After a solid 3Y auction on Tuesday and a stellar 10Y yesterday, moments ago the Treasury concluded the week's coupon issuance with a decidedly soggy 30Y auction, one which pushed yields to session highs.

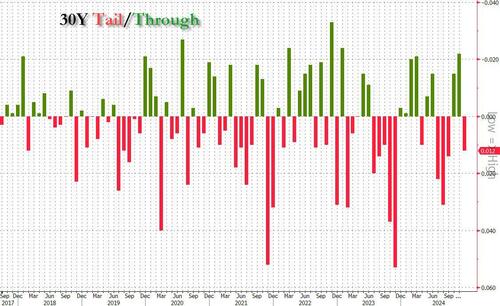

Today's sale was a $22BN reopening of 30Y paper in the form of 29Y-11M cusip UE6, which priced at a high yield of 4.535%, down modestly from 4.608% last month but stopping through the When Issued 4.523% by 1.2bps, the first tail since September and follows two solid stop throughs.

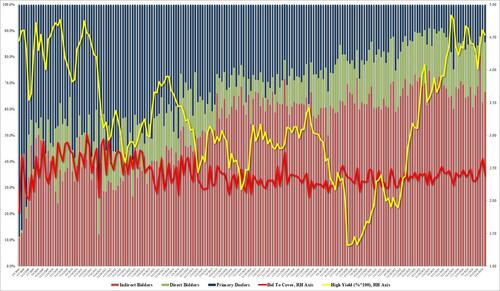

The Bid to Cover was also disappointed: unlike yesterday's blowout 10Y high, today's BTC was just 2.39x, down from 2.64x and the lowest since September; it was also below the six auction average of 2.43x.

The internals were soggy at best: Indirects were awarded 66.5%, up from 62.7% but below the recent average of 67.7%. And with Directs taking down 19.1%, down from 27.1% in November, Dealers were left holding 14.4%, the highest since September.

Overall, this was a C-rated auction at best, and the market reacted accordingly, sending 10Y yields up 2bps from 4.29% at auction time to 4.31%, and since drifting another basis point to session highs above 4.32%.

Source link