Housing market data from Redfin shows that US asking rents were flat in October, rising marginally by .2% year-over-year to $1,619. For two years, rents have remained flat nationwide following a massive boom during Covid, sparked by low interest rates and domestic migration trends. Now, in cities like Austin, Texas, rents are sliding due to a surge in new supply and reduced demand.

Drilling down into Austin's rental data, Nick Gerli, CEO and founder of the real estate analytics firm Reventure Consulting, shared on X a concerning breakdown of the local rental market downturn that could have landlords in the metro area deeply spooked.

Let's begin with Gerli's tweet...

The Austin, TX rental market is collapsing before our eyes.

With the median apartment rent dropping 15% over the last 2+ years.

The vacancies have skyrocketed. Rental concessions are everywhere.

Rents are now only 9.8% higher than pre-pandemic. Meaning that many Austin landlords are losing money, as property taxes, insurance, and interest costs are way higher.

(This is a harsh lesson on the boom/bust cycle in real estate for many developers and investors who bought into Austin during the boom. Read more below to see how this happened.)

The Austin, TX rental market is collapsing before our eyes.

— Nick Gerli (@nickgerli1) November 14, 2024

With the median apartment rent dropping 15% over the last 2+ years.

The vacancies have skyrocketed. Rental concessions are everywhere.

Rents are now only 9.8% higher than pre-pandemic. Meaning that many Austin… pic.twitter.com/dNFsoAqJ8a

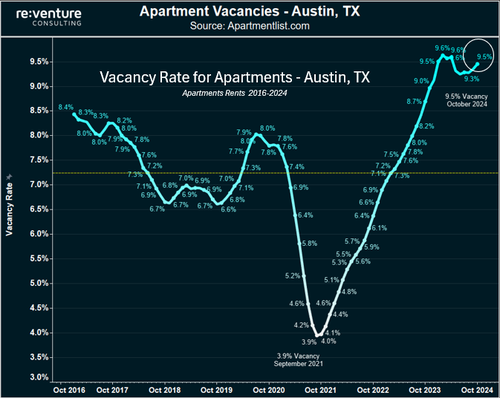

Austin's rental vacancy rate has exploded to a seven-year high:

You can see this reality expressed in vacancy rate statistics from Apartment list.

At the height of the pandemic in Sept 2021, Austin's rental vacancy rate was only 3.9%. Now it's 9.5% The highest level going back 7 years.

Gerli pointed out landlords in Austin are under severe pressure:

With so many vacant apartments, and rents that are still overpriced, landlords have no choice but to cut the rent to put heads in beds. Especially on lease-up projects. Which often deliver 200-400 units vacant all at once. This is exerting massive downward pressure on the rental market.

This is very good news for renters. He said:

4) Which is of course good for renters. Incomes on Austin have grown quite a bit the last five years, and now rents are dropping, so locals are beginning to feel as apartments are affordable-ish again.

— Nick Gerli (@nickgerli1) November 14, 2024

However, they will likely continue to get more affordable, as there is still…

Gerli explained that in 2025, Austin will continue to have an apartment supply issue, which means lower rents.

Gerli speculates...

9) If you squint, you can begin to see a bottom forming in Austin's housing market sometime in 2025.

— Nick Gerli (@nickgerli1) November 14, 2024

Rents and values will need to drop a bit further. But once they both go down another 5-10%, the market will be fairly valued.

And could have some growth opportunities once the…

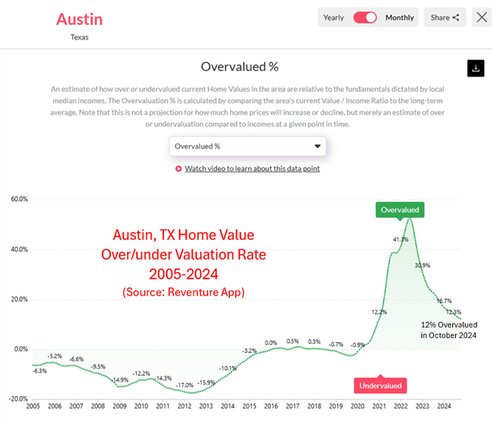

He cited Reventure App data showing that home prices in Austin were once 50% overvalued. That figure now stands at around 12%.

Gerli concludes by forecasting a possible bottom forming in Austin's housing market sometime in 2025.

Source link