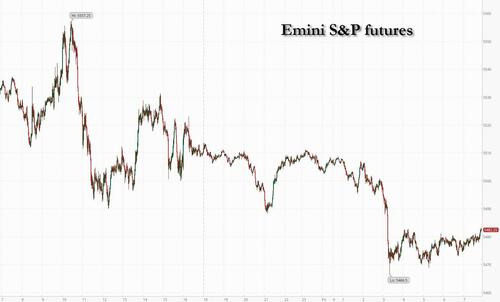

Futures are set to end a dismal first week of September lower, with tech again under pressure ahead of a very important jobs report. As of 8:00am, S&P futures are down 0.6% set for a 4th straight day of declines following a sudden dump around the European open; Nasdaq futures slide 1% as NVDA slides more than 2% pre-market while Broadcom also weighed on tech stocks after falling 9% after delivering a disappointing sales forecast. Bond yields are also lower, with the 10Y at 3.70%, the lowest since June 2023 as 2-, 5-, 10- yr yields are 3bp, 3bp, 3bp lower. The Bloomberg dollar index was lower for third day while the yen continues to surge on expectations today's NFP will come in below expectations and greenlight a 50bps rate cut. Commodities are mixed with base metals higher and oil flat. Today, all eyes on the NFP print at 8.30am ET. Consensus expects 165k jobs being added, with unemployment dropping to 4.2% (our full preview is here). Fed’s Williams and Waller will speak this afternoon before the blackout period begins.

In premarket trading, Broadcom weighed on tech stocks as it falls 7% after the chipmaker gave a revenue forecast that’s seen as disappointing. Other chip stocks are down in sympathy (NVDA -1.3%, AMD -0.9%). US Steel is up 2% after Cleveland-Cliffs’s top executive said he’s still in the market for his rival’s assets. Here are other notable premarket movers:

Friday’s jobs report will help the Fed decide whether the US economy is heading for a soft landing or a recession after a week of mixed numbers that whipsawed markets. Swap traders are fully pricing in 25 basis points of cuts when Fed officials meet in two-weeks time, with a roughly 35% chance of a 50 basis-point reduction.

"There’s likely to be volatility in markets as we work through whether or not we can actually have a soft landing,” said Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Co. “Investors need to be ready for more volatility, based upon a transition from a rate-hike cycle to a rate-cut cycle.”

As noted in our preview (link here), economists expect today's report will show a bounce in hiring and a tick lower in the unemployment rate in August, marking a stabilization after July. Payrolls probably rose by 165,000 last month following July’s 114,000 increase, according to the median estimate in a Bloomberg survey of economists. Unemployment probably edged down to 4.2%. “Risk markets are sensitive to growth dynamics rather than to interest rates right now, said Bilal Hafeez, chief executive officer and head of research at Macro Hive. “If we were to see a weak number, risk markets such as equities will take that badly.”

Europe's Stoxx 600 dropped 0.3% to the lowest in 3 weeks, but was off the lows; even so, the index is headed for the biggest weekly decline in almost a year. A key measure of euro-zone wage growth eased, proving further assurance to ECB officials seeking to lower interest rates next week. Should inflation continue to abate, borrowing costs will be lowered every quarter until they reach 2.5%, according to a Bloomberg survey. Here are the biggest movers Friday:

Earlier in the session, Asian stocks were steady, with the regional gauge poised for its worst week since July, amid muted trading as Hong Kong’s market was halted due to a typhoon. The MSCI Asia Pacific Index added 0.1%, erasing earlier losses, but was set to snap three weeks of gains as risk sentiment abates ahead of the US non-farm payrolls report, due later on Friday. The benchmark is headed for a weekly loss of 2.5% as concern was rekindled of overheating in artificial intelligence stocks. TSMC and Commonwealth Bank of Australia were among the biggest winners. Chinese shares in the mainland slid after news that the US administration plans export controls on critical technologies. Hong Kong scrapped trading for the day as Super Typhoon Yagi passed through the region. Persistent economic weakness in China, that prompted several strategists to lower their outlook on the nation’s stocks, has also quelled enthusiasm for riskier assets.

In FX, the Bloomberg Dollar Spot Index drops 0.2% while the yen has risen to the top of the G-10 FX pile, up 0.5% against the greenback. The Swiss franc is a close second with a 0.3% gain. Currency strategists see a strong chance the yen will test its August high versus the dollar if the payrolls data boost bets for a 50 basis-point move. The Japanese currency rose to trade below 143 against the dollar on Friday. The yen “is where the action will be” if there is any surprise in the figures, said Gareth Berry, a strategist at Macquarie Group Ltd. in Singapore.

In rates, treasuries climbed with US 10-year yields falling 3bps to 3.70%. European government bonds have followed suit although bunds showed little reaction to a downward revision to euro-area second-quarter GDP.

In commodities, oil prices were steady, with WTI trading near $69 a barrel; crude oil is poised for the biggest weekly loss in almost a year on concerns about soft demand and ample supply, even as OPEC+ delayed a planned increase in output by two months. Iron ore remained on track for its worst week since March, with few signs of a recovery for China’s steel market. Spot gold is also little changed near $2,518/oz.

Looking to the day ahead, and the main highlight will be the US jobs report for August at830am. In addition, we’ll get July data on German and French industrial production, along with Italian retail sales. The Fed calendar lists Williams (8:45am) and Waller (11am), the last scheduled events before quiet period lasting until the Sept. 18 policy announcement

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded without a firm direction following a similar lead from Wall Street, with the tone tentative heading into the much-awaited US jobs report, which could be the determining factor between a 25bps or 50bps cut by the Fed after the central bank shifted its emphasis to the labour market. As a reminder, Fed Vice Chair Williams and Governor Waller will be speaking after the jobs numbers ahead of the Fed's blackout period set to begin this weekend for the September 18th announcement. ASX 200 just about held onto gains at one point, with Utilities, Financials, Real Estate and Gold names countering the underperformance in Energy and Tech. Nikkei 225 was subdued under the 37k mark (and briefly dipped under 36.5k) with mining and industrial names among the worst performers, whilst Nippon Steel shares fell around 3% amid the ongoing spat with the Biden admin after the US intervened in the Nippon Steel takeover of US Steel amid national security risks. Hang Seng saw its Friday trade scrapped amid a typhoon signal. Shanghai Comp saw subdued trade amid the broader tentative mood across the market and lack of Stock Connect flows. In terms of newsflow, former PBoC Governor Yi Gang offered a bleak prognosis of the Chinese economy, whilst the PBoC drained a net CNY 1.1916tln for the week via open market operations, marking the biggest weekly net cash withdrawal in eight months, according to Reuters calculations.

Top Asian News

European bourses, Stoxx 600 (-0.3%) opened the session entirely in the red, and sentiment continued to sour as the morning progressed. Indices then found support and traversed worst levels, but with some choppy price action. European sectors hold a strong negative bias; Media takes the top spot, alongside Healthcare. Energy is towards the foot of the pile, hampered by the broader weakness in oil prices. US Equity Futures (ES -0.6%, NQ 1%, RTY -0.5%) are entirely in the red, as traders position themselves ahead of today’s key risk event, the US NFP report.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US event calendar

DB's Jim Reid concludes the overnight wrap

After much anticipation, we have finally arrived at the latest US jobs report day, which is of crucial importance as the Fed decides how much to cut rates this month. It was only five weeks ago that the last jobs report underwhelmed, with payrolls growth down to just +114k alongside negative revision to the previous couple of months. So the big question today is whether that disappointing report was just a blip, or was it the start of a more serious deterioration.

That last report triggered significant market turmoil, and led investors to immediately dial up the likelihood that the Fed would start cutting rates with a 50bp move. However, it’s also worth noting that the turmoil last month came on the back of several other factors, including the BoJ’s hike that week (hence an unwinding of the yen carry trade) along with a very underwhelming ISM manufacturing print the previous day. So the downside surprise in the jobs report was running into a very tough context. By contrast, the data over the weeks since has been a lot more mixed, with plenty for both sides of the debate to focus on.

On the bright side, yesterday brought a further decline in the weekly initial jobless claims, which is one of the timeliest indicators we get on the state of the US labour market. They fell to 227k (vs. 230k expected) over the week ending August 30, which was an 8-week low. In turn, that also pushed the 4-week moving average down to 230k, which is a 12-week low. Bear in mind that four weeks earlier, the 4-week moving average stood at 241k, so that’s seen a clear improvement in the last month. On top of that, we also found out that the ISM services index remained in the expansionary territory in August at 51.5 (vs. 51.4 expected). So again that points away from a sharper downturn.

That said, yesterday also brought some more negative prints. In particular, the ADP’s report of private payrolls for August fell to just 99k (vs. 145k expected). That’s the lowest it’s been since January 2021, and it was also a 5th consecutive monthly decline for that measure. And of course, the previous day we had the JOLTS report for July, where job openings fell to a three-and-a-half year low.

In terms of what to expect today, DB’s US economists are forecasting payrolls rose by +150k in August, which assumes that we get a rebound from the weather issues from last month’s report. Similarly for the unemployment rate, they see that coming down from 4.3% last month to 4.2%. Their take is that some bounce back in the labour market data would support their baseline view that the Fed should start cutting in 25bp increments. But if the jobs report is weaker than expected, then that could motivate a more aggressive start to rate cuts, with a 50bps move in September on the table. We’ll hear from the Fed’s Williams and Waller today, but the blackout period begins tomorrow ahead of the next meeting, so today is the last opportunity we’ll get to hear from Fed officials before their decision.

Going into the report, markets slightly dialled back the chance of a 50bp rate cut, which was down to 41% by the close, although it’s ticked up again overnight to 43% as we go to press. That trend yesterday was supported by the stronger ISM services release, which also saw the prices paid component rise to 57.3 (vs. 56.0 expected). However, the total amount of rate cuts priced over the next 12 months was little changed at 220bps by the close, and 2yr Treasury yields saw a marginal decline to their lowest in nearly two years (-1.1bps to 3.74%). 10yr yields were down -2.8bps to 3.73%, their lowest since June 2023. Overnight that trend has continued, with the 2yr yield down -1.2bps to 3.73%, whilst the 10yr yield is down a further -1.3bps to 3.71%.

US equities also struggled going into the payrolls release, with the S&P 500 (-0.30%) losing ground for a 3rd consecutive day. So September is continuing to live up to its reputation as the weakest month for the index, with the S&P 500 already down -2.57% since it began. Remember if it does end the month lower, it would be the 5th consecutive September that it’s lost ground now. Those losses also came despite a strong performance for the Magnificent 7 (+1.56%). This was led by Tesla (+4.90%), which outperformed after announcing that it plans to launch its advanced driver assistance system in Europe and China in early 2025. But the equity mood was more downbeat otherwise, with the equal-weighted S&P 500 (-0.61%) and the small cap Russell 2000 (-0.61%) underperforming.

Overnight that weaker trend has continued, with futures on the S&P 500 (-0.09%) and the NASDAQ 100 (-0.38%) both pointing towards further losses. In part, this follows an underwhelming outlook from chipmaker Broadcom after the market close, with its shares down by nearly -7% in after-hours trading. Meanwhile in Asia, the major indices have lost ground as well, with declines for the Nikkei (-0.49%), the KOSPI (-0.84%), the Hang Seng (-0.07%), the CSI 300 (-0.27%) and the Shanghai Comp (-0.23%).

Over in Europe, the main news yesterday was that French President Macron named Michel Barnier as the new Prime Minister. It follows the legislative elections that took place in July, after which no party or grouping was able to achieve a governing majority in the National Assembly. Barnier comes from the centre-right Les Républicains, and has significant experience in the EU, having most recently served as their chief Brexit negotiator.

When it came to European markets, equities performed similarly to the US, and the STOXX 600 (-0.54%) posted a fourth consecutive decline. Sovereign bonds also posted similar moderate gains, with yields on 10yr bunds (-1.7bps), OATs (-2.6bps) and BTPs (-1.4bps) all moving lower.

To the day ahead now, and the main highlight will be the US jobs report for August. In addition, we’ll get July data on German and French industrial production, along with Italian retail sales. From central banks, we’ll hear from the Fed’s Williams and Waller.

Source link