Two days ahead of the last remaining marketmoving macro event of 2024, the November CPI report, moments ago the NY Fed published its latest Survey of Consumer Expectations, which showed that inflation expectations increased by 0.1% point across all three time horizons studied in the survey, even as the Trump effect was in full force and US households now view their finances as the brightest since 2020, when Trump was also president.

Here are the details from the NY Fed's survey (which is an internet-based survey of a rotating panel of approximately 1,300 household heads. Respondents participate in the panel for up to 12 months, with a roughly equal number rotating in and out of the panel each month).

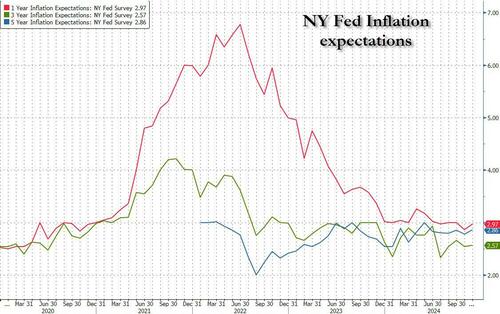

In November, US household anticipated 3.0% price growth in one year (up from 2.9%), 2.6% in three years (up from 2.5%) and 2.9% in five years (up from 2.8%), the highest since June. Respondents’ uncertainty about those figures also increased, as the measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) increased at all three horizons. The overall increase in one- and three-year ahead inflation expectations masks a decline among those without a college degree and an increase among those with a college degree.

Median home price growth expectations were unchanged at 3.0% in November. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023.

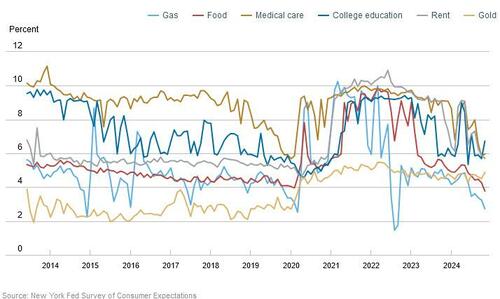

Year-ahead commodity price expectations declined by 0.5 percentage point for gas to 2.7%, 0.5 percentage point for food to 3.8%, and 0.2 percentage point for rent to 5.7%. The expected change in the cost of medical care increased by 0.2 percentage point to 6.0% and the expected change in the cost of a college education increased by 1.0 percentage point to 6.7%.

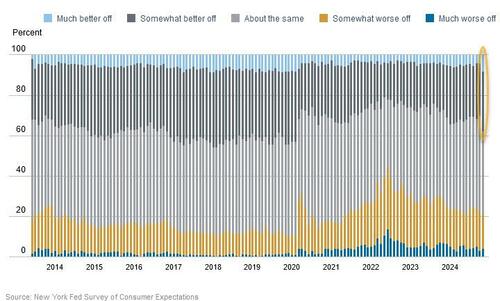

While inflation expectations were largely unchanged, what was perhaps more notable is that the share of US households expecting their financial situations to improve over the next year climbed in November to the highest level since early 2020.

Nearly 38% of consumers foresee being somewhat or much better off, according to data from the Federal Reserve Bank of New York. The percentage of people who anticipate a worse financial situation, meanwhile, dropped to the lowest level since May 2021. About 42% of Americans expect conditions to remain roughly the same.

"Perceptions about households’ current financial situations compared to a year ago were mostly unchanged but year-ahead expectations about households’ financial situations improved considerably in November. The share of households expecting a better financial situation in one year from now rising rose to its highest levels since February 2020, while the share expecting a worse financial situation fell to its lowest level since May 2021" the New York Fed wrote in a statement.

The shift in sentiment is a direct result of the collapse of the Biden regime, the most unpopular in history, and follow the election of Donald Trump in November. Many voters cited the economy and concerns about inflation as top issues.

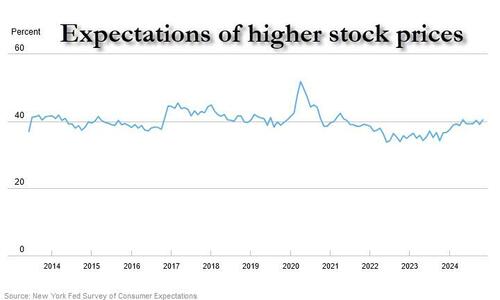

The survey also showed that consumers have a brighter outlook for equities. The average perceived odds that US stock prices will be higher in a year increased by 1.3 percentage points to 40.4%. Expected income growth also edged higher.

Some more highlights from the latest monthly survey, starting with the labor market:

And this is how household finance sentiment changed in the month Trump was elected:

Summary: Trump hasn't been inaugurated yet and the economy is already winning.

Source link