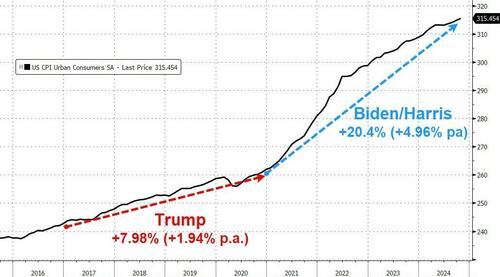

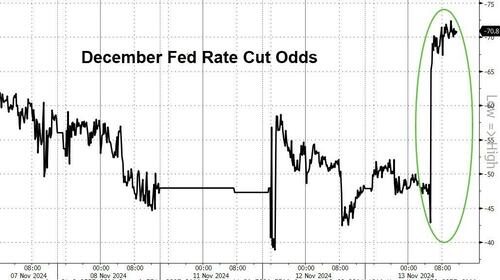

While this morning's CPI all printed in line with expectations, it is clear that the narrative that "inflation is headed in the right direction" is on increasingly shaky grounds...

Source: Bloomberg

Disinflation has stalled in the core goods sector...

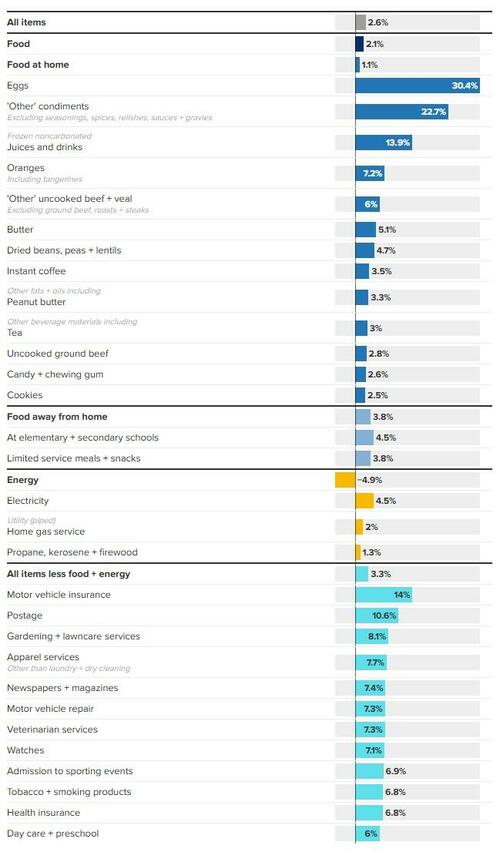

“October’s CPI report contains no information that would discourage the FOMC from cutting rates again at the December meeting.

Still, we see risks that the key outstanding information for the Fed’s preferred core PCE deflator - medical and financial services in the Producer Price Index, due Nov. 14 - may run hot in October.

That could lead to fears that underlying inflation is stuck at a high-2% level, above the Fed’s target.”

That didn't stop the algos going wild with kneejerk surges in the dollar, stock, and bond prices, as rate-cut expectations jumped...

Source: Bloomberg

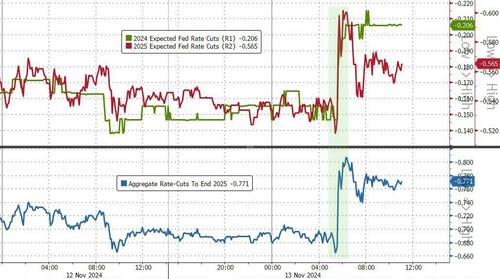

The odds of a 25bps cut by The Fed in December jumped up to 70%...

Source: Bloomberg

But, the day was still young...

Stocks gave back all of their gains by the close...

Mega-Cap Tech managed strong gains off the opening weakness but ended the day only marginally higher (still holding on to the major gains post-election)...

Source: Bloomberg

The 'Trump Trade' continues to surge higher...

Source: Bloomberg

VIX was clubbed like a baby seal back to a 13 handle - a four-month low...

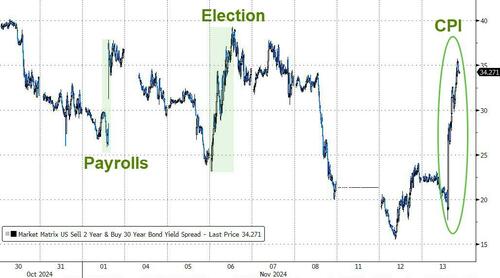

The Treasury curve massive steepened on the day as The Fed is now cornered with its rate-cutting cycle but the market knows where this ends (bullish lower rates for stocks in the short-term but long-end rates are the equalizer on any of that exuberance).

On the day, the short-end was a major outperformer (2Y -7bps, 30Y +5bps), but all yields are higher from pre-election levels with the long-end notably so...

Source: Bloomberg

...prompting a dramatic curve steepening that is screaming Fed policy error...

Source: Bloomberg

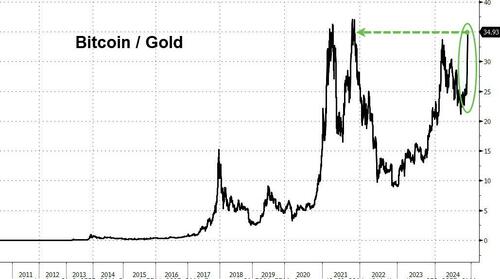

Bitcoin was the biggest winner with a massive surge to almost $93,500 before some late-day profit-taking...

Source: Bloomberg

And while that is a record in USD terms, it remains slightly off record highs in gold terms...

Source: Bloomberg

...despite gold's decline today, which dragged the barbarous relic down near two-month lows...

Source: Bloomberg

...not helped by the dollar's incessant surge (to two-year highs)...

Source: Bloomberg

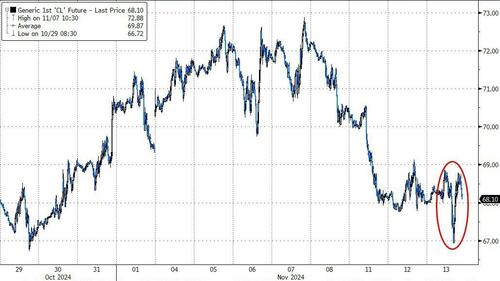

Oil prices ended the day unchanged after a big dump and pump around CPI, with WTI holding above $68...

Source: Bloomberg

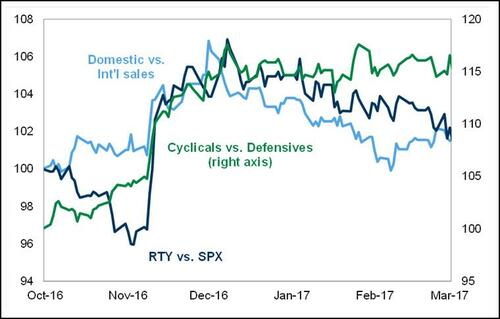

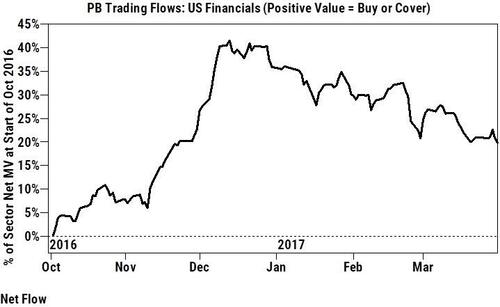

Finally, Goldman Sachs' trader John Flood highlighted the 2016 analogs

Source: Goldman Sachs

Similar trend for US Financials net flows (in 2016), as observed on GS's Prime book (i.e., HFs)...

Source: Goldman Sachs

Regarding his 2016 experience, Flood warned it is hard to trade against the current momentum, but a lot of these red sweep trades peaked in early December...

Source link