As a hopeful, and exhausted, Jim Reid writes this morning in his Early Morning Reai report, "it should be a quieter week as the recent relentless wave of US macro, earnings and political news flow in theory slows down with the main story on this front being on potential political appointments for the new Trump administration with Treasury secretary the one creating most interest with a huge amount of jockeying for position over the weekend between what are perceived to be the front runners, namely Scott Bessent and Howard Lutnick." The DB strategist also notes that Elon Musk endorsed the latter over the weekend suggesting he would be a disruptor. Indeed one of his recent quotes is that "When was America great? 125 years ago. We had no income tax, and all we had was tariffs." So this will be a fascinating race.

Indeed, although the macro world will be much quieter this week just when you thought it was a good point to have a lie down after a busy few weeks, the biggest global earnings event happens after the bell on Wednesday with $3.48 trillion of market cap at stake. Yes you guessed it Nvidia reports after the bell. For context, the entire FTSE, DAX and CAC have a market cap of £2.08tn, €1.71tn and €2.31tn, respectively. So it's like a whole G7 country's stock markets reporting at exactly the same time.

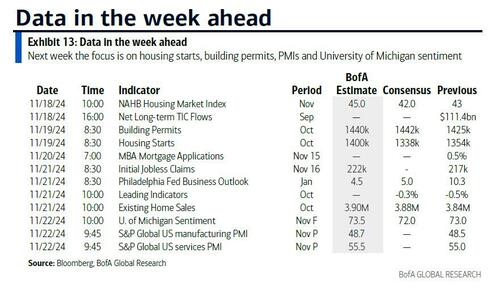

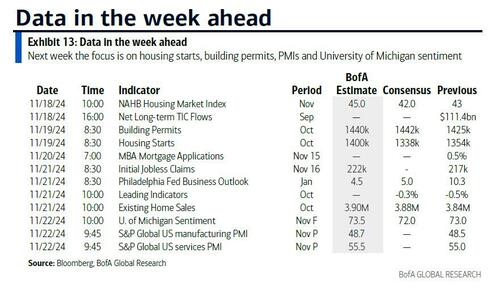

The next most important event might be the global flash PMIs on Friday. The reason being that they may capture some of the initial sentiment impact from around the world regarding Trump's victory. Europe will be especially interesting on this front as the continent awaits their trade fate. In the US, the main events are the Housing Starts and Building Permits on Tuedsay, Jobless Claims, and Philly Fed manufacturing index on Thursday, and the UMich and US PMIs on Friday.

Outside of that there will be a focus on inflation with final Eurozone CPI (tomorrow), Canadian CPI (tomorrow), UK CPI (Wednesday), German PPI (Wednesday), and Japan CPI (Thursday) being the key ones. For the UK, DB sees a mixed bag of inflation data, with headline CPI (DB forecast 2.07% YoY) and RPI (DB forecast 3.29%) picking up amid higher energy prices but core CPI is seen declining to 3.07% YoY and services CPI slowing to 4.78% YoY. His full preview is here. In Japan, our Chief Japan economist sees the nationwide CPI printing 2.1% YoY for core inflation ex. fresh food (2.4% in September) and core-core inflation ex. fresh food and energy at 2.2% (+2.1%).

There are also plenty of central bank speakers which you can see in the day-by-day week ahead at the end as usual which includes all the other data highlights this coming week.

Courtesy of DB, here is a day-by-day calendar of events

Monday November 18

Data: US November New York Fed services business activity, NAHB housing market index, September total net TIC flows, Eurozone September trade balance, Canada October housing starts, September international securities transactions

Central banks: Fed's Goolsbee speaks, BoJ's Governor Ueda speaks, ECB's President Lagarde, Guindos, Makhlouf, Lane, Stournaras, Vujcic and Nagel speak, BoE's Greene speaks

Tuesday November 19

Data: US October building permits, housing starts, Japan October trade balance, Italy September current account balance, ECB September current account, Canada October CPI

Central banks: ECB's Elderson and Muller speak

Earnings: Walmart, Lowe's, XPeng

Wednesday November 20

Data: China 1-yr and 5-yr loan prime rates, UK October CPI, RPI, PPI, September house price index, Germany October PPI, Eurozone September construction output, Denmark Q3 GDP

Central banks: ECB's financial stability review, Guindos, Stournaras and Makhlouf speak, BoE's Ramsden speaks

Earnings: Nvidia, Palo Alto Networks, Snowflake, TJX, Target, NIO

Auctions: US 20-yr Bonds ($16bn)

Thursday November 21

Data: US November Philadelphia Fed business outlook, Kansas City Fed manufacturing activity, October leading index, existing home sales, initial jobless claims, UK October public finances, Japan October national CPI, France November manufacturing confidence, EU27 October new car registrations, Eurozone November consumer confidence, Canada October industrial product and raw materials price index, Norway Q3 GDP

Central banks: Fed's Goolsbee and Hammack speak, ECB's Villeroy, Knot, Holzmann, Cipollone, Escriva, Elderson, Lane, Kazimir and Vujcic speak, BoE's Mann speaks

Earnings: Deere, Baidu, PDD, Intuit

Auctions: US 10-yr TIPS (reopening, $17bn)

Friday November 22

Data: US, UK, Japan, Germany, France, and Eurozone November flash PMIs, US November Kansas City Fed services activity, UK November GfK consumer confidence, October retail sales, Germany Q3 GDP details, France October retail sales, Canada September retail sales

Central banks: ECB's President Lagarde, Centeno, Nagel and Villeroy speak

* * *

Finally, looking at just the US, Goldman writes that the key economic data release this week is the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week.

Monday, November 18

10:00 AM NAHB housing market index, November (consensus 42, last 43)

10:00 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will deliver welcoming remarks at the Chicago Fed’s Financial Markets Group Fall Conference. On Friday, Goolsbee said that “as long as we keep making progress toward the 2% inflation goal, over the next 12 to 18 months rates will be a lot lower than where they are now.” He also noted that “if there’s disagreement [on the FOMC] of what’s the neutral rate, it does make sense at some point to start slowing how rapidly we’re getting there.”

Tuesday, November 19

08:30 AM Housing starts, October (GS -0.8%, consensus -1.3%, last -0.5%)

01:10 PM Kansas City Fed President Schmid (FOMC non-voter) speaks: Kansas City Fed President Jeff Schmid will deliver a speech on the economic outlook to the Greater Omaha Chamber. Q&A is expected. On November 13th, Schmid said that “while now is the time to begin dialing back the restrictiveness of monetary policy, it remains to be seen how much further interest rates will decline or where they might eventually settle.”

Wednesday, November 20

There are no major economic data releases scheduled.

Thursday, November 21

08:30 AM Initial jobless claims, week ended November 16 (GS 215k, consensus 220k, last 217k); Continuing jobless claims, week ended November 9 (consensus 1,885k, last 1,873k)

08:30 AM Philadelphia Fed manufacturing index, November (GS 10.0, consensus 7.0, last 10.3): We estimate that the Philadelphia Fed manufacturing index was roughly unchanged at 10.0 in November, reflecting a potential post-election boost but mixed global manufacturing indicators.

08:45 AM Cleveland Fed President Hammack (FOMC voter): Cleveland Fed President Beth Hammack will deliver welcoming remarks at the 2024 Financial Stability Conference, hosted by the Cleveland Fed. On October 24th, Hammack said that the FOMC had “made good progress” on inflation, but that it was still “running above [its] 2% objective.” Hammack noted that lower energy prices had contributed to lower headline inflation but that geopolitical events could make them “rapidly reverse course.” Hammack also suggested that “housing services inflation could remain elevated for a while” before rent growth for existing leases converges toward rent growth for new leases.

10:00 AM Existing home sales, October (GS +3.0%, consensus +2.5%, last -1.0%); Building permits, October (consensus +0.9%, last -3.1%)

11:00 AM Kansas City Fed manufacturing index, November (last -4)

12:25 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will take part in a moderated Q&A with the Central Indiana Corporate Partnership.

12:30 PM Cleveland Fed President Hammack (FOMC voter) speaks: Cleveland Fed President Beth Hammack will moderate a conversation with Sandra Thompson, Director of the Federal Housing Finance Agency at the Cleveland Fed’s 2024 Financial Stability Conference.

Friday, November 22

09:45 AM S&P Global US manufacturing PMI, November preliminary (consensus 48.8, last 48.5); S&P Global US services PMI, November preliminary (consensus 55.3, last 55.0)

10:00 AM University of Michigan consumer sentiment, November final (GS 73.9, consensus 73.5, last 73.0); University of Michigan 5-10-year inflation expectations, November final (GS 3.1%, last 3.1%)

Source: DB, Goldman

Source link