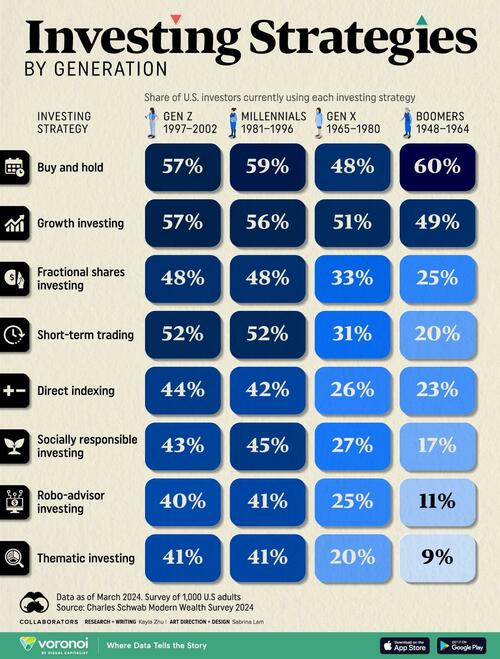

When it comes to investing, each generation has their own mix of strategies, and younger generations like to try a bit of everything.

This graphic, via Visual Capitalist's Kayla Zhu, visualizes the breakdown of how each generation uses each of the following types of investing strategies:

Buy and hold: Investors purchase stocks or assets and keep them long-term, regardless of short-term market fluctuations

Growth investing: Investing in companies expected to grow at an above-average rate, even if their stock prices are higher

Fractional shares investing: Purchasing a portion of a full share, allowing investors to invest in expensive stocks with smaller amounts of money

Short-term trading: Buying and selling assets quickly, typically within days or weeks, to capitalize on short-term market movements

Direct indexing: A method where investors buy and own individual stocks of an index directly rather than through a mutual fund or ETF, allowing for greater customization and tax efficiency

Socially responsible investing: Investing in companies that meet specific ethical, environmental, or social criteria

Robo-advisor investing: An automated investment service that uses algorithms to manage and optimize an investor’s portfolio, typically with low fees

Thematic investing: A strategy centered on investing in companies tied to specific trends or themes, such as clean energy or technological innovation

The data is based on a Charles Schwab Modern Wealth survey of 1,000 U.S. adults, and is updated as of March 2024.

Buy and Hold Investing Most Popular Across Generations

Americans of all generations mostly rely on the buy and hold strategy, with boomers relying on this strategy the most (60%) and Gen X relying on it the least (48%).

Across the board, younger generations tend to adopt a wider range of investing strategies than older generations. Specifically, Gen Z and Millennials tend to use newer investing strategies more often, including fractional shares investing (48% for both) and short-term trading (52% for both).

Both younger generations also use technology-driven strategies like robo-advisor investing much more than the older two generations.

Robo-advisors are online investing platforms that use algorithms to create and manage investment portfolios, like Betterment and Wealthsimple.

Younger generations are also increasingly turning to social media to inform their financial choices.

According to the Charles Schwab survey, 72% of Gen Z respondents considered financial advice from social media, compared to 57% of Millennials, 38% of Gen X, and only 19% of Boomers.

Gen Zs are also starting to invest earlier. On average, Gen Zs started investing at 19 years old, compared to 25 for Millennials, 32 for Gen X, and 35 for Boomers, according to Charles Schwab.

Investing earlier allows investors more time to grow their wealth, as compounding interest can significantly increase returns over the long term.

To learn more about Americans’ investing patterns, check out this graphic that visualizes shows the percentage of financial assets allocated to corporate equities among U.S. households and non-profits.

Source link