Kevin Warsh, Hoover Institution distinguished visiting fellow and former Federal Reserve Governor, said the quiet part out loud this morning during an interview with CNBC's 'Squawk Box' when he dared to offer a logical rebuttal of the over-arching narrative that a) The Fed is apolitical/independent, b) The Fed is data dependent, and c) The Fed knows what it is doing...

Warsh began by explaining why he thinks The Fed's decision to cut 50bps goes against what The Fed had been saying regarding their policy.

"They've had different theories about the cause of inflation and the measures they use, and people in the financial markets have tried to follow them," Warsh begins, then clarifying several of those measures still being significantly far away from The Fed's mandated 2% goals.

"...a few years ago they were for flexible average inflation targeting. When inflation was at 1.7%, they said 'we'll get it a little higher and try to balance around 2%'..." but Warsh notes "they seem to have gotten rid of that idea without replacing it."

"They don't have a broad new strategy," he quipped, noting that The Fed then said:

"Core PCE - that's what we should focus on (but it's not running around 2.7%, nowhere near their 2% target."

The Fed is constantly changing:

"About a year ago, they said the best measure of inflation is now - they created a new category they called 'Core Services Ex Housing'... well that's in the 4% range now..."

Previously Janet Yellen said what really matters - and is embedded in The Fed model is 'wages'.

Wages running around 3% is consistent with inflation running around 25, but as Warsh points out, wages are running around 4% growth currently.

"So all of this is to say that The Fed doesn't seem to have a serious theory of inflation that's theoretical and empirical... It's not obvious they acknowledge what their role is in prices, instead claiming it has something to do with wars and pandemics."

Translation: The Fed's 50bps rate-cut has no basis in the data.

Warsh has a warning:

"In a world this dangerous, with fiscal policy so irresponsible, the central bank needs to be very clear about its reaction function, be clear about its goals , and not look like its lurching... because that's what put ius in the mes we have."

While CNBC's Becky Quick makes the point that The Fed has dual mandates and from time to time needs to shift its focus from inflation to jobs, she also admits that currently the labor market looks anything but weak and in need of a 50bps cut.

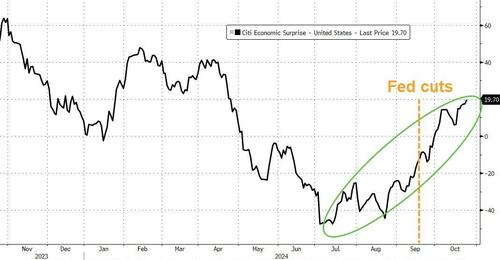

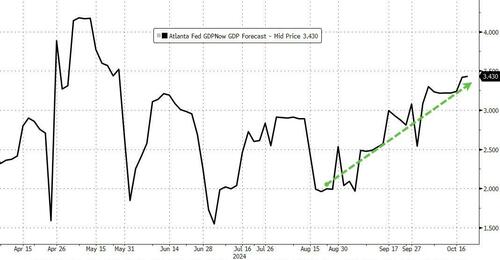

Warsh remarks that The Fed "has claimed that they are data dependent and when times change, they should change... of course... BUT the data since the early part of the summer has gotten better...

...the economy has gotten stronger...

...the broad sense of the data is the economy is in better shape."

So, says Warsh, ready to drop the bombshell: "if that's all true, maybe they're not data-dependent."

"I do not want to be the person accusing them of politics ... but when you don't have a theory of the case and you don't follow it, it is easy to get that accusation and it is harder ... to defend them."

With Sorkin speechless, Conservative-leaning Joe Kernen piped in to ask whether The Fed should push back against their apparent gatekeepers in Congress when they let the house get out of hand?

"When [The Fed] kept interest rates at zero for a decade and did QE... buying the bonds of the Treasury, they decided to more or less make that permanent feature - it is The Fed wondered into politics on a permanent basis," the former Fed governor admits, adding that "in a period of free money, what was the clear message to Congress - 'you can spend all the money you want'.. and so they did."

The Fed "encouraged the spending boom... and has put the country in a much more dangerous place."

"The central bank is playing a much more prominent role in the financial markets and wanting to - not just in crisis times - but for all seasons and all reasons."

The Fed's "framework is unanchored," Warsh continued, unburdened by what has been, noting that they seem to be "pursuing different objectives that are often at cross-purposes."

He ends with a simple example...

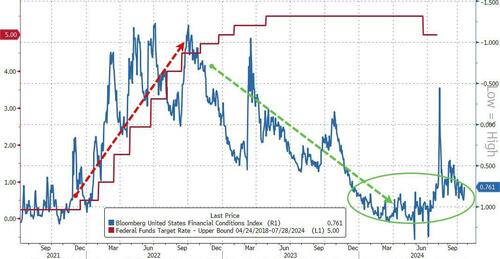

"they are now seeming to loosen the policy rate to provide more accommodation... but at the same time they are still in some modest quantitative tightening of the balance sheet... which is tightening financial conditions... and the rest of the world is watching..."

As we show in the following chart, financial conditions are at their 'easiest' since The Fed started HIKING rates... and yet they keep arguing that rates are restrictive.

As former Fed governor Warsh says - where's the 'restrictions'?

Watch the full interview below:

Source link