Something funny happened in late November.

Outgoing Treasury Secretary, and former Fed chair and vice chair, Janet Yellen said that she spoke with Donald Trump’s nominee to be her successor, Scott Bessent, after he was selected for the job. During a Tuesday event organized by the WSJ, Yellen said that in a call before Thanksgiving, she told Bessent, a veteran hedge-fund manager, about the breadth of the job and strength of the department’s staff.

Yellen, who had never worked one day in the private sector let alone a hedge fund where you are only as good as your last trade and only successful if you outsmart most of your peers, reiterated previous warnings against encroaching on Federal Reserve independence and on broad tariff hikes, while expressing regrets on the fiscal situation.

“What research has shown and this is certainly what I see from my own experience is that countries perform better — they have not only inflation performance — but real performance in terms of job creation and growth is also stronger when a central bank is left to use its best judgment without political influence,” Yellen said, apropos of nothing as the Fed is and always has been a political entity to be used and abused by whoever is in power. Case in point: Yellen, like her predecessor Bernanke, kept rates too low for too long so that her Democratic overlords could enjoy a period of relative tranquility (while also spawning what will soon be the biggest financial crisis in US history).

None of that was funny, however. What was is that Yellen also expressed regret over failing to make more progress in narrowing the fiscal deficit during her tenure.

“I am concerned about fiscal sustainability and I am sorry that we haven’t made more progress,” she said adding that “I believe that the deficit needs to be brought down especially now that we’re in an environment of higher interest rates.”

This is really funny for two reasons.

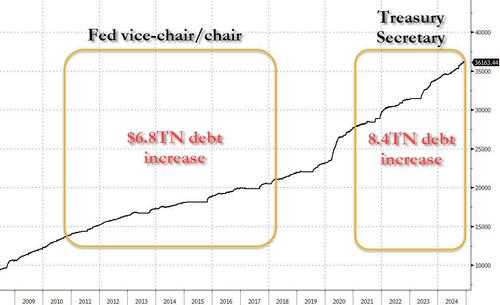

First, it was under Yellen's watch that the US experienced its biggest debt increase in history. As shown below, Yellen was Fed chair from Oct 2010 until Feb 2014, and then Fed Chair from Feb 2014 until Feb 2018, a period during which she intentionally kept rates at zero for almost the entire duration of her "apolitical" tenure. We say "apolitical" because in January 2021 the mask came off, and Yellen was picked for her political ideology to serve as Biden's top debt printing Democrat by taking control of the US Department of Treasury, where on more than one occasion she intentionally manipulated US debt issuance to boost risk assets at the expense of a harrowing debt crisis that looms under Trump's administration as trillions in debt now have to be rolled over at a much higher rate. But more to the point, under Yellen total US debt increased by $6.8 trillion while she was Fed Chair/vice-Chair and then another $8.4 trillion while she has been Biden's Treasury Secretary.

In other words, Yellen has personally presided over a gargantuan $15.2 trillion increase in US debt, or about 42% of all US debt ever issued! No one other government official can make even a remotely similar claim.

— Elon Musk (@elonmusk) December 11, 2024

So yes, the world certainly has every reason to be "concerned about fiscal sustainability" but the last person allowed to seek accountability is Yellen, who is the one person in the US most directly complicit in making US fiscal sustainability a huge joke. And no, saying she is "sorry" just won't cut it.

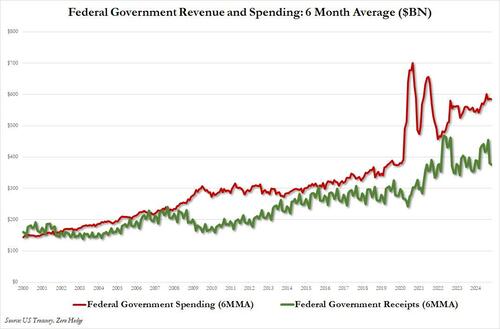

The second reason why Yellen's words are a laughable grotesque, is that as we showed earlier, in its final days, the Biden administration - which is best known for spending trillions to buy votes in the US (and inexplicably, in the Ukraine) - has decided to go out with a bang, and at a time when government spending is hitting new record high month after month, even as US tax revenue has flatlined for the past five years...

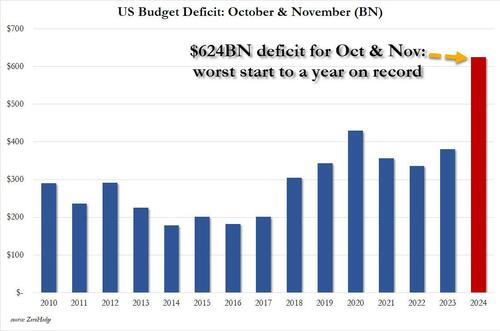

... the US just start its latest fiscal year with the biggest two-month increase in the budget deficit on record.

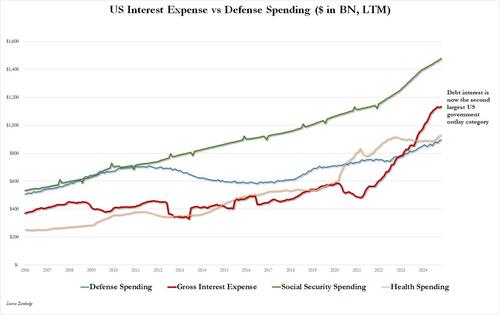

Meanwhile, US interest expense is now $1.2 trillion, the second largest government outlay surpassing defense and health spending, and is just one debt crisis and/or interest rate spike away from exceeding Social Security spending as the largest government outlay for the world's most indebted government.

So yes, Janet, we too are "sorry"... sorry that under your various official tenures the US took irrevocable steps to losing the world's reserve currency (don't believe us, just as gold and bitcoin), and sorry that the US is just a few months away from the biggest financial crisis in history. Of course, we also realize that at 78 your forecast that there will be "no major crisis in your lifetime" is - one way or another - likely spot on. If only that was also true for the rest of us.

Source link