covid shock.

Even as US equities recovered last week after President Trump’s 90-day pause for reciprocal tariffs on non-retaliating countries, Treasuries massively underperformed with the 30yr Treasury yield seeing its largest weekly increase (+46bps) since 1987 and the 10yr Treasury-bund spread seeing its biggest weekly widening on record in data back to German reunification (+50bps). Despite higher US yields, the dollar lost ground with the dollar index touching a three-year low this morning as volatile tariff headlines have driven reallocation away from US assets.

Tariffs continued to dominate headlines over the weekend, starting with news late on Friday that smartphones, computers and some other electronics would be exempt from US reciprocal tariffs, including the 125% rate on China. These categories make up about 12% of all US imports and about 20% of US imports from China, so it’s a significant exclusion. US officials later played down this exemption, with Commerce Secretary Lutnick saying that it was temporary with these goods would be covered by a forthcoming levy on semiconductors. On Sunday evening, President Trump reiterated that electronics from China would still face earlier 20% tariffs over fentanyl and indicated that tariffs on semiconductors will be announced in the coming week. That said, he also signaled some openness on the scope of tariffs on electronics, saying “We’ll be discussing it, but we’ll also talk to companies”. Earlier on the weekend, China's commerce ministry described the electronics exclusion as a “small step by the US toward correcting its wrongful action of unilateral ‘reciprocal tariffs’”, while encouraging Washington to fully remove the levies.

Markets have taken a positive spin on the electronics exemption news, with futures on the S&P 500 (+0.98%) and NASDAQ 100 (+1.45%) moving higher this morning. STOXX 50 futures (+2.41%) are posting a larger advance, having closed before Friday’s recovery in US markets fully played out. Asian equities have also started the week on a strong footing, with the Hang Seng index on course for its best performance in nearly four weeks (+2.41%), driven by tech companies, especially those exporting to the US. Japan's Nikkei (+1.80%) and Topix (+1.55%) have also rallied, while the KOSPI (+0.88%) and S&P/ASX 200 (+1.42%) are both rebounding from a volatile week. Mainland China indices are seeing more modest gains, with the Shanghai Composite up +0.86% and the CSI +0.47%. Meanwhile, 10yr Treasury yields are -3.0bps lower at 4.46% in Asia trading as we go to print.

However, the US dollar has extended its decline, trading -0.47% lower this morning and having now fallen by -4.01% since April 2. In comments on Friday evening, President Trump insisted that the dollar would always remain “the currency of choice” and that “If a nation said we’re not going to be on the dollar, I would tell you that within about one phone call they would be back on the dollar”.

Turning to the week ahead, while tariffs will remain the center of attention, investors will also be keeping an eye on incoming US data with the March retail sales and industrial production prints on Wednesday. For the retail print, our economists expect a strong headline (+0.8% mom vs. +0.3% previous) supported by frontloading of car purchases, with a slower but still solid growth in retail control (+0.3% vs +1.0% prev.). Amid increased fears of a US recession, markets and the Fed will be watching whether hard data start to catch down to the sharp weakening in surveys seen over the past couple of months. Weaker US sentiment was seen again in the University of Michigan’s preliminary consumer survey for April last Friday. The main sentiment index fell back to 50.8 (vs. 53.8 expected), its weakest since June 2022, while inflation expectations continued to climb, with the 1yr measure up to +6.7%, the highest since 1981. And the 5-10yr measure jumped to +4.4%, the highest since 1991.

It will be another busy week for Fedspeak, with Chair Powell’s speech on Wednesday the main event (see the full day-by-day week ahead at the end). Recent rhetoric from Fed officials has focused more on risks of a persistent inflation shock, with tariffs raising the bar for rate hikes unless evidence of weaker growth becomes more prevalent. Given the growth risks and rise in yields, there will also be increasing focus on the upcoming budget reconciliation process. Detailed work will now begin after the House passed the budget blueprint last week, but it will likely take at least a few weeks before we get a clear sense of the key details of the upcoming tax bill.

Over in Europe, the latest ECB meeting (Thursday) is widely expected to deliver another 25bps cut. Our economists see the ECB maintaining its open-ended guidance but think that the risks of disinflation are being underestimated, given the recent moves in FX and energy prices and risks of trade diversion (see their full preview here). The ECB will also publish its quarterly bank lending survey on Tuesday.

Elsewhere, we will see decisions from two other central banks exposed to the US trade war, namely the Bank of Canada (Wednesday) and the Bank of Korea (Thursday), while data highlights will include CPI prints in the UK (Wednesday) and Japan (Friday) as well as the Q1 GDP and March activity data in China (Wednesday).

Lastly, the earnings season will gather steam with more US bank results, including Goldman Sachs, Citigroup and Bank of America. Other notable US corporates reporting include UnitedHealth, Johnson & Johnson and American Express, while in the tech space we will hear from Netflix in the US, ASML in Europe and TSMC in Asia.

Early morning data showed that China's exports rebounded +12.4% y/y last month (v/s +4.6% expected; -3.0% in February) as businesses kept frontloading outbound shipments to avoid prohibitive US tariffs. At the same time, imports slipped -4.3% y/y in March (v/s -2.1% expected), suggesting still soft domestic demand. Separately, on Sunday, the PBOC showed that China’s aggregate social financing flows totalled a stronger-than-expected 15.2trn yuan in March (vs. 14.3trn expected), pointing to ongoing flows of stimulus to support the real economy.

Reviewing last week’s seismic market moves in more detail, US equities actually recovered some ground, as the S&P 500 rose +5.70% (+1.81% Friday), recovering about half of its -10.73% decline in the two days after April 2 reciprocal tariff announcements. That recovery was mainly because of President Trump’s decision to delay most reciprocal tariffs by 90 days, which led to a huge +9.52% surge on Wednesday. So all-in-all, the S&P 500 ended up posting its best week since November 2023, albeit having come off the back of its 9th-worst weekly performance since WWII.

However, even as equities recovered some ground, US Treasuries reversed course, with the 10yr yield moving up every single day last week. In fact, the rise in the 10yr yield of +49.5bps (+6.4bps Friday) was the biggest weekly rise since 2001, taking it back up to 4.49%. And the 30yr yield (+46.2bps to 4.87%) saw its biggest rise since 1987, with the 30yr real yield rising +41.4bps to 2.69%, its highest level since 2008.

Outside the US, equities struggled a lot more last week. For instance, Europe’s STOXX 600 fell -1.92% (-0.10% Friday), and Japan’s Nikkei fell -0.58% (-2.96% Friday). And emerging markets struggled in particular, with the MSCI EM index down -3.90% (+1.59% Friday). Conversely, sovereign bonds put in a much better performance outside the US, with yields on 10yr bunds coming down -0.9bps (-1.0bps Friday). One asset that did particularly well was gold, rising +6.56% last week (+1.93% Friday) to a record high of $3,238/oz

Source link