It was very much a given that ahead of tonight's debate between Donald Trump and Kamala Harris, the one variable that the state does control - the price of oil - will move in the direction that gives its preferred candidate the biggest benefit, and sure enough oil plunged more than 3%, dropping to the lowest price since December 2021 (right before it quickly doubled over the next 3 months).

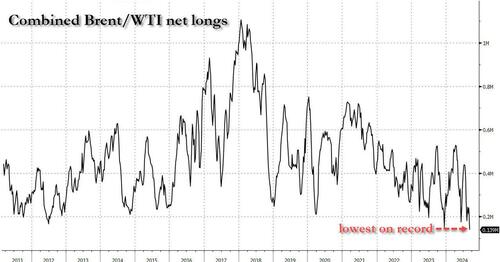

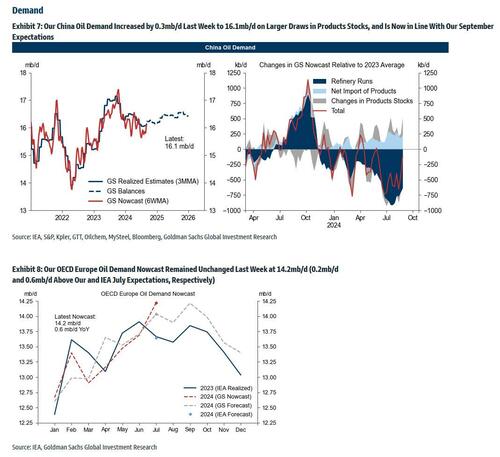

Yet while the pre-debate FUD was out in full force today, blaming everything from collapsing Chinese demand (which, by the way, is total bullshit as Jeff Currie explained), to soaring supply (which also is ridiculous, since oil - a commodity - trades on spot supply and demand, not what may or may not happen in 5 years), something strange has emerged: as Goldman Yulia Zhestkova Grigsby wrote in a note today, we once again have unprecedented divergence between the physical oil market (where demand remains quite resilient) and the paper oil market (where, as noted earlier, funds and CTAs have never been more bearish).

This is what the Goldman analyst wrote (much more in the full note available to pro subs):

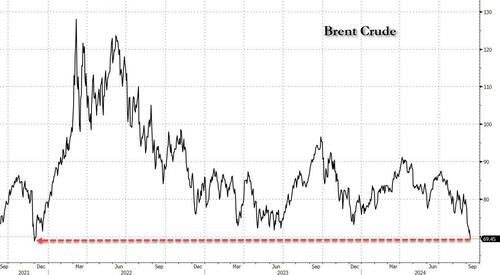

The Brent crude price continued sliding down over the last week to the lowest level since December 2021, with the disappointing US jobs report on Friday pushing Brent below our $70/bbl floor in tandem with the broader risk asset sell-off. An extension of OPEC+ production cuts till December helped to keep the floor under crude prices last week. Brent edged up on Monday as well on increasing risks to Gulf of Mexico oil production from the strengthening Tropical Storm Francine and on higher US SPR purchases.

Despite the macro-driven selloff, our trackable net supply decreased by -0.6mb/d last week on lower Russia and Canada production and on a moderate recovery in our China demand nowcast. In contrast to stronger physical demand, oil financial demand dropped to its new all-time low, and has plummeted by a massive average 7mb/d over the past two months. Together with the tightening physical market, any normalization from the currently extremely low speculative positioning and sizable undervaluation of the Brent 1M/36M timespread should help crude prices to recover further, and we expect Brent to average at $77/bbl next quarter.

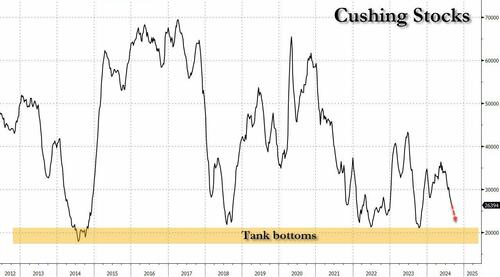

This unprecedented divergence between paper and physical markets is why earlier today we warned that with prices artificially depressed in an environment of healthy physical buying, we will soon hit the dreaded "tank bottoms" in Cushing, which could results in a slingshot higher in prices as suddenly there is no accessible physical oil, and certainly no deliverable to satisfy all those record shorts. Think of it as a mirror image to what happened in April 2020 when the glut of oil, and inability to park it, send prices negative.

There it is: record shorting by funds/CTAs despite stable physical demand. Tank bottoms coming up https://t.co/AB1OobZVQE pic.twitter.com/BDD3fq58MH

— zerohedge (@zerohedge) September 10, 2024

And we didn't have long to wait: shortly after the close, API reported that while crude stocks tumbled again, sliding by 2.8 million (the 9th weekly draw in the past 10), with gasoline down 513K barrels and Distillates fractionally higher, it was the plunge in Cushing that was - as we expected earlier today - the biggest shock: at -2.6 million, this was the biggest weekly drain in Cushing stocks since August 18, 2023.

And while we await the DOE to confirm this report (the DOE is well-known to manipulate the data in a way that will keep oil prices depressed until such time as it can't manipulate it any more and then prices explode), the chart of Cushing stocks - using the API update - suggests that we are now effectively at tank bottoms...

... which is stunning as it means just one large weekly draw and oil prices will absolutely erupt higher in what could be a short squeeze of financial bets for the ages.

For now, however, let the bears have their pyrrhic victory: after all, had oil not been artificially depressed to 3 year lows, Kamala would have zero talking points in today's debate.

Source link