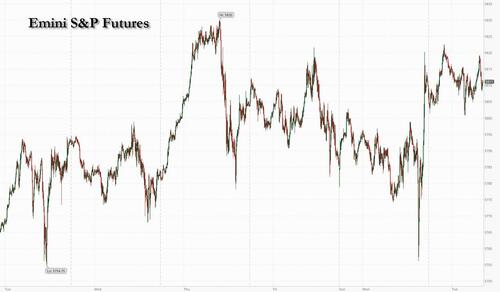

US equity futures are down a touch as we enter Q4 after trading overnight in a narrow range, with NDX leading and RTY lagging, a familiar pattern from the first half of the year. So far in 2024, S&P is +20.8%, NDX +19.2%, and RTY +10.0% (a full YTS performance return in a latter post). As of 8:00am ET,. S&P futures are down 0.1% after the index notched a fresh record Monday, the 43rd of the year, following a third-quarter rally that capped the longest such winning stretch since 2021; Nasdaq futs are unchanged with Mag7 names mixed as Semis hold a slight bid. FTSE +35bps, CAC -20bps, DAX +30bps, Nikkei +1.93%, the record China market juggernaut (Hang Seng/Shanghai) is closed for the next week due to holidays. Bond yields are lower as the yield curve bull steepens, and USD is higher. Commodities are mixed with Ags/Energy under pressure and Precious Metals are leading Base metals. Overnight news focused on Israel “targeted ground raids” into Lebanon (Israeli security official said a wider operation into Beirut is not on the table) and the US Dockworkers strike starting on the East Coast with economic costs estimated to be up to $5bn/day; hurricane recovery continues in the Southeast. Today’s macro data focus is on ISM-Mfg, JOLTS, Construction Spending, and Vehicle Sales. There are five Fed speakers today.

In premarket trading Boeing slips about 1% as the company is considering raising at least $10 billion by selling new stock, according to Bloomberg. Apple is down 1.5% after Barclays warns of weak demand for iPhone 16, countering JPM optimism yesterday. Marine shipping firm ZIM Integrated Shipping fell as much as 4.9% after dockworkers walked out of every major port on the US East and Gulf coasts, marking the beginning of a strike. FedEx Corp. and United Parcel Service Inc. edged higher after Stifel said they are the “most obvious beneficiaries” of disruptions caused by the strike. Here are the other notable premarket movers:

A global bond rally got fresh fuel Tuesday from data that euro-area inflation has been mostly vanquished, emboldening bets on interest-rate cuts. Treasuries advanced, while yields on 10-year German bonds fell as much as seven basis points to the lowest level since January. Optimism that the Fed can engineer the elusive “soft landing,” restricting policy but not so much that it chokes off growth, helped drive rallies in both bond and stock markets in the third quarter as markets are pricing in a recessionary 200bps in cuts which however is viewed as good for stocks. Indeed, money markets imply a one-in-three chance the Fed will deliver another half-point cut in November, and price a total of about 190 basis points of easing by the end of next year. That scenario may not pan out as expected, Larry Fink warned.

“The amount of easing that’s in the forward curve is crazy,” Fink, the chief executive officer of BlackRock Inc. said in an interview with Bloomberg TV. “There’s room for easing more, but not as much as the forward curve would indicate.”

European markets rise, with the Euro Stoxx 600 up 0.4% near session highs. FTSE 100 outperforms peers, adding 0.3%, IBEX lags, dropping 0.3%. Tech, real estate and travel are the strongest performing sectors. Euro-area inflation slowed below the European Central Bank’s 2% target for the first time since 2021, prompting money markets to add to bets on another quarter-point decrease by the ECB this month. Earlier, ECB President Christine Lagarde said the bank is becoming more optimistic about getting price pressures under control.

Earlier in the session, Asian stocks edged higher in thin trading on Tuesday, with a number of major markets including China, Hong Kong and South Korea closed for a holiday. The MSCI Asia Pacific Index was up about 0.2%. Japanese stocks recouped some of their losses from the previous day, when benchmarks were down more than 3%, thanks to a weaker yen. Australian stocks slipped. The outlook for Japanese equities has become uncertain as investors digest policy signals from new Prime Minister Shigeru Ishiba’s cabinet, as well as a potential fund rotation given China’s outperformance. Also boding well for the region’s outlook is a strong rally in Chinese stocks on the back of government measures. Any spillover to the rest of the region this week may be limited as the mainland Chinese market is closed for the Golden Week holiday.

“For China, the recent re-rating has been driven by the rising belief in a PBOC/government put option supporting shares off a low base,” Macquarie strategists including Eugene Hsiao wrote in a note. “Structural concerns on China remain unchanged, but in a one-party system, a little love to the markets can go a long way”

Mfg PMIs in Europe were mostly still in contractionary (Italy worse, Germany/EZ/Spain/France better/UK in-line). EZ CPI printed in-line (1.8%) and below the ECB target since the first time since June ’21. Japan Aug unemployment was slightly lower vs consensus (2.5 vs 2.6%).

ISM preview: ISM manufacturing index expected to tick up to 47.6 in September from 47.2 in August but remain in contraction. New orders component likely to get some additional scrutiny after falling to weakest level since May 2023 in the last print.

In FX, the Bloomberg Dollar Spot Index rises 0.2% while the euro falls as euro-area inflation slowed below the ECB’s 2% target for the first time since 2021. AUD and JPY are the best performers in G-10 FX; NOK and NZD underperform.

In rates, treasuries were underpinned by gains for core European rates after euro-area inflation slowed below the European Central Bank’s 2% target for the first time since 2021. Yield curve is notably flatter led by similar price action in bunds. US yields are richer by 2bp to 5bp across the curve near session lows with 2s10s, 5s30s spreads flatter by 1bp-2bp on the day; 10-year around 3.74% is down about 4bp vs Monday’s close with bunds and gilts in the sector outperforming by 3.5bp and 2bp. German bonds rally across the curve, led by the long end, while also outperforming comparable 10-year gilts and Treasuries. Bull-flattening rally in bunds has German 2s10s, 5s30s spreads flatter by 4bp and 3bp on the day with 10-year German yields remaining down around 8bp at ~2.05%. US session highlights include ISM manfacturing data and JOLTS job openings, along with several Fed speakers.

In commodities, concerns of oil oversupply as Libya is set to restore production weighs on prices. While they’ve trimmed some losses, WTI and Brent are down on the day. Spot gold climbs roughly $14 to trade near $2,649/oz on haven demand amid rising tensions in the Middle East.

Looking at today's calendar, US economic data calendar includes September final S&P Global US manufacturing PMI (9:45am), August construction spending and JOLTS job openings and September ISM manufacturing (10am) and September Dallas Fed services activity (10:30am). Fed speakers scheduled include Bostic (11am, 11:10am, 6:15pm), Cook (11:10am), Barkin and Collins (6:15pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new quarter mixed amid a slew of data releases and several key market closures with markets in Mainland China, Hong Kong and South Korea closed, while participants also reflected on Fed chair Powell's recent comments and Israel's ground offensive in Lebanon. ASX 200 was pressured as underperformance in the mining, materials and financial sectors overshadowed the resilience in tech and defensives, while data releases were mixed as Retail Sales topped forecasts but Building Approvals showed a sharper-than-feared contraction. Nikkei 225 rallied after the recent heavy selling with the recovery facilitated by a weaker currency amid mixed Tankan data and varied BoJ opinions.

Top Asian News

European bourses, Stoxx 600 (+0.2%) began the session around flat, but quickly dipped lower as sentiment took a hit early in the morning; a move which has since stabilised. As it stands, indices in Europe are mixed and trade very modestly on either side of the unchanged mark. EZ Manufacturing PMI/HICP figures passed through with little impact on price action. European sectors hold a slight positive bias, but with the breadth of the market fairly narrow. Tech takes the top spot alongside strength in Travel & Leisure. Energy is found at the foot of the pile, given the continued weakness in oil prices. US Equity Futures (ES -0.1%, NQ U/C RTY -0.3%) are mixed, with slight underperformance in the economy-linked RTY as traders continue to digest remarks from Fed Chair Powell who pushed back against another oversized cut in 2024.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

Welcome to Q4. As it’s the start of the quarter, we’ll shortly be publishing our usual performance review for Q3 (and September), covering how various financial assets fared. Markets put in a strong overall performance, despite the turmoil in early August, and as it stands, the S&P 500 has now posted its strongest YTD advance of the 21st century so far up to Q3, having advanced more than +20% since the start of the year. Other Q3 highlights include the strongest advance for the Japanese Yen since Q4 2008, whilst US Treasuries are up for a 5th consecutive month for the first time since 2010. See the full report in your inboxes shortly.

When it came to the last day of the month, markets outside of China which had the best day since September 2008 on Monday, saw a mixed day. Europe was down heavily and the US stumbled a little following some less dovish comments from Fed Chair Powell, but positive month-end effects late in the session helped the S&P 500 (+0.42%) post its 43rd all-time high of the year.

Powell’s remarks led to some doubts over whether the aggressive pace of the easing cycle priced by markets would materialise. While maintaining data-dependence, he emphasised that the economy remains solid, noting that “this is not a committee that feels like it’s in a hurry to cut rates quickly”. He also reiterated the rates signal from the most recent SEP, saying that “if the economy performs as expected that would mean two more cuts this year, for a total of 50bps more”. So some conditional pushback relative to market expectations that had moved to fully price 75bps of further cuts by year-end.

In response, Fed funds futures tempered the rate cut expectations, with the amount of easing priced by December falling to 70bps, down from 77bps at the start of the day and 73bps before Powell spoke. Off the back of this, Treasury yields extended what had been a modest increase earlier in the day, with 2yr Treasury yields closing +8.2bps higher on the day at 3.64%, while 10yr yields were up +3.0bps to 3.78%.

US equities were briefly weighed down, with the S&P 500 falling by as much as -0.6% following Powell’s comments, but recovered to post yet another record high (+0.42% on the day). This came amid a sharp move in the final 30 minutes of trading, suggesting that month- and quarter-end effects were likely at play. The tech mega caps outperformed in this late rally, with the Mag-7 up around 0.8% in the final half an hour of trading to close +0.63% higher on the day.

Before Powell’s remarks, European markets had lost ground, despite growing anticipation that the ECB would be cutting rates again at their meeting in a couple of weeks’ time. Overnight DB's European economics team have added a cut at this meeting into their forecast with back-to-back cuts out to neutral (2.00-2.50%) by mid-2025 with risks skewed towards a 50bps in December. See their piece here.

The increased October cut talk was initially driven by the latest German inflation data, where the EU-harmonised measure was down to +1.8% in September as expected. That’s the first sub-2% reading since February 2021, so it helped cement the view that the ECB was well on the way to getting inflation durably back to target. Similarly, the Italian data showed inflation down to just +0.8%, although it’ll be the Euro Area-wide release today that ultimately matters for the ECB’s decision.

After the inflation data, we then heard from ECB President Lagarde, who kept the door open to an October cut in her latest comments to the European Parliament’s Committee on Economic and Monetary Affairs. In her prepared remarks, she said that “inflation might temporarily increase in the fourth quarter of this year as previous sharp falls in energy prices drop out of the annual rates, but the latest developments strengthen our confidence that inflation will return to target in a timely manner. We will take that into account in our next monetary policy meeting in October.” That explicit mention of October raised investors’ hopes that the ECB were considering whether to cut once again, and overnight index swaps dialled up the likelihood of an October cut from 82% on Friday to 91% by the close last night.

Despite the mounting rate cut anticipation for October, sovereign bond yields saw little change in Europe yesterday, as investors’ expectations for rate cuts further out into 2025 didn’t see a similar dovish shift. Indeed by the close, yields on 10yr bunds (-1.0bps) were only slightly lower, and those on 10yr OATs (-0.3bps) and BTPs (+0.2bps) were little changed. And for equities there were more consistent losses, with the STOXX 600 (-0.98%) falling back from its all-time high on Friday, whilst the CAC 40 (-2.00%) posted its worst daily performance since August 1.

Asian equity markets are mixed and much quieter this morning with China starting a week long holiday and some other markets closed. The Nikkei is up +1.91% as I type, supported by a weaker yen, after a significant drop of nearly -5% in the previous session, following Shigeru Ishiba’s win in the Liberal Democratic Party’s leadership race on Friday, given they are seen as a monetary hawk. In contrast, the S&P/ASX 200 is down by -0.82%, reversing its previous gains after hitting an all-time high yesterday. US futures are pretty flat along with US Treasuries.

Early morning data showed that retail sales in Australia rose +0.7% m/m in August (v/s +0.4% expected) as unusually warm weather brought forward spring spending. This follows an upwardly revised increase of +0.1% in July. Separately, Japan’s unemployment rate dropped to 2.5% in August (v/s +2.6% expected) against a level of +2.7% the previous month. Also, the jobs-to-applicants ratio in August declined to 1.23 from 1.24 in July. The Bloomberg forecast was for 1.24. Meanwhile, business optimism among large Japanese manufacturers remained steady at +13, unchanged from the quarter before. Separately, sentiment among large non-manufacturers improved, rising to +34 from +33 in the second quarter, beating market expectations of +32. So a big data dump in Japan that was generally slightly positive.

There wasn’t too much other data yesterday, although UK mortgage approvals picked up to 64.9k in August, which is their highest level since the month of the mini budget in September 2022. Separately, Q2 GDP growth was revised down a tenth to +0.5%.

To the day ahead now, and from the US we’ll get the ISM manufacturing for September, as well as the JOLTS job openings for August. Otherwise, there’s the global manufacturing PMIs for September, and the Euro Area flash CPI release for September. Central bank speakers include the Fed’s Bostic, Cook, Barkin and Collins, ECB Vice President de Guindos, the ECB’s Nagel, Rehn and Schnabel, and the BoE’s Pill. Today’s earnings releases include Nike. And in the political sphere, there’s a US election debate between the Vice Presidential candidates and French PM Barnier will give a policy speech and likely give clues to the latest on a difficult budget negotiation.

Source link