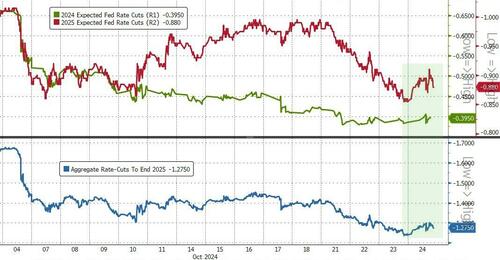

After yesterday's selling in bonds, stocks, gold, and crypto; today saw the reverse as the dollar dipped and everything else (except crude) rallied... as rate-cut expectations increased modestly...

Source: Bloomberg

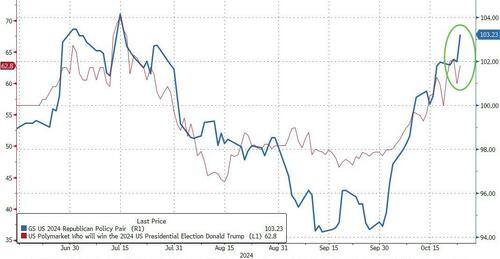

The 'Trump Trade' reignited in stocks today, back to its highest this cycle...

Source: Bloomberg

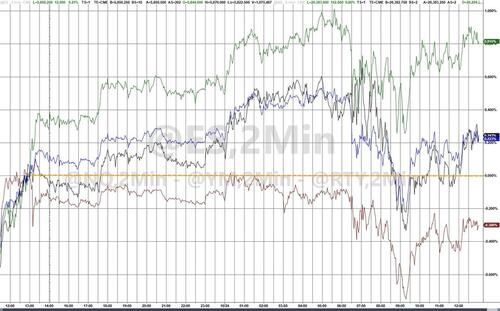

The Dow lagged on the day, down for the 4th straight day. The S&P and Small Caps managed to fight for small gains as Nasdaq outperformed...

Memes and Most Shorted stocks squeezed higher today, putting big pressure on hedgies - which significantly underperformed today...

Source: Bloomberg

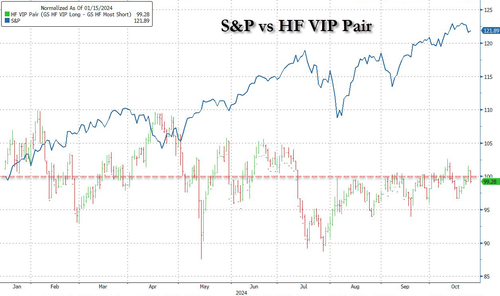

It's been a tough year for hedgies indeed...

Source: Bloomberg

Before we leave equity-land, it would remiss of us not to note the massive 21% surge ($145BN) in TSLA stock today after earnings last night...

which explains why hedgies were proper fucked today

Tesla and Exxon represent the two largest short positions among hedge funds: GS pic.twitter.com/eSCoc0DriB

— zerohedge (@zerohedge) May 23, 2024

Treasuries were mid across the curve today with the long-end outperforming (30Y -5bps, 2Y -1bp) with the whole curve still holding above 4.00%...

Source: Bloomberg

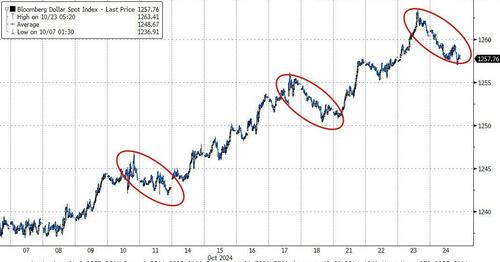

The dollar index declined today... pause that refreshes...

Source: Bloomberg

Today's gain in gold (erasing most of yesterday's loss)...

Source: Bloomberg

...moved it to a new 'real' (inflation-adjusted) high since January 1980...

Source: Bloomberg

Palladium broke out of its recent range today, now at its highest since Dec 2023...

Source: Bloomberg

Silver accelerated further after Russia central bank headlines...

Source: Bloomberg

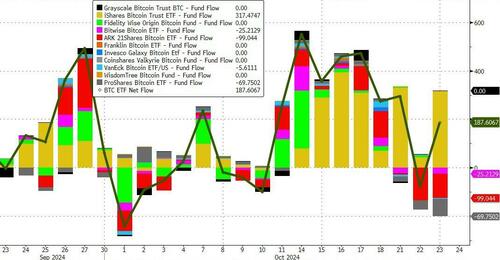

After yesterday's dramatic inflows into BTC ETFs - which saw BTC prices fall...

Source: Bloomberg

...Bitcoin rallied back above $68,000 today

Source: Bloomberg

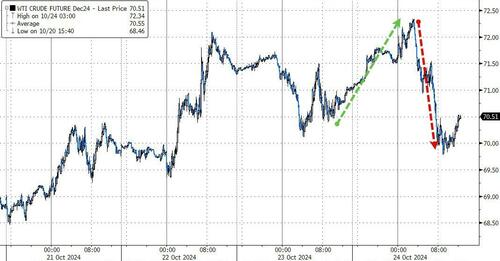

Oil prices pumped and dumped today to end slightly red...

Source: Bloomberg

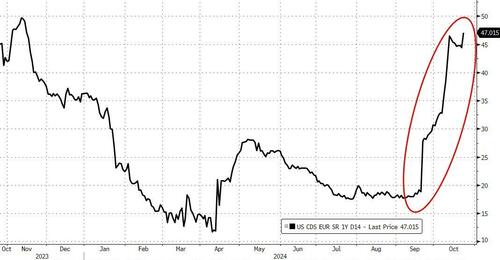

Finally, USA sovereign risk is on the rise once again, now at one year highs...

Source: Bloomberg

Is that the ultimate hedge for a 'sweep' in the election (either way).

Source link