For the second day in a row, the market needed a sticksave, and got it thanks to - guess who - Nvidia.

Earlier this morning we reminded readers that NVDA was set to present at the Goldman Tech conference in San Fran...

NVDA presentation begins at GS tech confhttps://t.co/dkJQaKajvf

— zerohedge (@zerohedge) September 11, 2024

... an event we said would have greater significance than the CPI print, and sure enough that's what happened, because as stocks were slumping and were threatening to take out Friday's lows...

... a soundbite from NVDA CEO Jensen Huang saved the day yet again.

As quoted by Bloomberg, Huang said that “the demand on [chips] is so great, and everyone wants to be first and everyone wants to be most." He added that “we probably have more emotional customers today. Deservedly so. It’s tense. We’re trying to do the best we can.”

Huang also said that Nvidia leans heavily on Taiwan Semiconductor for production of its most important chips and does so because that company is the best in its field by a large margin. But geopolitical tension has raised risks. China sees TSMC’s home island as a rogue province, stoking concerns that it might try to reclaim the territory. That could potentially cut off Nvidia from the key supplier.

Huang also said he develops much of the company’s technology in-house and that should allow Nvidia to switch orders to alternative suppliers. Still, such a change would likely result in a reduction in quality of his chips.

TSMC’s “agility and their capability to respond to our needs is just incredible,” he said. “And so we use them because they’re great, but if necessary, of course, we can always bring up others.”

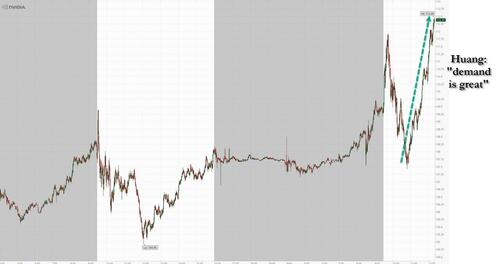

In any case all the market heard is "demand is great", which sent NVDA stock soaring from a session low of $107 to a session high of $113...

... which has also pushed the broader market to session highs:

And just like that stocks have been sticksaved once again.

Source link