Tl;dr: The inflation story is far from over... no matter what The Fed or The White House claims...

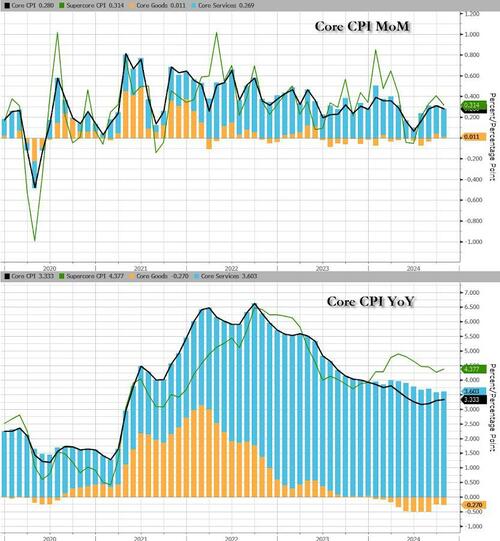

For the 53rd straight month, core consumer prices rose on a MoM basis in October with the YoY pace re-accelerating to +3.33%...

Source: Bloomberg

Services costs are starting to pick up again...

Source: Bloomberg

The index for all items less food and energy rose 0.3 percent in October, as it did in August and September.

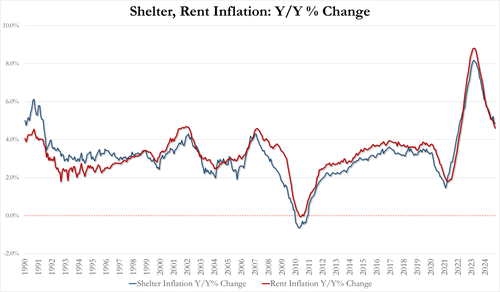

The shelter index increased 0.4 percent in October.

The index for owners’ equivalent rent rose 0.4 percent and the index for rent rose 0.3 percent over the month.

The lodging away from home index rose 0.4 percent in October, after falling 1.9 percent in September.

The medical care index increased 0.3 percent over the month after increasing 0.4 percent in September.

The index for physicians’ services increased 0.5 percent in October and the prescription drugs index rose 0.2 percent over the month.

The used cars and trucks index rose 2.7 percent in October, after rising 0.3 percent in the previous month.

The index for airline fares rose 3.2 percent over the month and the index for recreation increased 0.4 percent.

Other indexes that increased in October include personal care and education.

The index for apparel fell 1.5 percent in October, following a 1.1-percent increase the preceding month.

The communication index decreased 0.6 percent over the month, as it did in September.

The index for household furnishings and operations and the index for motor vehicle insurance also declined in October.

The new vehicles index was unchanged over the month.

The index for all items less food and energy rose 3.3 percent over the past 12 months.

The shelter index increased 4.9 percent over the last year, accounting for over 65 percent of the total 12-month increase in the all items less food and energy index.

Other indexes with notable increases over the last year include motor vehicle insurance (+14.0 percent), medical care (+3.3 percent), education (+3.8 percent), and personal care (+2.5 percent).

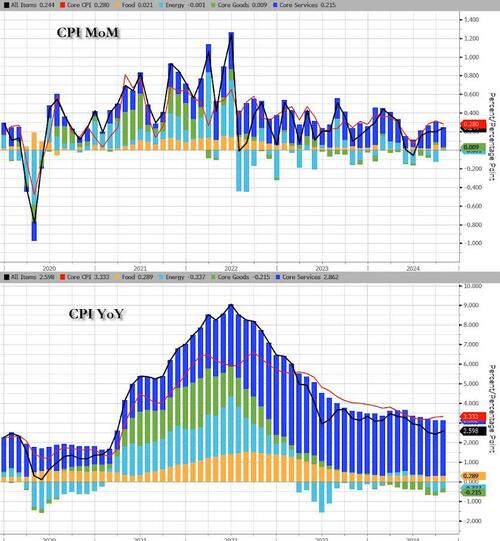

The headline CPI rose 0.2% MoM (as expected) which reaccelerated the YoY rise to +2.6% (as expected)...

Source: Bloomberg

Goods deflation ended on a MoM basis...

Source: Bloomberg

While Goods prices are still in deflation, they are re-acclerating and Services inflation remains extremely elevated...

Source: Bloomberg

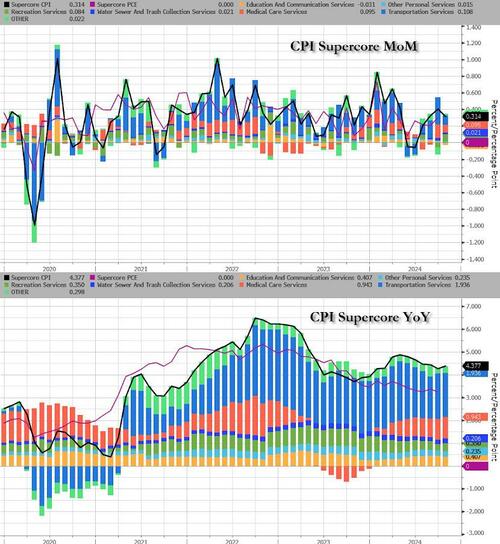

Under the hood, the much-watched (for a while) SuperCore (Services Ex-Shelter) CPI remains stubbornly high...

Source: Bloomberg

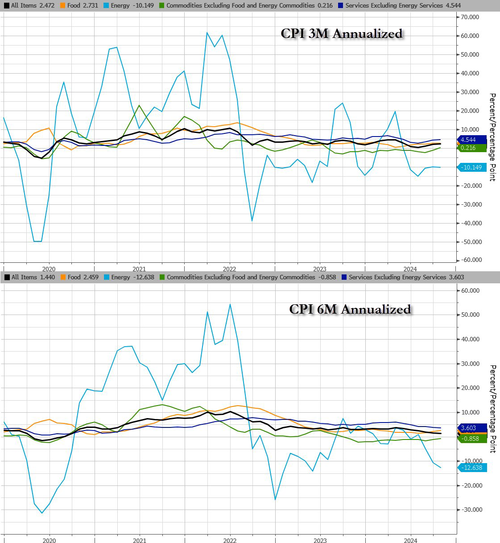

The deflationary pressures are easing...

Source: Bloomberg

On a short-term basis, it's energy's deflation that is doing God's work for Biden/Harris/Powell..

Source: Bloomberg

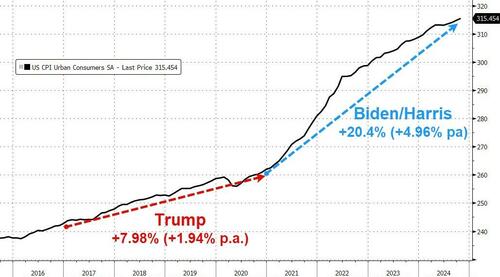

Overall, headline consumer prices are up 20.4% since Biden/Harris took over (that is almost three times the pace of price inflation that was seen under Trump's first term)...

Source: Bloomberg

Is a resurgence in CPI already baked in the cake (as global money supply has been resurgent)?

Source: Bloomberg

Finally, could we really replay the '70s once again?

Source: Bloomberg

Will that really be Powell's legacy? Or will the timing of this resurgence in inflation be perfectly timed to coincide with Trump's election victory... and offer a perfect patsy for who is to blame?

Source link