Via Greg Hunter’s USAWatchdog.com,

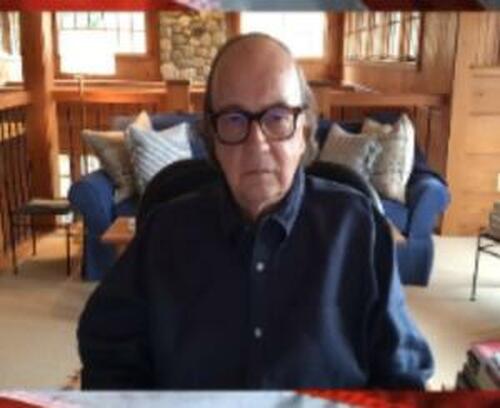

Seven-time, best-selling financial author Jim Rickards predicted in July 2023 (when gold was trading in the $1,600 range) that the yellow metal would get a big boost.

He was correct.

In his new book called “Money GPT: AI and the Threat to the Global Economy,” Rickards lays out the case for AI-caused disasters in everything from finance to nuclear war. Rickards says,

“About five stocks are upwards of 40% of the entire index.

Almost all those gains are being driven by AIs: Nvidia, AMD, Microsoft, Apple, Facebook/Meta and Google. We all know their names.

The market is going higher on AI, and nobody wants to say anything negative on AI.

I have studied this very closely, and there are these huge dangers for investors that they need to be aware of. Any crash is going to be worse because AI will be accelerating it.”

It gets worse with an AI driven world, especially when it comes to nuclear war.

AI can and will accelerate that too. Rickards explains,

“You can’t teach a computer common sense.

You can teach it rules.

You can make it go up the escalation ladder for war.

A stock market crash is pretty bad, but nuclear annihilation is far worse.

I am offering constructive advice in the book saying here’s the problem.

Here’s how it works. Don’t put AI in the kill chain because you will end up getting killed.

Rickards is hoping Trump can deescalate the wars in Ukraine and in the Middle East.

Even if Trump is able to turn down the volume on the war drums, the economy is already in big trouble. Rickards says,

“The US economy is definitely in for slowing growth at best, and probably a recession in the next 9 months. Trump is going to get blamed for it because if you are President, you get blamed for whatever happens even though he has nothing to do with it.

This recession is already happening.

The stock market will draw down, and from there, I think it will come back. Trump’s policies are enacted. They get a tax bill through. They get tariffs up. They create high paying US jobs. They cut regulation. There are a lot of bullish things in the pipeline, but they take time to implement . . . and take effect.

In the meantime, we will have a rocky road.”

Rickards still likes gold, silver and other tangible assets such as farm ground and fine art.

Rickards contends this is true diversification of your wealth.

There is much more in the 54-minute interview.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Jim Rickards, seven-time, best-selling author, not including his latest called “Money GPT: AI and the Threat to the Global Economy,” for 11.12.24.

* * *

To Donate to USAWatchdog.com Click Here

If you want a copy of “Money GPT: AI and the Threat to the Global Economy,” click here.

Source link