Update (1245ET): Stocks could not maintain joy on Tuesday after the White House confirmed that 104% additional tariffs will go into effect at noon ET because China refused to remove its retaliatory measures.

The new tariff will be collected beginning tomorrow, April 9th. Markets were predictably displeased.

We ran out of chart pic.twitter.com/3uuXcoNxXy

— zerohedge (@zerohedge) April 7, 2025

Clearly only another Ackman meltdown or Walter Bloomberg tweet can save us now.

* * *

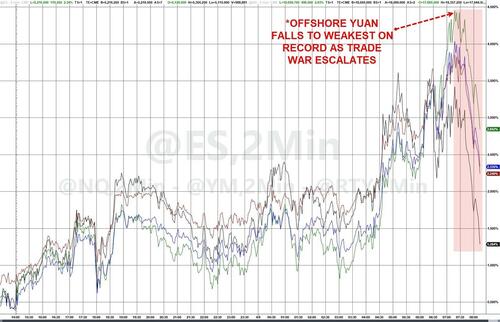

Update (1100ET): US equity market are fading rapidly from a huge start this morning...

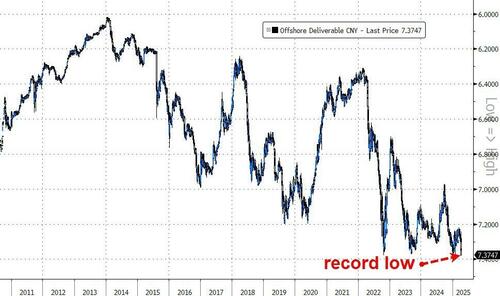

...the top seemed to coincide with a renewed surge lower in China's offshore yuan...

...to a new record low against the dollar...

...further raising the specter of China trade war escalation with the possibility of a devaluation looming (as we detailed overnight).

The spread between Onshore Yuan (fixing) and offshore yuan is at its limit - something has to give.

Remember, China has three options:

China has three options:

— zerohedge (@zerohedge) April 4, 2025

1. Concede defeat to whatever terms Trump demands

2. Devalue the yuan by 20-40%

3. Unleash biggest fiscal stimulus in its history (talking $2-3 trillion) which will push its debt off the chart

Did that just decide to go with Option 2?

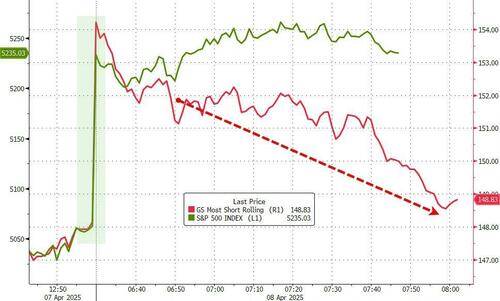

Notably the initial exuberant short-squeeze was unsustainable and has been hinting at the rally's fragility all morning...

Finally, bear in mind that, as Goldman noted, those paying attention during the first trade war in 2018 would remember similar wording from the MOFCOM in Apr 2018 when the spokesperson also said Beijing will “fight to the end” yet the two sides entered into talks just the month after.

* * *

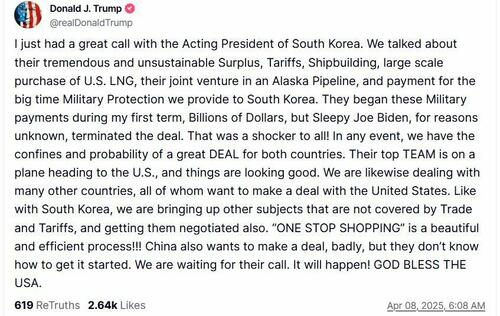

Update (1920ET): President Donald Trump sent futures accelerating to the upside on Tuesday after suggesting on Truth Social that China "wants to make a deal, badly, but they don't know how to get it started."

"We are waiting for their call," Trump continued, adding "It will happen!"

The comments come after China threatened various "countermeasures" in response to US tariffs - including increasing counter-tariffs on US agricultural products, prohibiting the import of US poultry, suspending China-US cooperation on fentanyl, restricting corporate trade, banning the import of American films, and reassessing the benefit US companies have gained from intellectual property in China.

"If the US escalates its tariff measures, China will resolutely take countermeasures to safeguard its own rights and interests," a ministry spokesperson said on Monday. "The US threat to escalate tariffs against China is a mistake on top of a mistake, which once again exposes the US's blackmailing nature. China will never accept this. If the US insists on going its own way, China will fight it to the end."

“The US hegemonic move in the name of ‘reciprocity’ serves its selfish interests at the expense of other countries’ legitimate interests and puts ‘America first’ over international rules,” embassy spokesman Liu Pengyu said in response to a question on the latest US move.

“China will firmly safeguard its legitimate rights and interests,” he said, without specifying any actions.

Needless to say - after China's threats, markets are so far pleased at Trump's response...

Wolfe Research says Monday’s sharp intraday reversal—driven by fake rumors of a 90-day tariff pause—highlights just how fragile markets are to tariff headlines right now. The firm believes the President “could stop or lessen the selloff with a single social media post,” given how…

— Wall St Engine (@wallstengine) April 8, 2025

* * *

Best sellers at ZH Store last week:

FREE SHIPPING OVER $50!

FREE SHIPPING OVER $50!* * *

US Equity futures are accelerating gains following comments by US Treasury Secretary Bessent this morning that tariff negotiations are the result of massive inbound calls, not the market.

When asked about tax with Europe, says "everything is on the table."

Trump will be personally involved in negotiations.

Japan, South Korea and Taiwan may be engaged in Alaska deal (Early March, Trump said Japan, south Korea and others want to partner with US in a gigantic natural gas pipeline in Alaska).

If they are successful, tariffs would be a melting ice cube in a way.

Have discussed which countries to prioritize. Japan would get priority after swiftly reaching out to the US.

If there are solid proposals, could end up with some good deals.

As part of calculus with deals, some part of tariffs may stay on.

Bessent was not involved in the calculations of the tariff numbers.

Thinks escalation by China was a big mistake.

China has chosen to isolate itself by retaliating and doubling down on previous negative behavior.

US President Trump is committed to fixing trade imbalances.

The reaction was positive to Bessent's comments:

Watch Bessent's full interview here: "The President has maximum negotiating leverage. Many of our trading partners have not escalated, and they will get priority in the queue. I think it was a big mistake, this Chinese escalation."

BESSENT: The President has maximum negotiating leverage. Many of our trading partners have not escalated, and they will get priority in the queue. I think it was a big mistake, this Chinese escalation.

— Election Wizard (@ElectionWiz) April 8, 2025

pic.twitter.com/h2UgjWM9D6

Is the short-squeeze back sustainable?

Politico reports that Bessent is having some success steering the White House tariff messaging away from permanence and toward negotiations after warning Trump of further market losses.

Source link