Oil prices briefly spiked after last night's API-reported big crude draw, but that reverted back lower fast. Overnight has seen a small roller-coaster with prices slipping during the US session and then a series of bad news data point in the US sparking a 'good news for Fed cuts' response in oil prices, holding just above green on the day.

The question is - was API's data fluke...

API

Crude -9.16mm - biggest draw since mid-Jan 2024

Cushing +404k

Gasoline +2.47mm

Distillates -740k

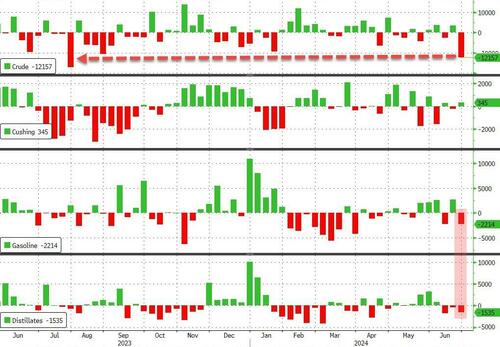

DOE

Crude -12.16mm - biggest draw since Jul 2023

Cushing +345k

Gasoline -2.21mm

Distillates -1.54mm

Nope. The official data confirms the huge crude draw last week (which we suspect was pre-emptive draws ahead of 'Beryl'

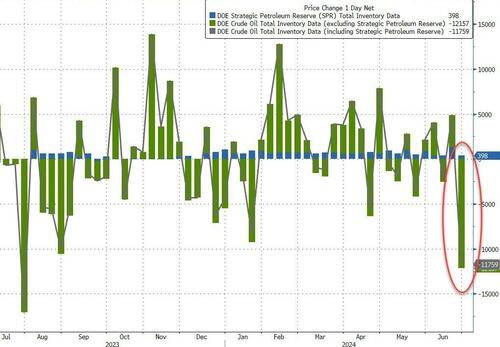

Source: Bloomberg

Adjusted for the 398k barrel addition to SPR, the 11.579mm barrtel draw was the largest since the last week of July last year...

Source: Bloomberg

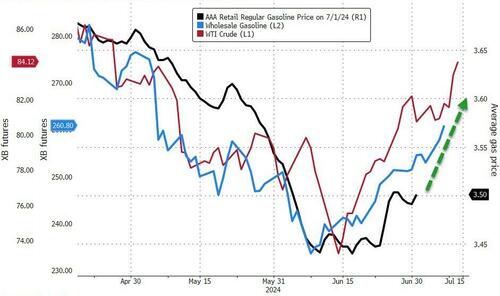

Oil prices spiked on the big crude draw...

Source: Bloomberg

Even if crude prices ease a little, pump-prices are set to rise further...

Source: Bloomberg

Pouring more salt in President Biden's polling wounds.

Source link