Well that was a shitshow of a day... politically chaotic and macro-economically depressing on a holiday-shortened (super low liquidity) day (with FOMC Minutes due an hour after the close).

So BUY BUY BUY!!!!

Bonds, stocks, and gold all bid as collapsing 'hard' and 'soft' data (Challenger-Grey job cuts soared, ADP payrolls miss, continuing jobless claims surged, factory orders plunged, ISM Services puked)...

Source: Bloomberg

...send the overall US macro surprise index to its weakest since Dec 2015...

Source: Bloomberg

...and spark panic-buying in STIRs, sending rate-cut expectations (dovishly) soaring...

Source: Bloomberg

This helped lift stocks (with Nasdaq and S&P outperforming) as The Dow and Small Caps ended approximately unchanged...

...as Mag7 dominated once again...

Source: Bloomberg

...as evidenced by the NVDA buyback machine being on fire today...

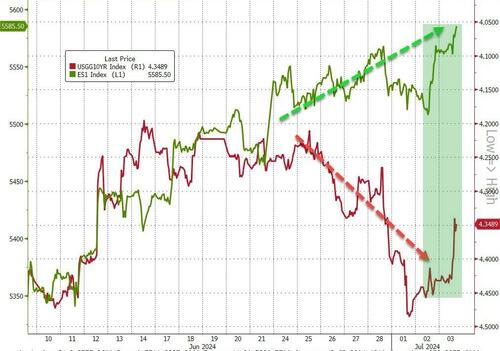

Bonds and stocks rallied for the second day together but since the debate - rates and stocks have decoupled in favor of a Trumpian victory bet...

Source: Bloomberg

The bad news was also good for bonds with yields tumbling across the curve (long-end outperforming) and all now lower on the week...

Source: Bloomberg

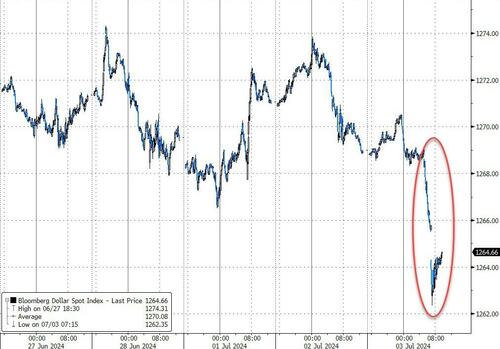

The dollar was dumped on the dovish bad news...

Source: Bloomberg

Oil prices spiked on the big crude draw (just like last night's API) but reversed fast to end modestly lower...

Source: Bloomberg

Gold spiked back up to what appears to be a critical resistance level...

Source: Bloomberg

Bitcoin was clubbed like a baby seal, but found support at $60k amid more Mt.Gox headlines...

Source: Bloomberg

With a two year lag, the yield curve is screaming that VIX is way too low...

Source: Bloomberg

...and with jobless claims starting to rise quickly (and spread across states), means simultaneous stress on company balance sheets nationwide (more unemployment means lower demand, stressing the balance sheets of companies who will hang on to their employees for as long as they can) which feeds through to increased equity volatility.

Source link