Geopolitically, more missiles were reported to have been sent into Russia overnight and that dragged stocks down early... and the micro and the macro kept stocks down for most of the day. Late on, buyers appeared as FOMO spread ahead of NVDA's earnings. That lifted The Dow into the green for the day...

On the Micro side, it was all about Target's epic fail...

Then, on the Macro side, round 12ET, Fed Governor Michelle Bowman poured some hawkish water on the dovish hopes:

“We have seen considerable progress in lowering inflation since early 2023, but progress seems to have stalled in recent months,” 'Miki' noted.

“I would prefer to proceed cautiously in bringing the policy rate down to better assess how far we are from the end point,” because progress in reducing inflation has slowed.

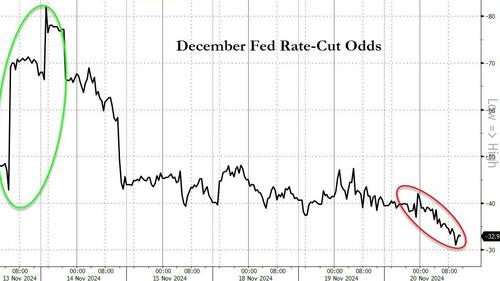

That sent December rate-cut odds significantly lower (33% now)...

Source: Bloomberg

Mega-Cap tech was slammed at the open, erasing all of yesterday's gains...before the FOMO buyers stormed in late...

Source: Bloomberg

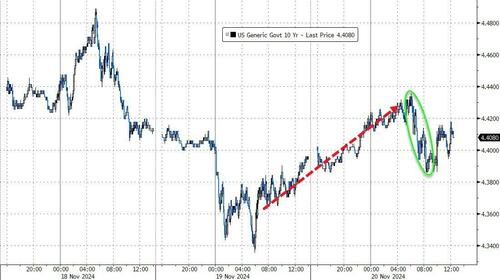

Treasury yields ended the day higher with the short-end hit hardest (but still only 3bps)

Source: Bloomberg

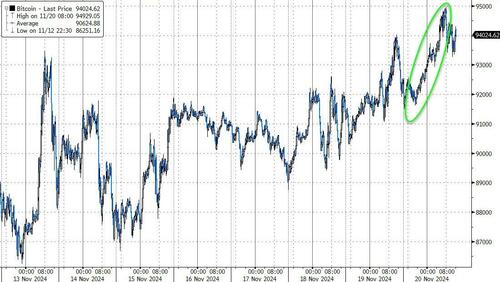

Bitcoin accelerated to yet another new record high today (within a few bucks of $95,000)...

Source: Bloomberg

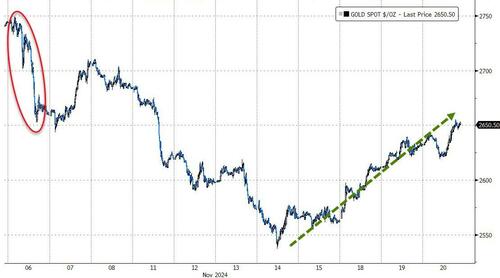

Gold rose for the third day in a row, back to its initial low from the election...

Source: Bloomberg

Notably gold and bitcoin rose together today amid the geopolitical chaos, but decoupled shortly after the US equity market opened...

Source: Bloomberg

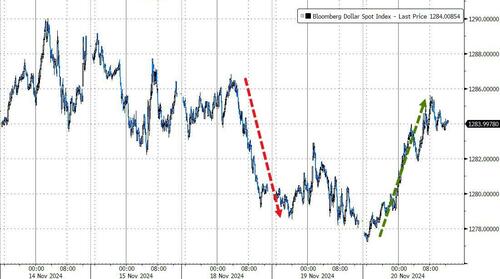

The dollar rallied strongly, erasing Monday's losses...

Source: Bloomberg

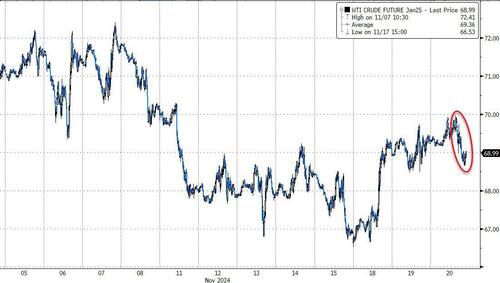

Crude prices slipped lower this afternoon to end the day unchanged with WTI hovering around $69...

Source: Bloomberg

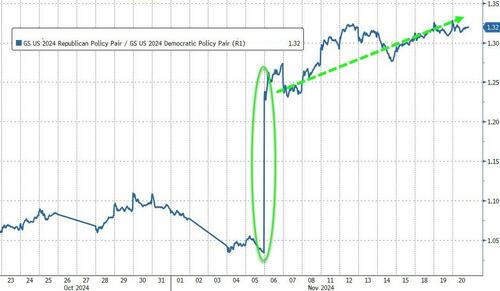

Finally, in case you were worried, the 'Trump Trade' continues to work..

Source: Bloomberg

..and will continue - if history is any guide - until the inauguration.

Source link