By John Kemp, energy analyst

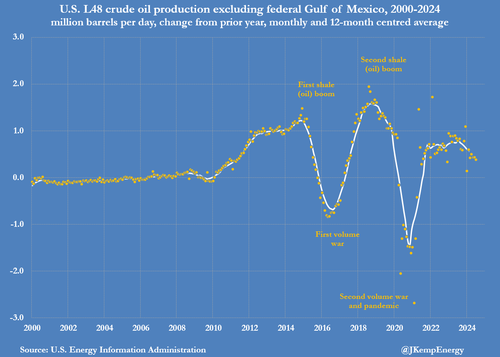

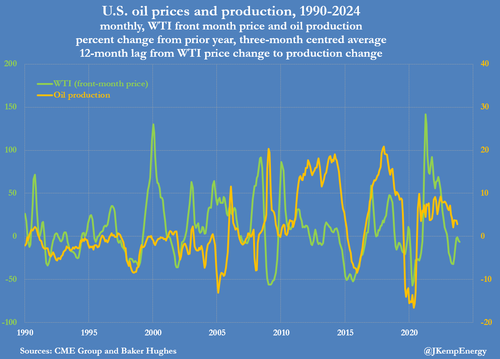

U.S. oil production growth continues to slow in response to the fall in prices, as the initial shock from Russia’s invasion of Ukraine and the sanctions imposed in response more than two years ago fades.

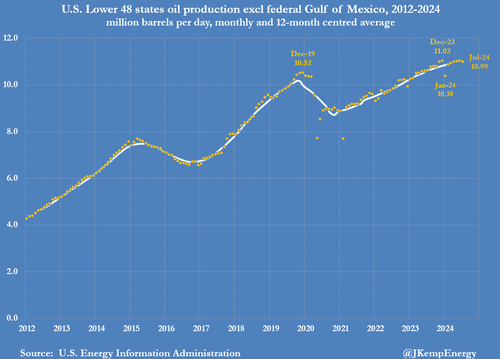

Crude and condensates output from the Lower 48 states excluding federal waters in the Gulf of Mexico averaged 11.0 million barrels per day (b/d) in July 2024, according to the latest data from the U.S. Energy Information Administration.

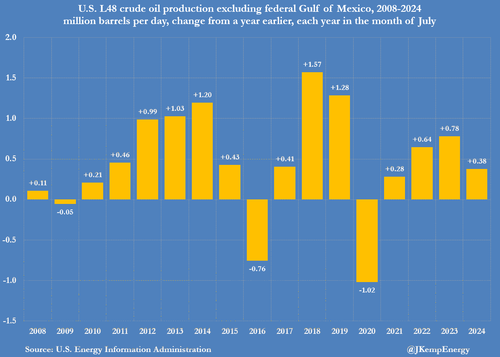

Production had increased by less than 0.4 million b/d compared with the same month a year earlier, the smallest increment for the time of year since the first waves of the coronavirus pandemic in 2020/21.

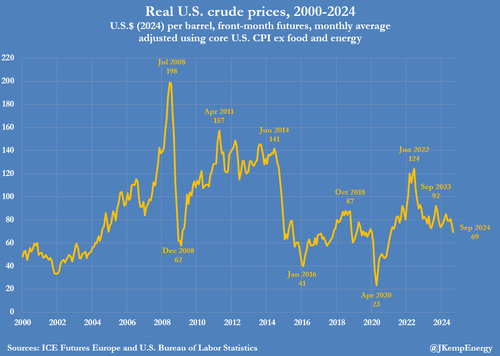

Following the invasion, oil prices peaked in June 2022 but have since retreated, and production growth has decelerated with a delay of around twelve months, typical for the lag between a change in prices and output.

Inflation-adjusted front-month U.S. futures prices fell to an average of $79 per barrel in July 2023 (48th percentile for all months since 2000) from $124 (82nd percentile) in June 2022.

Twelve months later, production growth had halved to 0.4 million b/d in July 2024 from 0.8 million b/d in June 2023.

By July 2024, there had been no net growth for eight months since November 2023, as the sector’s expansion ground to a halt.

Since then, prices have fallen even further to an average of just $69 (38th percentile) in September 2024, which is likely to ensure production remains fairly flat through the middle of 2025.

If prices stay around current levels, production growth from the Lower 48 will probably fall close to zero by late 2024 or early 2025.

By curbing U.S. shale producers’ willingness to boost drilling, and forcing Saudi Arabia and its OPEC⁺ partners to postpone plans to increase output, lower prices are heading off an incipient surplus later in 2024 and 2025.

U.S. GAS PRODUCTION

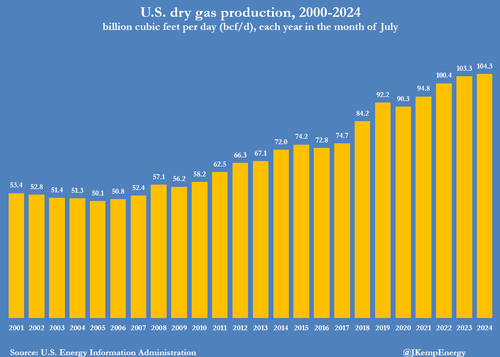

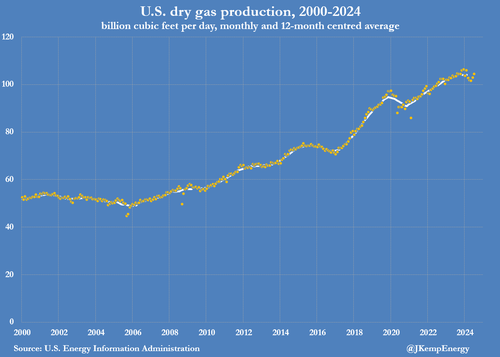

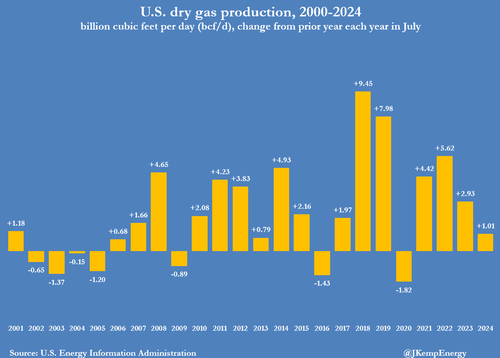

Dry gas production averaged 104.3 billion cubic feet per day (bcf/d) in July 2024, up from 103.3 bcf/d a year earlier, but the seasonal increment was the smallest since the pandemic in 2020.

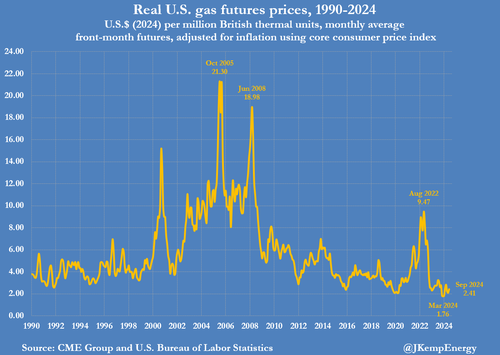

Output growth has slowed as prices have slumped from post-invasion highs reached in the third quarter of 2022 to record lows by the early months of 2024.

Between February and April 2024, front-month futures tumbled to around $1.80 per million British thermal units, the lowest for over three decades, after adjusting for inflation.

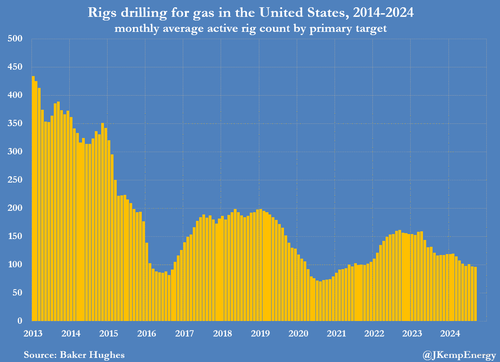

Fewer than 100 rigs have drilled for gas on average in the third quarter of 2024 down from an average of nearly 160 in the third quarter of 2022.

Even more than oil, gas has been hit by over-production, and unlike crude there has been no equivalent of OPEC⁺ to limit the accumulation of excess inventories by coordinating output cuts.

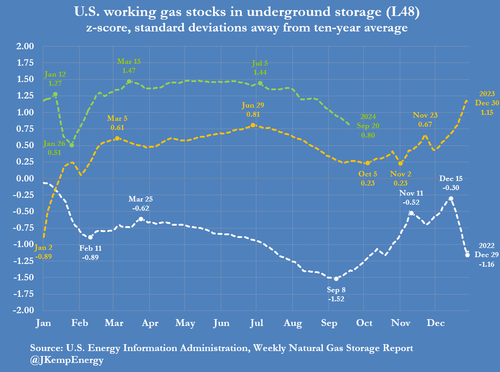

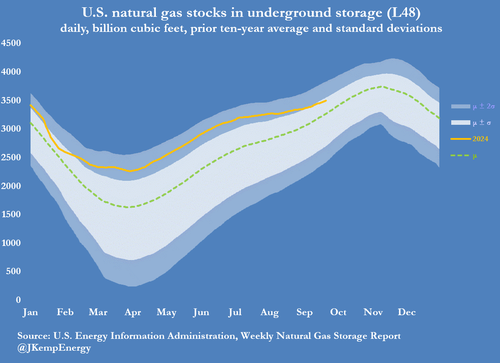

Exceptionally mild temperatures slashed heating and power generation in the winter of 2023/24, leaving the industry carrying near-record stocks at the end of the heating season and intensifying the crisis.

By February 2024, the price slump had become so severe that several major U.S. producers announced plans to curb drilling and production.

Since then, however, ultra-low prices have encouraged record gas consumption by power generators throughout the summer and gradually returned stocks to more normal levels.

By late September 2024, working gas inventories were within ±1 standard deviations of the prior ten-year seasonal average.

In response, front-month prices climbed to an average of $2.40 last month, still only in the 3rd percentile for all months since 2000, but a significant bounce from the multi-decade lows six months earlier.

If gas production remains subdued, the remaining surplus is likely to be eliminated over the course of winter 2024/25.

Once the surplus is gone, prices and production will have to increase significantly in 2025 to satisfy the growing demand from generators and exporters.

Source link