Authored by Charles Hugh Smith via OfTwoMinds blog,

Confidence / complacency doesn't map the real world, in which liquidity dries up and markets go bidless.

When Alan Greenspan issued his mea culpa in late 2013 about missing the subprime mortgage implosion and the resulting Global Financial Meltdown (Why I Didn't See the Crisis Coming Foreign Affairs), he started by noting the complete and utter failure of everyone's sophisticated models to predict the collapse of confidence.

The core failure, he suggested, lay in the models' reliance on the notion that humans make decisions rationally as Homo economicus, when the reality is we are extremely prone to irrational exuberance (a.k.a. running with the greed-enchanted herd) and panic (running off the cliff with the herd). He invoked Keynes famous "animal spirits" as the missing variable in economic models.

Irrational "animal spirits" generate "tail risk," events that supposedly happen only rarely but when they do happen, they trigger outsized consequences, and the Fed's models failed to accurately account for "tail risk" because they happen more often than statistical models predict.

All this boils down to liquidity and illiquidity: When "animal spirits" are confident in future increases in asset valuations, participants place a constant bid under the market because prices will keep going up so I'll make more money in the future. This constant bid is called liquidity: cash is flowing into the asset class, be it stocks or housing or cryptocurrencies or commodities.

When "animal spirits" turn to panic, sellers rush to sell as buyers vanish as they fear that prices will keep going down so I'll lose more money in the future. Buying into a downtrend is known as "catching the falling knife": the initial "buy the dip" players have their head handed to them on a platter, and those on the sidelines decide not to try to catch the falling knife.

This is an illiquid market: when sellers dump assets on the market and buyers vanish, the bid keeps dropping until buyers are willing to gamble that "this is the bottom." But should asset prices continue sliding after an initial euphoric pop higher--"the bottom is in, buy!"--then those who held back find their caution reinforced: that wasn't the bottom after all, and everyone who jumped in lost money.

As every surge of "buy the dip" players has their head handed to them on a platter, the market goes bidless--everyone who wanted to play "catch the falling knife" has been burned, and those who have lost the "animal spirits" to gamble stay out. The market goes bidless, and asset prices crash to levels no one in the greed-euphoria stage could imagine were even remotely possible.

Those who follow liquidity assume that the more cash sloshing around the system, the more money will flow into assets. But this assumes participants--and therefore markets--are rational. When caution--and then panic--take hold of the herd, no matter how much cash is sloshing around, none of it will be gambled on a losing bet.

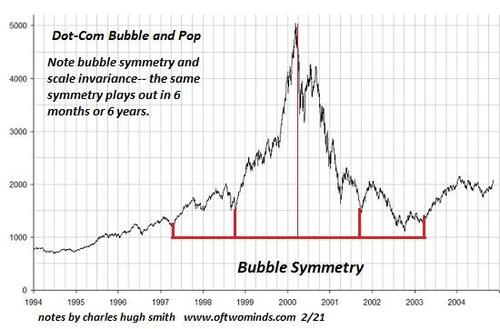

Take a look at this chart of the Nasdaq dot-com bubble, and note the bubble symmetry: what shot up soon plummeted back to pre-bubble levels. Stocks that had reached $60 per share were recommended as "buys" at $45--a rational play perhaps, but wildly off the mark, as the stock eventually bottomed at $4.

When sellers desperate to sell swamp buyers, prices decline. If buying dries up, prices crash.

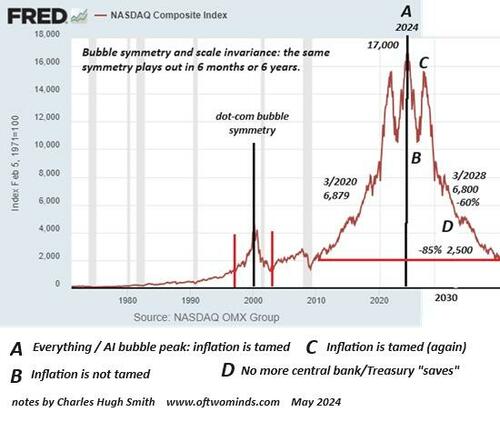

It's worth pondering the psychological reality that losses make a much bigger impression on us than gains. This is the foundation of risk aversion: once burned, twice shy. Everyone's surprised when "animal spirits" reverse polarity, but the confidence that any asset has reached "a permanently high plateau" is misplaced. Every manic greed-inflated bubble pops and cascades back to Earth. Here is a preview of the Everything Bubble popping:

Greenspan's models--and everyone else's--projected a rational market in which buyers continued to buy assets even as they lost money on previous attempts to "catch the falling knife." In other words, the markets will always be liquid.

The Pavlovian "buy the dip" reflex that was so profitable on the way up now becomes the road to ruin as every pop higher gets sold. Those playing "buy the dip" are eventually wiped out, leaving only those burned and wary. Eventually people tire of losing and they give up. After losing 40%, a 4% return on a Treasury bond--brushed off in the glorious ascent as foolishly cautious--now looks pretty good.

Confidence / complacency doesn't map the real world, in which liquidity dries up and markets go bidless. In the real world, humans panic and eventually decide to never again buy stocks or real estate, as the sting of their losses lingers far longer than their memories of glorious gains earned by riding the bubble higher.

* * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Source link