This morning, Deutsche Bank published its World Outlook for next year entitled “Navigating Trump 2.025” (available to pro subscribers in the usual place). It includes all of the German bank's global economic and asset price forecasts for 2025.

As summarized by Jim Reid, the bank's head of thematic research, the election result means we can forget “business as usual” and a wider range of outcomes has opened up for the global economy and financial markets. These span from a potentially much more positive US outlook on the one hand, to a much more negative European outlook on the other. President-elect Trump has several potentially conflicting economic policy goals, and how he weights them in office will influence global growth and asset prices in 2025 and beyond.

If the primary focus of the new administration is boosting growth, there’s every chance that this can be very positive for the US, with spillovers elsewhere across the globe. But that would likely require less of a focus on campaign promises like the deportation of undocumented immigrants and on tariffs.

The main downside risks are more likely to emerge if greater weight is put on aggressive trade and immigration policies. This could be more negative for growth and push up inflation. That would lead the Fed to cease the cutting cycle and possibly even contemplate restarting rate increases which would likely put upward pressure on bond yields. This would have implications for the US and even more so to the rest of the world. A maximalist Trump trade agenda and a Europe constrained to act because of fragmentation is a huge but realistic risk for the continent. Looking ahead, the German election in February will be a pivotal event.

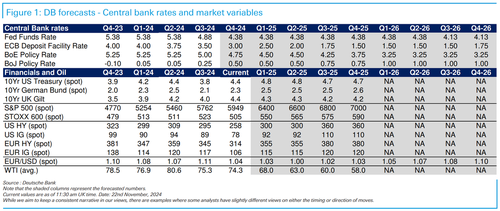

DB's base case for 2025 is stronger US growth and inflation and a higher Fed terminal rate than previously expected with the opposite conditions for Europe. This is driven by the assumption of modest US tax cuts, a strong deregulation push, and more supportive financial conditions. On trade the German bank assumes a 10% increase in the tariff rate on imports from China in the first half of the year (ratcheting up a further 10% in H2) and an equalization of tariff rates on motor vehicles with Europe. The forecast also assumes a 5% universal baseline tariff, though that is more likely to be implemented late 2025/early 2026.

More in the full DB note “Navigating Trump 2.025”, available to pro subscribers in the usual place

Source link