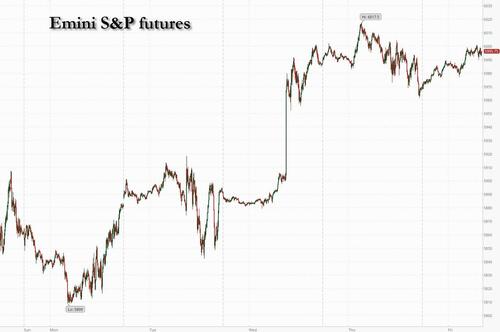

US equity futures are higher modestly, rebounding from yesterday's just as modest loss. As of 8:00am, S&P futures rise 0.4%, with the underlying index poised for its biggest weekly gain since November’s election, while Nasdaq 100 futures advanced 0.5% thanks to Mag 7 stocks mostly higher (NVDA +1.3%, TSLA +0.9% and GOOG/L +0.6%) as the latest data and comments from Fed officials suggest the central bank will have room to cut interest rates this year. 10Y Treasury yields edged lower, slipping more than 15 basis points below recent multi-month highs, while the USD is higher. Base metals are mostly higher amid upside surprise on China Q4 and December macro data: Q4 GDP prints 5.4% vs. 5.0% survey vs. 4.6% prior; Retail Sales and IP both surprised to the upside. However, reactions from local Asian markets remain muted. Today, macro focus will be on housing data (Housing Starts and Building Permits).

In premarket trading, all members of the Magnificent Seven are higher: Alphabet (GOOGL) +0.4%, Amazon (AMZN) +0.5%, Apple (AAPL) +0.7%, Microsoft (MSFT) +0.3% , Meta Platforms (META) +0.3%, Nvidia (NVDA) +0.9%, and Tesla (TSLA) +0.7%. JetBlue and Southwest Airlines shares fall about 2% after BofA downgraded the carriers to underperform from neutral, citing their lower exposure to corporate, premium and international routes. Here are some other notable premarket movers:

A big reason for this week's stock market outperformance is that swap markets now expect some 40 basis points worth of rate cuts from the Fed this year, following a weaker than expected core CPI print, moving from not even pricing a single quarter-point move earlier this week.

"Even equity managers were more concerned over rates than earnings,” said Kevin Thozet, a member of the investment committee at Carmignac. “What we have had is reassuring data on this front — whether retail sales or inflation — hinting that the US economy may not be overheating. This has allowed for fixed income markets to take a bit of a breather.”

With Q4 earnings just starting, investor focus is also turning to President-elect Donald Trump’s inauguration on Monday and his plans for tariff hikes, tax cuts and mass deportation of undocumented migrants. “Key things to be aware of are whether Trump goes big from the very first day, coming up with executive orders and being very vocal,” Carmignac’s Thozet said. “He has been saying a multitude of things and we will see if he is more talking than acting.”

Europe’s Stoxx 600 index also gained, rising 0.6%, and on course for its strongest week since September. Basic resources shares led the way after Bloomberg reported that Glencore and Rio Tinto held early-stage talks about combining their businesses. The news, alongside a weaker pound, helped London’s FTSE 100 hit a record high. China-focused European sectors such as retail and auto also climbed after data suggested Beijing’s stimulus blitz is succeeding in shoring up economic growth. Here are some of the biggest movers on Friday:

Earlier, Asian stocks snapped a three-day winning streak, led by losses in Japan after the yen strengthened on an outlook for higher interest rates while largely shrugging off news that China’s economy had expanded at its fastest pace in six quarters to hit the government’s growth goal last year. Analysts say the growth report for 2024 is overshadowed by looming US tariffs on Chinese exports. The MSCI Asia Pacific Index declined as much as 0.7% before erasing most of the loss. Korean companies Hyundai and Samsung were among the worst performers on the regional gauge. Shares in Hong Kong and mainland China advanced after data showed the world’s second-largest economy hit the government growth target last year. Market weakness is expected to continue into next week’s meeting as the BOJ maintains cautiousness, said Kieran Calder, head of Asia equity research at Union Bancaire Privee in Singapore. “If we get only talk and no rate hike from the BOJ, then expect a sharp reversal” toward a weaker yen. Despite Friday’s drop, the key Asian stock gauge is still on track to eke out its first weekly gain of the year.

In currency markets, Bloomberg’s dollar index rose 0.1%, as data continue to highlight the strength of the US economy relative to developed-market peers. The pound slipped as much as 0.6% to near the weakest level since November 2023, after a surprise drop in retail sales added to evidence of a struggling British economy. The yen briefly strengthened through 155 against the dollar early Friday as expectations ramp up for an interest rate hike by the BOJ; it has since retreated and was the weakest of the G-10 currencies, falling 0.4% against the dollar even as traders boost bets on the BOJ raising rates next week. Despite the drop, the Japanese currency is still up more than 1% versus the dollar for the week. Tightening in Japan comes amid uncertain prospects for cuts by the Federal Reserve amid recent US economic data.

In rates, treasury futures hold small gains as US session gets under way, with yields at or near weekly lows. Long-end tenors lead, richer by more than 3bp, flattening the curve. UK gilts pace gains for government bonds globally for a second straight day, with yields lower by 5bp-7bp, after weaker-than-expected UK retail sales figures boosted wagers on BOE easing. Fed’s self-imposed quiet period ahead of Jan. 29 rate decision begins Saturday. With US front-end yields little changed, 2s10s spread is nearly 3bp flatter on the day; US 10-year around 3bp richer at 4.59%, trails UK counterpart by 3bp in the sector while keeping pace with Germany’s. Bunds stayed higher as euro area CPI was confirmed at 2.4% year-on-year in December. IG credit new-issue slate is dormant after GSIBs dominated an eight-deal, $27.6b calendar Thursday, taking weekly supply to nearly $47b, beyond the $40b projected

In commodities, WTI rises 0.6% to $79.20 a barrel. Spot gold drops $10 to $2,705/oz. Bitcoin rises 2% above $102,000.

The US economic data calendar includes December housing starts/building permits (8:30am), December industrial production (9:15am) and November TIC flows 4pm. Fed speaker slate is blank

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed in mostly rangebound trade after the uninspiring handover from Wall St and despite encouraging Chinese GDP and activity data. ASX 200 traded indecisively as weakness in the top-weighted financials sector and telecoms clouded over the marginal gains in most sectors, while the index also failed to benefit from the mostly better-than-expected data in Australia's largest trading partner. Nikkei 225 continued to underperform amid recent currency strength and the potential for a BoJ rate hike next week. Hang Seng and Shanghai Comp were choppy with only mild support seen after GDP, Industrial Production & Retail Sales beat expectations with China's economy growing 5.4% Y/Y (exp. 5.0%) in Q4 and by 5.0% (exp. 4.9%) for 2024. Nonetheless, the data only briefly supported Chinese stocks which were ultimately rangebound after the mixed commentary from the stats bureau which noted the impact of external environment changes is deepening, domestic demand is not sufficient, and economic operations still face many difficulties and challenges but also stated that positive factors will outweigh negative factors for China's economy in 2025. In addition, US-China trade frictions continued to linger after the USTR found China shipbuilding to be actionable under Section 301.

Top Asian News

European bourses (Stoxx 600 +0.7%) opened modestly firmer across the board and have continued to climb since the cash open; as it stands, indices reside near best levels. European sectors hold a strong positive bias, with Autos & Parts leading the gains whilst Tech is the marginal laggard, as it trades on either side of the unchanged mark, paring the TSMC-induced upside seen in the prior day. US equity futures are modestly in positive territory, attempting to make up for the lacklustre performance in the prior session and garnering optimism via a strong European session thus far.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets put in a decent performance over the last 24 hours, with bonds and most equities posting a fresh advance, despite a slump for the Magnificent 7 (-1.92%) pushing down the S&P 500 (-0.21%). The big focus for investors was on Scott Bessent’s nomination hearing to become US Treasury Secretary, but the largest moves of the day were actually driven by comments from Fed Governor Waller. He sounded open to a rate cut as soon as March, and also said that 3 or 4 cuts were possible this year if the data cooperated. So those comments pushed back against the more hawkish narrative that developed because of strong data like the jobs report last week. And if we did end up with 3 or 4 cuts, that would be a faster pace than the Fed’s dot plot showed only last month, when the median dot pencilled in just 2 cuts this year.

After Waller’s comments, investors swiftly dialled up their expectations for Fed rate cuts this year. For instance, the likelihood of a cut by the May meeting moved up to 56%, and the total number of cuts by the December meeting moved up +3.3bps to 42.5bps. Those moves kept up the momentum from the CPI report on Wednesday, which helped to revive investors’ hopes that the Fed were still on a path to cut rates. So that meant it was a strong day for US Treasuries, with the 10yr yield (-4.0bps) down to 4.61%, whilst the 2yr yield (-3.5bps) fell to 4.23%.

In the meantime, when it came to Scott Bessent’s hearing to become US Treasury Secretary, the most notable comment was regarding new Russian sanctions, with Bessent saying he would support sanctions on Russian oil majors. But otherwise, his remarks were broadly in line with our understanding of existing policy. For example, Bessent called for an extension of tax cuts, saying that they would face “an economic calamity” if they didn’t renew them. Separately, he said that “we must ensure that the US dollar remains the world’s reserve currency”. And on fiscal policy, he said that the US “must work to get our fiscal house in order”. By the close, the dollar index had weakened -0.12%, but the main move lower came earlier in response to Waller’s comments, rather than anything Bessent said.

Ahead of all that, we had a reasonably positive set of US data yesterday. The strongest was the Philadelphia Fed’s manufacturing business outlook survey, which surged to 44.3 in January (vs. -5.0 expected). That’s the highest reading for the index since April 2021, as well as the biggest monthly jump in the index since June 2020. Otherwise, some of the hard data was more mixed, with retail sales ex autos up by +0.4% in December (vs. +0.5% expected), but the retail control group up by a stronger +0.7% (vs +0.4% expected). Meanwhile, initial jobless claims moved up to 217k in the week ending January 11 (vs. 210k expected). So with that pretty good set of data, the Atlanta Fed’s GDPNow estimate for Q4 ticked up to an annualised pace of +3.0%.

Despite the solid backdrop, the S&P 500 (-0.21%) declined for the first time this week, but this was primarily due to drag from the big tech firms as all of the Magnificent 7 (-1.92%) lost ground. By contrast, around three-quarters of the S&P 500’s constituents advanced on the day, led by rate-sensitive sectors. In fact, the equal-weighted S&P 500 was up +0.81% yesterday, bringing its gains for the week up to +3.42% so far. So even if the equal-weighted index is unchanged today, that would make it the second-best weekly performance in the last year, only behind the week of the US election in November.

Over in Europe, equities put in a much stronger performance, with the STOXX 600 (+0.98%) up to a one-month high, with France’s CAC 40 (+2.14%) posting the largest advance of the major indices amid strong gains for luxury stocks. That advance came just before French Prime Minister Bayrou survived a confidence vote in the National Assembly, thanks to abstentions from Marine Le Pen’s National Rally, as well as the Socialists. And in Germany, the DAX (+0.39%) hit an all-time high with just over 5 weeks until the federal election.

Meanwhile in the UK, gilts outperformed for a second day running after the latest growth data was weaker than expected. It showed the UK economy only grew by +0.1% in November, (vs. +0.2% expected), and if you look at the full three months to November, the economy was stagnant compared to the previous three months. So after the downside inflation surprise on Wednesday, that led investors to expect more rate cuts from the Bank of England this year, with 65bps now priced in by the December meeting. In turn, that led gilt yields to fall across the curve, with the 2yr yield down -8.1bps, and the 10yr yield own -5.1bps.

Elsewhere in Europe, yields on 10yr bunds (-1.5bps) and OATs (-1.8bps) posted a modest decline following the US rates move lower. We did get the account from the ECB’s December meeting as well, which confirmed the prevailing view that further cuts were still likely. And notably, there was some discussion of a larger 50bp cut, with the account saying that some members “would have favoured more consideration being given to the possibility of such a larger cut.” But ultimately, they only cut by 25bps, and the account said “it was remarked that a 50 basis point cut could be perceived as the ECB having a more negative view of the state of the economy than was actually the case.”

Overnight in Asia, the main story has been China’s GDP data, which showed the economy grew by +5.0% in 2024 as a whole. Moreover, the Q4 number was stronger than expected, with GDP up +5.4% on a year-on-year basis (vs. +5.0% expected). And some of the monthly data for December also surprised on the upside, with industrial production up +6.2% y/y (vs. +5.4% expected), whilst retail sales were up +3.7% y/y (vs. +3.6% expected).

Against that backdrop, Chinese equities have advanced this morning, with solid gains for the CSI 300 (+0.77%) and the Shanghai Comp (+0.55%). But elsewhere in Asia there’ve been losses this morning, with Japan’s Nikkei (-0.38%) and South Korea’s KOSPI (-0.28%) both losing ground. Looking forward however, US and European equity futures are all positive, with those on the S&P 500 (+0.22%) and the DAX (+0.15%) pointing higher.

To the day ahead now, and data releases from the US include industrial production, capacity utilisation, housing starts and building permits for December, and in the UK there’s also retail sales for December. From central banks, we’ll hear from the ECB’s Nagel, Escriva and Centeno.

Source link